Do you remember the days in late 2017 when Bitcoin’s price jumped by almost 2000%? It was all because people didn’t want to miss out. Or what about the panic in 2023, after Terra Network and FTX collapsed, causing a big drop in prices? These events show us that the crypto market is all about how people feel.

Crypto Market Sentiment

Our exploration of the crypto market has taught us that knowing how investors feel is key to making smart trading choices. Thanks to AI and machine learning, we can now understand these feelings better. This gives us an edge in the fast-changing world of crypto investments.

Key Takeaways

- Sentiment analysis captures the collective emotional state of investors towards cryptocurrencies.

- Influential personalities, like Elon Musk, can dramatically sway market sentiment and price movements.

- The Fear & Greed Index is a vital tool for interpreting market emotions, and guiding buy and sell decisions.

- Significant events like the Terra and FTX collapses illustrate how negative sentiment can lead to mass selloffs.

- Combining sentiment analysis with technical indicators, such as the “golden cross” or “death cross,” can enhance prediction accuracy.

- Sentiment analysis is invaluable in developing robust cryptocurrency investment strategies.

Introduction to Crypto Market Sentiment

In the world of cryptocurrencies, knowing about crypto sentiment is key to understanding market trends. “Sentiment” in finance means the views and feelings about a market’s condition. It looks at how investors feel about different cryptocurrencies, affecting market actions.

Crypto market sentiment is a barometer of crowd psychology. By observing and interpreting these collective emotions, we gain invaluable insights into the underlying currents that shape market trends.

Sentiment analysis collects and analyses data from social media, news, and forums. It gives scores to opinions, classifying them as positive, negative, or neutral. These scores reflect feelings like fear, greed, and excitement, which affect crypto prices more than traditional markets.

Tools for sentiment analysis show how the market’s emotions add up. This helps Crypto Pro traders predict market moves. For example, a positive sentiment means a cryptocurrency might go up, while a negative one could mean a drop.

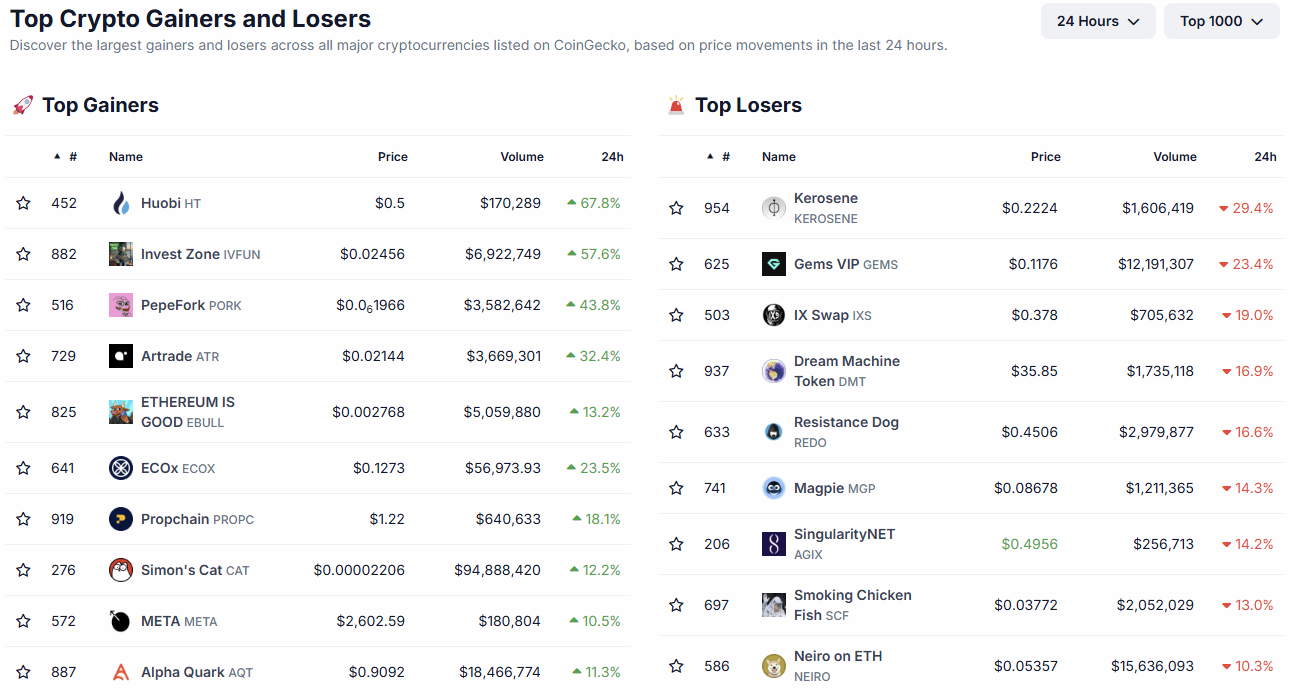

Top Gainers and losers in crypto

Feelings like FOMO or panic-selling guide market trends. Knowing these emotions helps Crypto Prop traders manage risks better. Sentiment analysis tools act as a guide, helping investors through the crypto market’s ups and downs.

Advanced AI and machine learning have made sentiment analysis better. These technologies help understand the emotional undercurrents in the crypto market. This ensures investors make informed choices.

But, sentiment analysis has its challenges. Online discussions can be tricky due to slang, sarcasm, and cultural differences. Still, using sentiment analysis in trading can greatly improve decision-making and risk management. It’s crucial for cryptocurrency trading.

Techniques Behind Crypto Sentiment Analysis

Understanding how crypto sentiment analysis works is key for investors and Crypto Prop traders. It’s about the feelings and opinions of investors towards assets. The crypto market changes a lot because of emotions, news, and social media. Sentiment analysis helps us guess market moves before they happen.

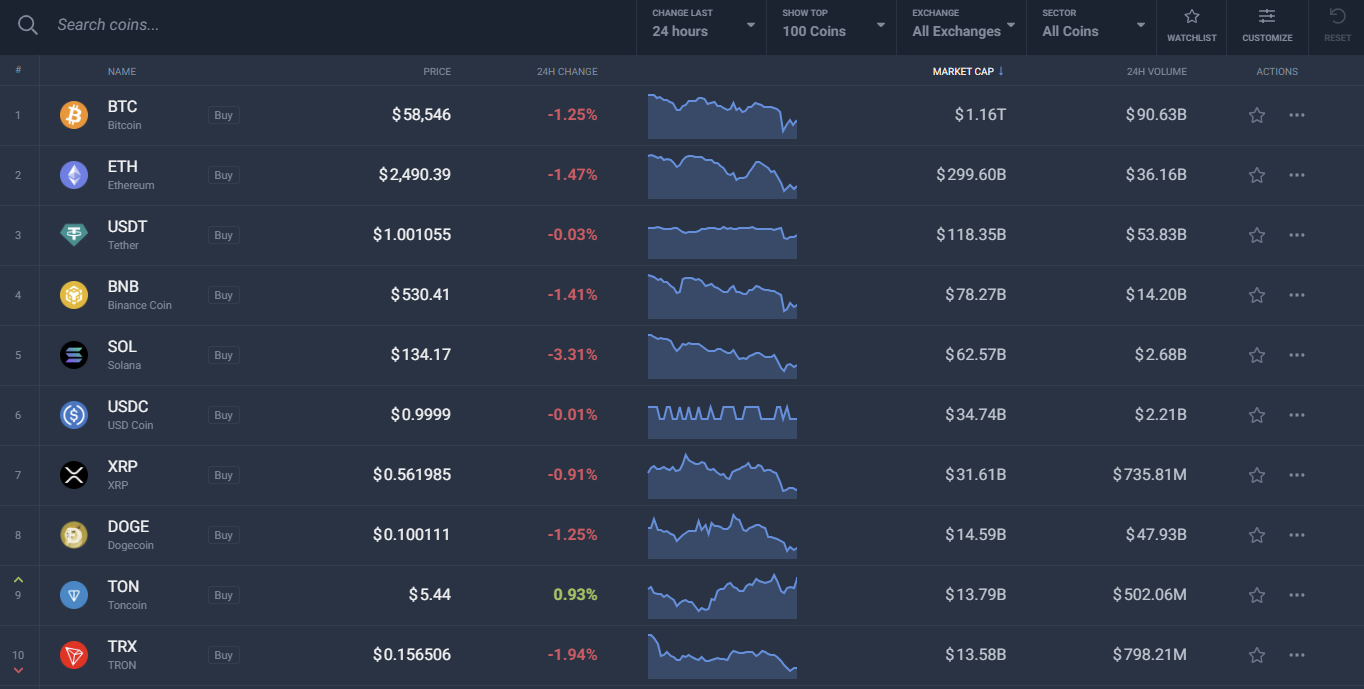

Top 10 Crypto coins

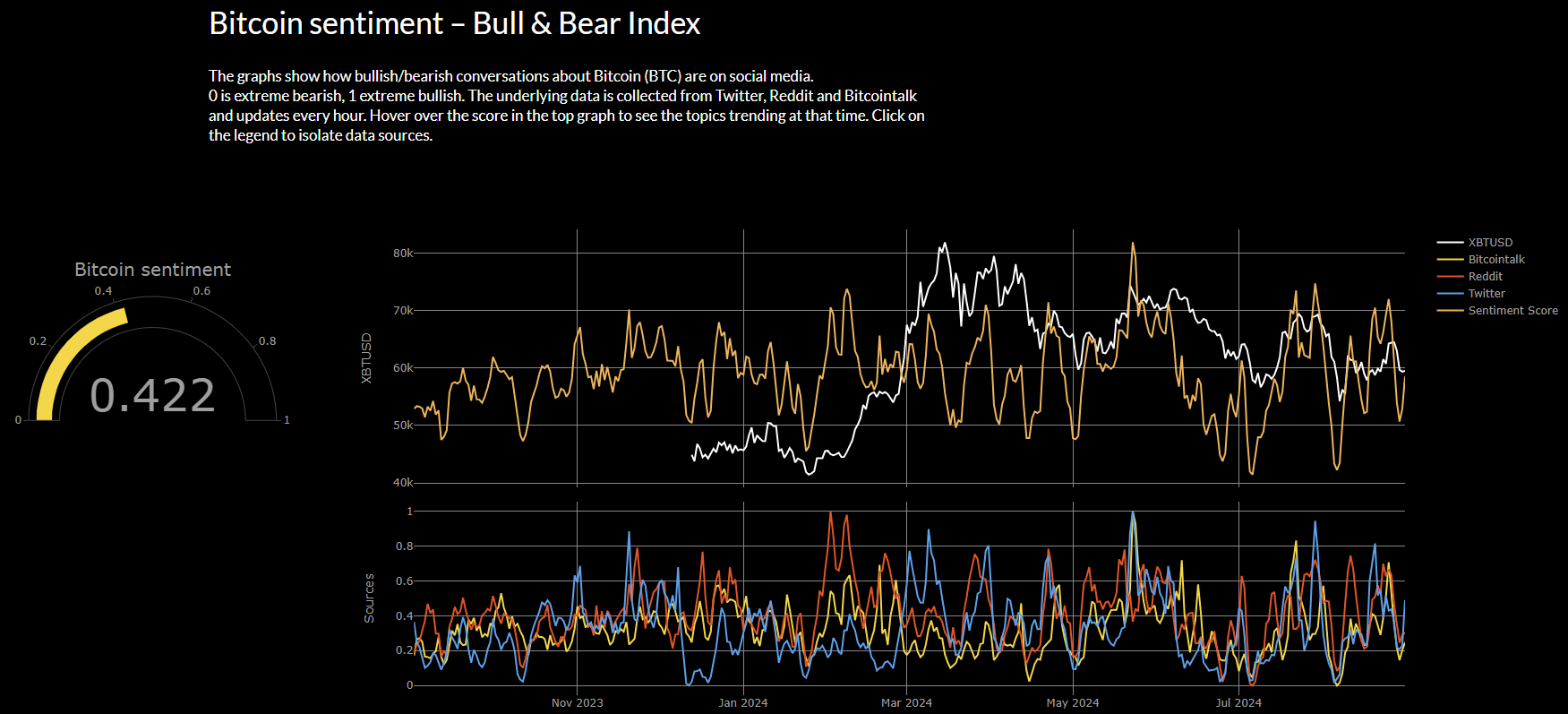

A top tool for checking crypto sentiment is natural language processing (NLP). This uses NLP to look at what people say on big social media sites like X (formerly Twitter), Reddit, and Telegram. It sorts messages as positive, negative, or neutral, giving sentiment scores that show what investors feel overall. For example, the Fear and Greed Index shows how scared or greedy the market is, from 0 to 100.

Cryptorank uses advanced AI and deep learning for real-time analysis. It watches sentiment across over 350 coins, giving Crypto Prop traders important info for their plans. It tells if online messages are informative or emotional, helping us understand the market’s mood.

Sentiment analysis in crypto isn’t just about feelings. It also looks at things like trading volumes, price changes, and chart patterns. Big trading volumes often mean big price moves. Knowing about support and resistance levels helps us see if the market is stable. Looking at the tech behind cryptocurrencies, their partnerships, and how people use them also helps us understand their true value.

In conclusion, getting good at crypto sentiment analysis means using NLP, real-time data analysis, and understanding market psychology. By combining these methods in our trading plans, we can move through the crypto market better and with more accuracy.

The Role of AI and Machine Learning in Sentiment Analysis

In the world of cryptocurrency, AI and machine learning are key. They give investors deep insights. These technologies look into a lot of online data to understand the market’s feelings.

AI uses complex algorithms to understand text data. It can handle slang, sarcasm, and cultural differences. When combined with other analyses, AI gives a clearer picture of the market.

Here are some important tools:

- Funding Rates: Show how confident investors are.

- Sentiment Index: Gives a summary of the market’s mood.

- Social Media Analysis: Helps understand what people think.

- Community Analysis: Looks at how engaged and what people feel about the community.

- Whale Monitoring: Watches the big investors.

- Crypto Market Sentiment Indices: Like the Fear & Greed Index.

Tools like those looking at Twitter and Reddit, and APIs like Token Metrics, understand public feelings. On-chain tools like Sentiment look at transactions and wallet activity. This makes predictions more accurate.

Machine learning looks at these data to predict prices. Algorithms like Random Forest and XGBoost use past data and current trends. This helps investors make smart, less emotional choices.

Looking closely at the crypto market shows how many things affect it. AI in sentiment analysis catches even the smallest changes in feelings. This helps investors make the best decisions in the fast-changing crypto market.

How to Read Crypto Market Sentiment?

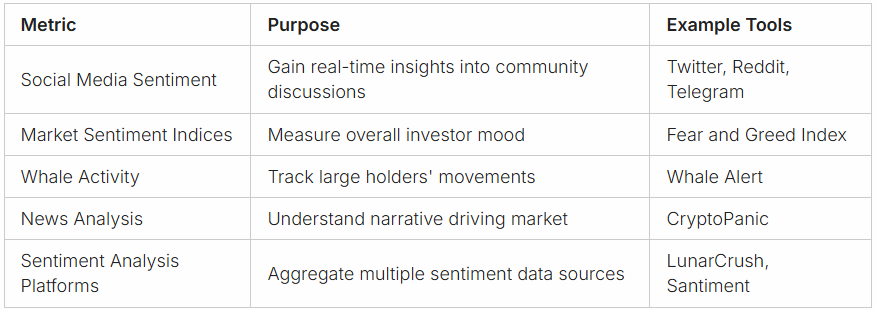

Understanding the crypto market sentiment is a skill that needs ongoing learning and a keen eye on social media. Key platforms like Twitter, Reddit, and Telegram are full of live discussions about digital assets. These talks help us understand the mood of the cryptocurrency market.

How to read crypto sentiment

The Bitcoin Crypto Fear and Greed index is a powerful tool for gauging market sentiment. It uses data from various sources to show how people feel, on a scale from 0 to 100. A score of 0 means extreme fear, while 100 means extreme greed. This helps traders see if people are feeling positive or negative about the market.

“Sentiment analysis involves techniques like social media monitoring and on-chain analysis, providing traders with insights into the market’s psychological state and potential directions.”

Watching the actions of big cryptocurrency holders, or “whales,” through tools like Whale Alert, also gives us clues about market sentiment. These big players often hint at where the market might go next. Studies show that what people talk about on social media can be a better guide for short-term price changes than news.

To stay on top, it’s important to use a mix of market sentiment indicators. Tools like the Fear and Greed Index help us match our trading plans with the market’s mood. Sites like HyroTrader make this easier by offering funded accounts based on these insights.

In the world of crypto, analyzing sentiment is more than just collecting data. It’s about deeply understanding what investors are feeling. By putting in the effort, traders can make smart, timely choices and stay ahead in the market.

Impact of Market Sentiment on Trading Strategies

Crypto market sentiment is key in shaping trading strategies. When it’s positive, known as bullish sentiment, asset purchases go up, leading to higher cryptocurrency price fluctuations. On the flip side, bearish sentiment, being negative, causes sell-offs and price drops. Knowing these emotional trends helps in making better trading decisions and improving market positioning.

Market sentiment greatly affects trading decisions. A positive sentiment can push prices up, while a negative one can lead to a drop. Crypto Prop Traders who understand sentiment can make the most of price movements by entering and exiting at the right times. Contrarian investors, for example, see extreme sentiment as a sign of potential price changes, making moves against the market trend.

Sentiment analysis tools, using natural language processing, are key in spotting trends through social media and other sources. This helps predict price changes and adjust trading strategies. Tools like the Commitment of Traders (COT), Volatility Index (VIX), and High/Low Sentiment Ratio give insights into bullish or bearish sentiment in the market:

- Commitment of Traders (COT): Shows traders’ net long and short positions.

- Volatility Index (VIX): Measures implied volatility, often called the ‘fear index’.

- High/Low Sentiment Ratio: Compares stocks hitting 52-week highs and lows.

Using various sentiment indicators in trading strategies helps make better decisions and manage risks. Market sentiment is volatile, often driven by irrational feelings, causing quick cryptocurrency price fluctuations. So, managing risks well is key to profitable trading in this dynamic market.

Volume is another important factor, showing sentiment in stocks and options markets. High volumes often mean strong sentiment, either bullish or bearish, helping Crypto Prop traders make timely decisions.

In summary, adding sentiment analysis to trading strategies boosts Crypto Prop traders’ skills in the cryptocurrency market. By understanding and predicting emotional trends, Crypto Prop traders can better position themselves and increase their chances of making profits in a changing market.

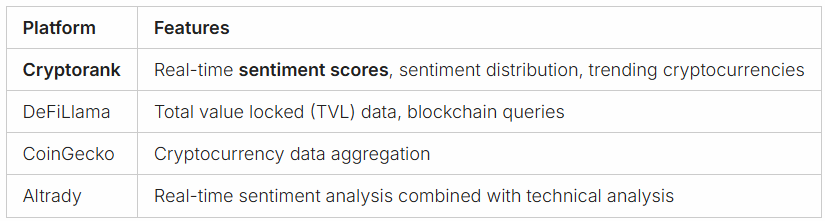

Tools for Crypto Sentiment Analysis

Sentiment analysis in the crypto market looks at how investors feel about different assets. This feeling can be positive, showing confidence, or negative, showing doubt. This feeling greatly affects the market. Recently, many crypto analysis tools have come out to give real-time insights on these feelings. This helps with making trading plans.

Augmento.ai is a top tool in this area. It gives real-time sentiment data from social media, forums, and news. This data helps Crypto Prop traders and investors see the market’s mood and make smart choices. It has cool features like WordClouds and rankings of popular cryptocurrencies based on social mentions.

Other great crypto analysis tools are LunarCRUSH and Coingecko. They focus on what people feel and think on social media. For news sentiment, The TIE and NewsCrypto look at news articles and releases to spot market trends. These tools are key for Crypto Prop traders who use sentiment to understand the market and guide their trading.

Crypto Market Sentiment tool

Tools like Solume.io check sentiment on crypto forums and communities. Advanced tools like Sentiment.io and Augmento use NLP and ML for deep insights. These tools are great for spotting trends and predicting the future based on past feelings.

For Crypto Prop traders who like to mix sentiment with technical analysis, TradingView has sentiment indicators along with traditional chart tools. This gives a full view of the market. Platforms like Sentiment look into trading metrics to see what emotions drive market moves.

Using these tools well means looking at the real-time sentiment data and combining it with other analysis methods. This way, Crypto Prop traders can make better decisions and understand market feelings better.

Challenges in Analysing Crypto Market Sentiment

Looking into crypto market sentiment is complex, especially when trying to understand the data. With the market valued at over $2.5 trillion by 2024, the data volume is huge. People generate over 100 MB of data every minute, including opinions on various topics. But, it’s hard to accurately pick up on colloquial language and sarcasm online, which can lead to mistakes in sentiment analysis.

One big problem is the noise in sentiment analysis. It’s thought that over 15% of tweets about cryptocurrencies come from bots, which can change the sentiment results. Even though neural networks can spot bots with 82% accuracy, the rest can still cause issues.

Also, there’s always the risk of market manipulation. Fake news and planned market moves can hide the real sentiment, leading to wrong conclusions for Crypto Prop traders and investors. It’s key to know the real trends from the fake data to use sentiment analysis well.

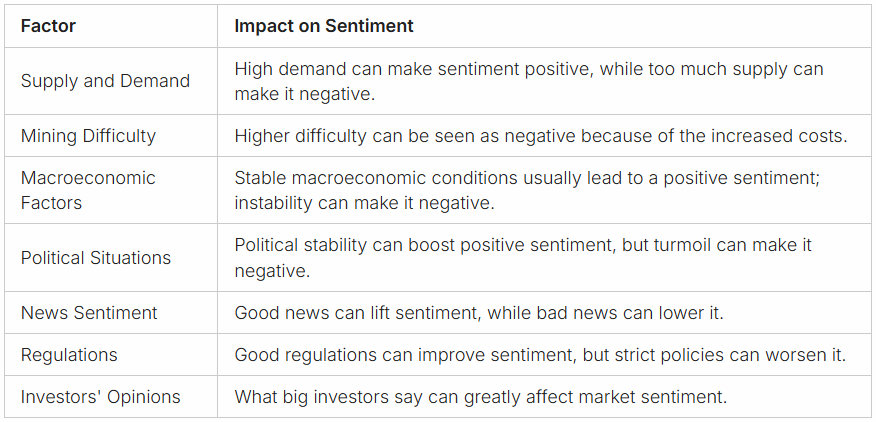

Many things affect cryptocurrency prices, like supply and demand, mining difficulty, and market trends. These factors need a lot of data to understand, often needing advanced tech like neural networks.

Integrating Sentiment Analysis with Other Trading Techniques

To make a complete trading plan, it’s key to mix sentiment analysis with other strong methods. This blend of sentiment, technical, and fundamental analysis gives Crypto Prop traders a full view of the crypto market. Sentiment shows how people feel about the market right now. Technical analysis looks at price trends and volumes. Fundamental analysis checks the real value and future of assets.

Crypto Prop traders use tools like social media and APIs to understand market feelings. The Fear & Greed Index is a great tool that shows the market’s mood. It looks at things like market ups and downs, social media, and trading activity.

Adding sentiment to technical analysis creates a strong system. It often warns of changes in trends early. Tools for checking crypto sentiment include charts and software for showing data. Using Machine Learning and Artificial Intelligence helps Crypto Prop traders spot trends and sentiment better, making their decisions smarter.

Using different analytical methods helps us make better investment choices. Strategies like contrarian and breakout/momentum use sentiment to guide trading. These methods helpCrypto Prop traders deal with market ups and downs.

It’s important to keep improving and updating trading strategies. By staying up-to-date with new tools, Crypto Prop traders can predict market trends better. This helps them make the most of their trading.

Conclusion

In the world of cryptocurrency, using crypto market sentiment insights can really help our trading plans. Sentiment analysis shows us how investors feel overall. This gives us big benefits that go beyond just looking at numbers.

By adding sentiment analysis to our tools, we can understand market feelings better. This helps us predict trends and make smarter choices. It makes our investment strategies stronger.

Now, combining sentiment data with other analysis methods is key. Crypto Prop Traders use tools like social media and special indicators. These tools help a lot with making smart trades.

Platforms like DefiLlama, Dune, and CoinGecko give us important sentiment data. This data helps Crypto Prop traders make better decisions. It’s a big help in making successful investment plans.

AI and blockchain are making sentiment analysis better and more useful. They help us ignore the noise and get more accurate data. This lets us understand market feelings better and act on them.

But, we need to watch out for problems like fake data and tricky language. Despite these issues, sentiment analysis is still key in cryptocurrency trading. It gives Crypto Prop traders a big advantage in making more money and doing well over time.

FAQ

What is crypto market sentiment?

Crypto market sentiment shows how investors and traders feel about the market. It affects how they react to trends and news. It’s key because it shows the mood of the market.

How does sentiment analysis work in cryptocurrency trading?

Sentiment analysis uses NLP to look at online talks. It sorts these into feelings or facts. Tools like StockGeist.ai help spot the mood of investors and reactions to the news, helping traders understand each cryptocurrency’s sentiment.

What role do AI and machine learning play in sentiment analysis?

AI and machine learning are vital for understanding crypto market sentiment. They help sort through lots of data to find sentiment scores. AI can understand complex feelings in texts, like slang and sarcasm.

How can traders read and interpret crypto market sentiment?

Traders should watch social media, and news, and use tools like the Fear and Greed Index. These show how investors feel overall, helping predict market moves.

How does market sentiment impact trading strategies?

Sentiment affects trading by making Crypto Prop traders buy or sell based on feelings. A positive mood can push prices up, while a negative mood can drop them.

What tools are available for crypto sentiment analysis?

Tools like StockGeist.ai give real-time insights into the market’s feelings. They use WordClouds and rankings to show what people are talking about. Watchlists and charts help Crypto Prop traders dig deeper into sentiment.

What are the challenges in analysing crypto market sentiment?

Challenges include understanding slang and sarcasm online. Fake news and manipulation can also distort true feelings, making it hard to predict sentiment.

How can sentiment analysis be integrated with other trading techniques?

A good strategy combines sentiment analysis with technical and fundamental analysis. Sentiment shows emotional reactions, while technical analysis looks at price trends, and fundamental analysis at value.

How can sentiment analysis help pass a prop challenge?

Knowing the market’s sentiment can boost your trading strategy, helping you pass challenges from crypto firms. It lets Crypto Propraders predict market moves and align trades with performance goals.