The Volume Weighted Average Price (VWAP) has long been a staple benchmark in traditional finance. Institutional traders on Wall Street use VWAP as a yardstick to gauge trade execution quality and market impact.

In fact, many large players attempt to execute large orders around the VWAP to avoid moving the price, blending their trades into the market without causing swings.

Because so many institutions watch this indicator, the VWAP price level often becomes highly influential in intraday price action. Stocks tend to respect VWAP as an intraday support or resistance, reflecting the day’s true average price once volume is factored in.

When bringing VWAP into the crypto realm, traders must account for key differences. Unlike stock markets with defined opening and closing times, crypto trades 24/7 on fragmented exchanges, which adds nuance to VWAP calculations.

VWAP typically resets each trading session (for stocks, that’s daily). Crypto markets have no official “close,” so traders often treat midnight UTC or a 24-hour period as the VWAP reset point.

This continuous market means volume distribution can vary greatly by time of day. For example, Bitcoin’s trading volume might surge during U.S. or Asian market hours and ebb during off-peak times.

Experienced crypto traders know to interpret VWAP with these patterns in mind – a mid-day VWAP in crypto might encapsulate two very different liquidity environments from the same 24-hour period.

Despite these differences, VWAP remains a valuable benchmark in crypto trading, providing a volume-weighted view of average price that can signal whether the market is trading at a premium or discount relative to recent volume.

Integrating VWAP into Crypto Trading Strategies

Seasoned crypto traders incorporate VWAP into their strategies to fine-tune trade entries, exits, and overall market bias. Because VWAP represents an average price weighted by volume, it acts as an “equilibrium” level for the day.

Many intraday crypto strategies evolve around the VWAP line. For instance, a common VWAP crypto strategy is to buy dips toward VWAP during uptrends and sell rallies toward VWAP during downtrends, assuming that price will gravitate back to the mean.

If Bitcoin breaks out above the VWAP and then retraces, some traders wait to re-test VWAP as a lower-risk entry point, only going long if the price holds above VWAP after the pullback.

This approach uses VWAP as a dynamic support level: when the price is above VWAP, the day’s momentum is bullish, so the VWAP line can serve as support on pullbacks. Conversely, if the price is below VWAP, rallies up into the VWAP line often act as resistance, presenting potential short opportunities.

These tactics rely on the idea that VWAP marks where the bulk of volume traded, so price returning to VWAP can be an attractive mean-reversion point.

Another use of VWAP in trading crypto is for intraday trend confirmation. Traders often gauge sentiment by whether the price is above or below the VWAP. If an asset stays above VWAP for a sustained period, it suggests buyers are in control (price is above the day’s average cost), reinforcing a bullish bias. If it lingers below VWAP, sellers dominate, indicating a bearish intraday trend.

Experienced traders may even set trading rules such as: only take long entries when the price is above VWAP and the trend is strong, or only short when the price is below VWAP.

One popular rule of thumb is to align your position with the side of VWAP, the price is on – long above VWAP, short below – as this means you are trading in the direction of the day’s weighted momentum.

Of course, this is not absolute; there are days when the rule flips (for example, on a range-bound day, going long below VWAP anticipating a return to it). The key insight is that VWAP helps identify relative value intraday: is the price high or low relative to where most volume is traded?

Savvy crypto traders use that information to time entries and exits more effectively, rather than blindly chasing momentum.

VWAP can also be integral to risk management and position sizing. For example, some traders will use the distance from VWAP as a gauge of stretched price action. If price is dramatically above VWAP (say +5% or more on a volatile day), a trader might avoid new longs because the asset is “overextended” above its average price.

They might tighten stop-losses on existing longs or even look for reversal setups, knowing that such divergences often snap back toward VWAP. Conversely, if price deviates far below VWAP, it could signal a short-term oversold condition – a potential opportunity to scale into a long position with the expectation of a bounce back toward the mean.

By incorporating the VWAP indicator, crypto traders add a volume-aware dimension to their strategy, complementing pure price analysis with a sense of where heavy trading activity has occurred.

VWAP vs EMA and Other Indicators

It’s essential to distinguish VWAP from other moving averages, like the EMA (Exponential Moving Average), which crypto traders commonly use.

The VWAP indicator crypto traders rely on is volume-weighted and resets daily. In contrast, an EMA is a continuously calculated average that gives more weight to recent prices but ignores volume.

Each has its place. VWAP excels as an intraday benchmark and dynamic support/resistance indicator, reflecting real-time consensus price by factoring in volume traded. EMAs, on the other hand, are better for identifying longer-term trend direction across days or weeks, since they don’t reset and will smoothly follow price over time.

In practice, VWAP vs EMA isn’t an either/or choice – they serve different purposes. As one analysis succinctly notes, “The VWAP is better for intraday trading as it incorporates volume, while the EMA is useful for identifying trends over different time frames.”.

A day trader might use VWAP to decide intraday entry points (e.g., buy when price crosses above VWAP with strong volume) and use a short-term EMA to judge if the short-term trend is up.

Meanwhile, a swing trader might lean on a 50-day or 200-day EMA to gauge the broader trend and use an anchored VWAP from the start of the week to find a good intra-week entry level.

When it comes to support and resistance, VWAP and EMAs can both act as barriers or magnets for price, but for different reasons.

VWAP’s significance comes from traded volume – heavy volume levels create a “fair value” area that the price often gravitates toward. EMAs create support/resistance based on trader observation and algorithms that use those averages.

Notably, on an intraday chart, VWAP will typically lag less than a long-period EMA early in the day (since VWAP starts fresh each day). However, by afternoon, VWAP is a cumulative average of the whole session, so it becomes a slower, smoother line – somewhat analogous to a long-period moving average.

A quick tip for traders: use VWAP for intraday mean reversion signals and short-term bias, and use EMAs to stay aligned with the higher-timeframe trend. For example, if the price is above the daily VWAP (bullish intraday) but below the 50-day EMA (bearish longer-term trend), you might be cautious and take only quick counter-trend trades or wait for alignment between intraday and daily trend before going big on a position.

VWAP also pairs well with other indicators beyond moving averages. Because VWAP is a lagging indicator by nature (it aggregates past data as the day progresses), it’s often combined with leading indicators or additional signals to sharpen its effectiveness.

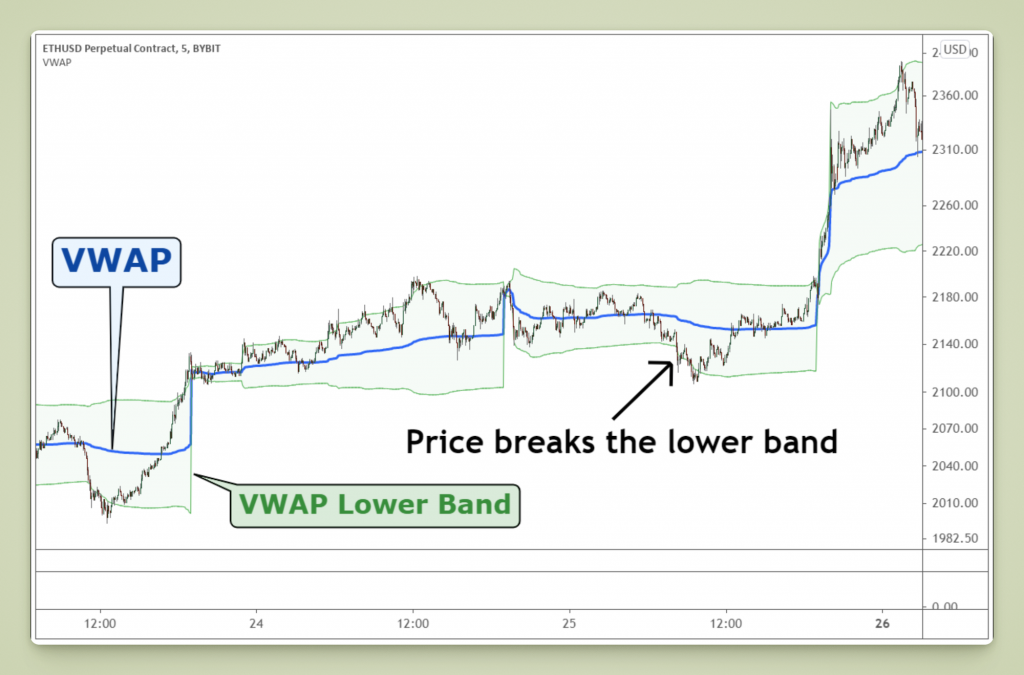

Some traders overlay Bollinger Bands or standard deviation bands on VWAP to identify statistically extreme deviations – essentially creating dynamic support/resistance zones around the VWAP. Others use oscillators like RSI to confirm whether price crossing VWAP is accompanied by momentum strength or divergence.

For example, if the price dips below VWAP but RSI shows an oversold reading, it could strengthen the case for a long contrarian trade expecting a move back above VWAP.

Ultimately, VWAP is rarely used in isolation; it becomes most powerful when integrated into a holistic strategy. In fact, studies and trading wisdom suggest no single indicator, VWAP included, guarantees a winning edge on its own. In the long run, traders often see better results by combining VWAP signals with other indicators or price action clues, ensuring confirmation before acting on a trade idea.

Best Practices and Advanced VWAP Tips for Crypto

To get the most out of VWAP in crypto, consider a few best practices. First, ensure you’re using appropriate chart settings. The best VWAP settings for crypto traders typically involve using intraday time frames and resetting VWAP daily.

Best VWAP Settings for Day Trading

Many traders use VWAP on the 1-minute, 5-minute, or 15-minute chart for intraday analysis. Shorter time frames feed VWAP with more granular data points, making the VWAP line more responsive to sudden volume spikes.

On higher time frames (like 4-hour or daily charts), a standard VWAP that resets every day becomes less useful, since each candle might span multiple VWAP sessions. Instead, if you want to apply the VWAP concept over longer periods, you might use anchored VWAP.

Anchored VWAP lets you start the calculation at a specific point in time (for example, the beginning of a week, month, or at a significant price swing or event). This can be incredibly useful in crypto markets that trend over weeks: an anchored VWAP from a major swing low can act as a rising support indicator, and one from a swing high can act as resistance.

Some experienced crypto traders will have multiple VWAPs on their chart simultaneously, each anchored to a pivotal high or low, providing a volume-weighted view of average price since those key turning points. This advanced technique helps visualize how the market values the asset over various periods, not just the current day.

Liquidity is another factor to keep in mind. VWAP’s reliability can diminish in low-liquidity markets or altcoins with sporadic volume. In thinly traded coins, a few large orders can skew the VWAP notably.

For example, if an altcoin usually trades low volume but suddenly one big buyer steps in, the VWAP will jump due to that volume, which might not reflect a broad market consensus, but rather one entity’s action. In such cases, be cautious: VWAP might be less predictive of true support or resistance. It’s often wise to supplement VWAP with other indicators or analysis in low-liquidity scenarios.

On the flip side, in highly liquid markets like BTC or ETH, VWAP is extremely useful because the heavy volume generally provides a stable average that many market participants respect. Always consider the asset’s typical volume: use VWAP confidently on high-volume pairs and be more critical on obscure alt pairs.

Another best practice is aligning the VWAP with trading sessions or time zones relevant to your market. Crypto being global, you might notice patterns such as the Asia session often setting the day’s initial VWAP trend, which then gets either reversed or accelerated during the European and U.S. sessions.

Some traders even use a rolling session VWAP (e.g., a VWAP that starts at the beginning of the London trading hours and resets 24 hours later) to gauge regional influence. While the default is a daily reset at 00:00 UTC, feel free to experiment with what “session” definition best captures the rhythms of the particular coin you trade. Just be consistent in what you use so you can read it reliably.

Finally, maintain a balanced perspective with VWAP. It’s a powerful tool for intraday trading and short-term analysis, but it has limitations.

By the afternoon of a trading day, VWAP will have a lot of data “memory” and thus will move slowly even if price breaks out – at that point, don’t expect VWAP to catch up to a sharp rally or dump in real-time.

It’s showing you the average price paid, not the current market price. If a late-day breakout occurs, VWAP will likely lag below the price, and that’s normal. In such cases, savvy traders switch to using VWAP as a post-trade benchmark (to evaluate how good their fill was relative to the day’s average) rather than as a real-time entry trigger.

And remember, as with any indicator, context is king. A VWAP signal during a high volatility news-driven move might be less reliable, since extraordinary volume can temporarily distort the average. Using judgment and not treating VWAP signals as gospel will serve you well.

Implementing VWAP Strategies with HyroTrader

Successfully trading with VWAP not only requires knowledge and practice, but also the right tools. Integrating a VWAP-centric strategy into your workflow helps you use a trading platform that supports real-time data, flexible rule-setting, and fast execution.

One such platform is HyroTrader, a crypto prop trading firm designed for serious traders. HyroTrader provides an environment where VWAP-based strategies can thrive by offering several key advantages:

Real-time Market Execution

In fast-moving crypto markets, executing your strategy at the moment a VWAP signal triggers is crucial. HyroTrader’s platform streams real-time market data and routes orders with minimal latency, so you can hit that VWAP pullback entry or breakout trade without delay.

This real-time execution means that when the token’ss price touches your VWAP level, your order can fill almost instantly at the intended price, rather than slipping due to platform lag.

Flexible Trading Rules

Unlike some restrictive trading programs, HyroTrader allows a high degree of freedom in trading style. You can scalp, crypto day trade, or swing trade using VWAP or any other indicators without running afoul of arbitrary rules.

The platform’s flexible trading rules accommodate strategies like VWAP mean-reversion, trend-following, or even combining VWAP with news trading.

You won’t face penalties for things like holding trades for only a few minutes or avoiding certain times – you have the freedom to trade your VWAP strategy as you see fit.

Instant Crypto Payouts

When your VWAP strategy pays off, HyroTrader ensures you get your profits quickly. It offers instant (fast) crypto payouts, typically processing withdrawals within 12-24 hours in USDT or USDC stablecoins.

This is a huge benefit for active traders: you can compound your gains or enjoy your profits without long waiting periods. Fast payouts also reflect the platform’s trust and efficiency, letting you focus on trading rather than worrying about cashing out. View more HyroTrader reviews.

Account Scaling Opportunities

A successful VWAP trading strategy can yield consistent profits, and HyroTrader helps you capitalize on that success by offering account scaling. As you demonstrate profitability and sound risk management, your trading capital can be increased in stages.

This account scaling means a skilled trader who started on a $50k funded account could see that account grow (e.g., +25% capital every few months) – allowing larger position sizes and potentially larger profits, all while still limiting personal risk. Scaling up rewards your performance and lets your VWAP strategy leverage more capital as you prove yourself.

Freedom of Trading Style

HyroTrader emphasizes trader autonomy. You have the freedom to trade any available crypto pairs, at any time, using any strategy style (news trading, technical patterns, algorithmic, etc.) as long as risk parameters are respected.

This freedom of trading style is particularly advantageous for VWAP-centric traders, because you can integrate VWAP with other methods (maybe you use VWAP plus EMA crossover, or VWAP with order flow analysis) without being constrained. The platform’s support for custom strategies means you can continuously refine your VWAP approach in a live market environment.

In short, HyroTrader provides an optimal setting for executing a refined VWAP crypto strategy. By combining real-time execution, flexible rules, quick payouts, and a scalable account model, it empowers experienced traders to focus on what they do best – trading – while alleviating common pain points.

Conclusion

VWAP is a powerful tool in the experienced crypto trader’s arsenal. Integrating it into your trading workflow can improve your sense of intraday value, help you time entries and exits more effectively, and serve as a benchmark to judge your execution quality.

We’ve seen that techniques honed in traditional markets – like using VWAP as an execution benchmark or support/resistance indicator – translate well into crypto, with some adaptation for a 24/7 market and unique liquidity patterns.

By comparing VWAP vs EMA and other indicators, we understand that VWAP fills a different niche, excelling in short-term trade decision support, while EMAs guide longer-term trend alignment.

The savvy trader uses both in harmony, alongside other tools, to cover all bases. We also covered best practices such as using the best VWAP settings for crypto (typically on short time frames and high-liquidity assets) and employing advanced tricks like anchored VWAP for broader contexts.

Remember, the goal is not to use VWAP in isolation, but to blend it into a comprehensive strategy – much like an ingredient in a recipe, it works best with others to bring out the full flavor of a trading plan.