Cryptocurrency markets never sleep, and neither should your trading strategy. As an experienced crypto trader, you might have developed profitable manual strategies, but have you considered the power of algorithmic trading to scale your efforts?

Imagine deploying crypto trading bots that execute your plans 24/7, across multiple exchanges, at lightning speed. What if you could capture every arbitrage opportunity and respond to market moves in milliseconds, all while avoiding emotional decisions?

This article dives deep into the world of cryptocurrency algorithmic trading, exploring advanced automated trading strategies, the tools and platforms that make it possible (including prop firm solutions like HyroTrader), and how you can leverage them to amplify your trading results.

We’ll cover how algorithmic trading works in the crypto space, why it’s a game-changer for scaling up, and what strategies and best practices can help seasoned traders maximize their edge.

By the end, you’ll see why combining your expertise with automation – and tapping into resources like API crypto trading and professional crypto trading platforms – can elevate your trading to new heights. Let’s get started on unlocking the full potential of algorithmic crypto trading.

Why Algorithmic Trading Is a Game-Changer in Crypto

Algorithmic trading – using computer programs to automatically execute trades based on predefined criteria – has revolutionized traditional markets over the past decades. In the cryptocurrency market, it’s becoming indispensable for serious traders.

Why?

Because crypto trading is fast-paced, global, and runs nonstop. Human traders need sleep and can only monitor so much at once, but algorithms don’t have those limitations.

To put it into perspective, a significant portion of the crypto market volume is already driven by trading bots and algorithms. Some industry estimates suggest that well over 60-70% of trades on major exchanges are executed by automated programs rather than manual clicks.

This dominance of algorithmic trading in crypto indicates how competitive and efficient the market has become. If you’re trading manually, you could be competing against sophisticated bots that react in microseconds to price changes or news.

The advantages of algorithmic trading in crypto are clear:

- Speed and Precision: Algorithms can analyze market conditions and execute orders in fractions of a second. For example, if Bitcoin’s price breaks a key level at 3:00 AM, an algorithmic strategy can instantly place orders to capitalize on the breakout. No human can reliably react that fast or with such precision.

- 24/7 Operation: Crypto markets operate around the clock. An automated trading bot never needs rest, meaning your strategy can continuously scan for opportunities day and night. You won’t miss an overnight price surge or a weekend flash crash.

- Emotion-Free Execution: Even experienced traders can fall prey to fear, greed, or hesitation. Algorithms stick strictly to logic and predefined rules. This removes emotional bias – no more panic selling on FUD or chasing pumps impulsively. Consistent execution often leads to more reliable performance over time.

- Multitasking and Scale: A single trader might effectively follow several trading pairs at once. A program can monitor dozens or even hundreds simultaneously. Using algorithmic strategies, you could deploy multiple crypto trading bots to trade various pairs and strategies concurrently without getting overwhelmed. This allows you to scale your operation in breadth (more markets) and depth (more frequent trades) far beyond what manual trading permits.

In short, algorithmic trading empowers you to trade faster, smarter, and at scale. It doesn’t replace your trading skill – it amplifies it. By encoding your strategies into algorithms, you ensure your trading plan is executed exactly as intended, every time. For an experienced trader looking to expand their reach, this is a game-changer.

Before we delve into specific strategies, let’s consider how leveraging algorithmic trading can concretely scale up your trading efforts and profits.

Scaling Your Trading Efforts with Automation

One of the main motivations for going algorithmic is the ability to scale up what’s already working. If you have a strategy that yields consistent returns, you might be limited by time, capital, or concentration when trading manually. Algorithmic trading helps break through those barriers:

Imagine you have a manual strategy that nets a modest 10% annual return. Trading with $50,000, that’s $5,000 a year. To increase that profit, you either need to devote more time (to find more trades) or trade more capital. Both are challenging – there are only 24 hours in a day, and you might not have a bigger bankroll handy. This is where automation and clever use of resources come in:

Higher Trade Frequency

Automation lets you exploit many small opportunities that you might ignore manually. For instance, a mean-reversion bot could flip trades every few minutes, capturing tiny profits that add up. These automated trading strategies can run continuously, scaling your number of trades exponentially while you focus on strategy improvement.

Leveraging External Capital

More capital usually means more profit potential. Instead of using only your own funds, you can partner with a crypto prop trading firm like HyroTrader to trade a larger account.

HyroTrader allows skilled algorithmic traders to access funded accounts (tens of thousands to even hundreds of thousands of dollars) with high leverage. This means your algorithm can command a much larger position size than your personal account would allow, multiplying the returns (and the importance of proper risk management).

We’ll discuss prop firm crypto trading in detail later, but it’s a key avenue for scaling without taking on all the risk yourself.

Parallel Strategies

With coding, you aren’t limited to one strategy at a time. Maybe you have a great trend-following system for trending markets and a different range-trading system for choppy markets. You can run both simultaneously in different market conditions or even on different assets. Each algorithm can focus on its niche, collectively broadening your profit sources. Running multiple bots is like having a team of specialized traders working for you.

Global Market Access

Crypto is a global market with hundreds of exchanges. An algorithm can be programmed to monitor price differences across exchanges or regions. It’s feasible to have a bot arbitraging between a U.S. exchange and a Korean exchange at 3 AM, something a single trader would rarely manage logistically. This geographical and market reach is a form of scaling your presence to every corner of the crypto world.

Scaling up through algorithmic trading does come with challenges: more trades and bigger positions can mean higher risk if not managed well. It’s crucial that as you scale, you also implement strict risk controls (which we will cover). However, with prudent management, automation allows you to grow your trading operation in ways that simply aren’t possible manually.

This sets the stage. Now let’s explore the concrete strategies and methods you can employ algorithmically in the crypto markets.

Advanced Algorithmic Trading Strategies for Crypto

Experienced traders often seek an edge through sophisticated strategies. The beauty of algorithmic trading is that it can implement complex ideas with discipline and speed. Below, we outline several advanced strategies particularly suited for crypto trading bots and automated systems. Each of these strategies can be coded into an algorithm to run hands-free once set up.

Arbitrage Opportunities

Arbitrage is a classic algorithmic approach. It involves profiting from price differences of the same asset in different places or forms. In crypto, arbitrage opportunities can arise because the market is fragmented across many exchanges.

Exchange Arbitrage

This is the simplest form – buying a cryptocurrency on one exchange where the price is lower and simultaneously selling it on another exchange where the price is higher.

For example, if Ethereum is trading for $1,800 on Exchange A and $1,820 on Exchange B, a bot can execute a buy on A and a sell on B in milliseconds, locking in a nearly risk-free $20 minus fees. Such price gaps often close in seconds, so only an automated program can exploit them consistently.

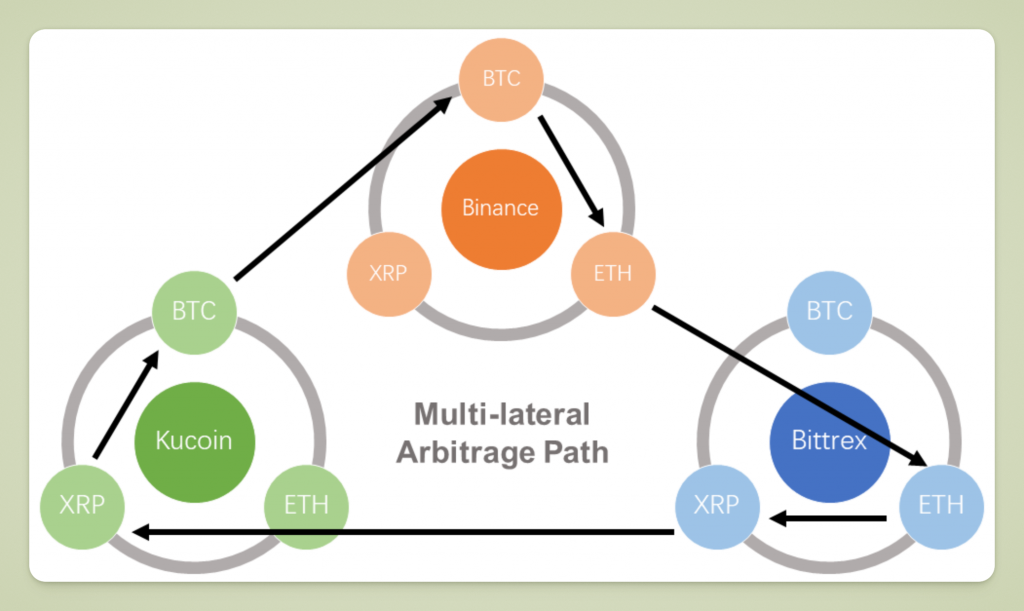

Triangular Arbitrage

This takes advantage of price differences between three trading pairs. For instance, consider a triangle of currencies like BTC, ETH, and USD. If the exchange rates between BTC/USD, ETH/USD, and BTC/ETH get out of sync, an algorithm can cycle through trades (BTC -> USD, USD -> ETH, ETH -> BTC) to end up with more BTC than it started with. These opportunities are subtle and fleeting, but a well-written algorithm can sniff them out across multiple markets.

Cross-Market Arbitrage

Crypto also offers arbitrage across different market types – say between a cryptocurrency’s spot price and its futures price, or between a decentralized exchange (DEX) and a centralized exchange.

During volatile periods, futures might trade at a premium or discount relative to spot. An algo might buy spot and sell futures when a gap appears (known as cash-and-carry arbitrage), locking in a profit when prices converge.

Arbitrage bots require careful handling of transaction costs, withdrawal times (for cross-exchange transfers), and execution risk. High-speed connections and low latency are crucial – arbitrage is an ultra-competitive arena. Nonetheless, it’s a staple algorithmic strategy that exemplifies how automation can profit from inefficiencies that humans alone can’t catch in time.

Trend Following and Momentum Bots

Another popular algorithmic strategy category is trend following or momentum trading. These algorithms seek to ride the wave of market momentum – getting in when a strong trend is detected and exiting when that trend weakens or reverses.

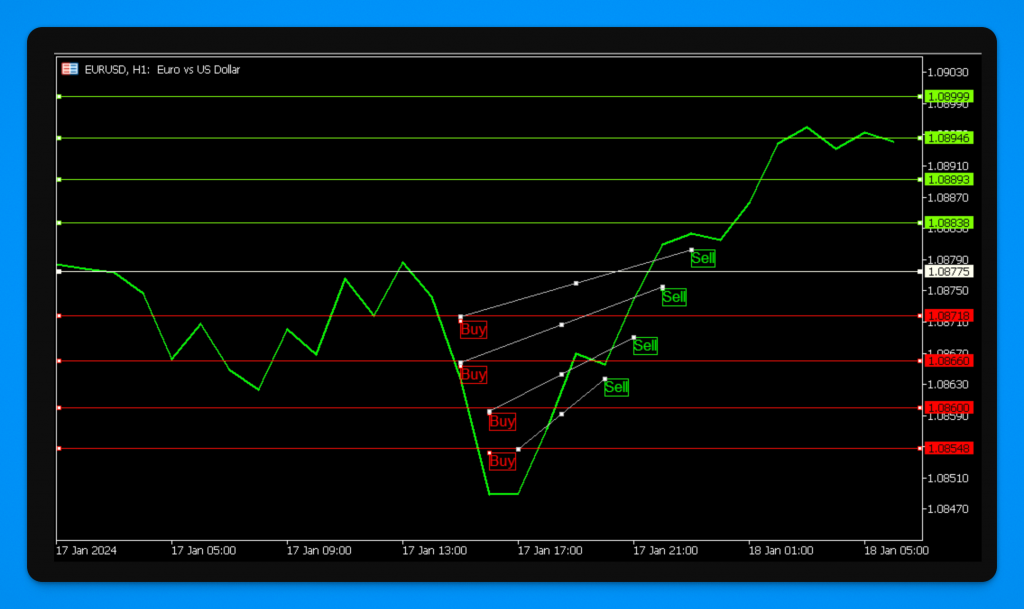

Breakout Trading

A momentum bot might watch for when a cryptocurrency breaks out of a defined range or hits a new high on strong volume. The algorithm could then initiate a long position in the direction of the breakout, aiming to capture the continued move. For example, if Bitcoin has been hovering between $29k and $30k for days and then surges past $30k with a volume spike, a trend-following algorithm could buy immediately, anticipating further upside.

Learn more: Crypto Breakout Trading

Moving Averages and Technical Indicators

Many trend bots rely on indicators like moving average crossovers (e.g., 50-day moving average crossing above the 200-day, a classic bullish sign) or momentum oscillators. The bot can systematically check these indicators across multiple timeframes, something tedious to do manually for many markets.

When conditions meet predefined criteria – say, price above a certain moving average, RSI indicating strength – the bot enters the trade. The selling might be triggered by an opposite crossover or a trailing stop to lock in profits.

Ride the Winners

In the altcoin world, momentum plays can be highly lucrative. An algorithm could scan a list of altcoins for top performers of the day or hour, then jump on the ones with accelerating gains.

By the time a human notices an altcoin is up 20% and tries to jump in, an algorithm might have already identified the move at 5% and captured a chunk of the rally. Of course, risk management is key, as momentum can reverse sharply in crypto.

Trend-following algorithms need to balance being quick to catch trends with not overreacting to fake-outs (false breakouts). Fine-tuning parameters and incorporating risk controls (like stop-loss levels) helps ensure they capitalize on genuine trends without getting chopped up in sideways noise.

Mean Reversion and Grid Trading

On the flip side of momentum strategies are mean reversion strategies, which assume that prices will eventually revert to a mean or equilibrium. Crypto markets, despite their trends, also experience oscillations and ranges where mean reversion can thrive.

Range Trading Bots

If a coin tends to bounce between support and resistance levels, a bot can exploit this by buying near the support (when the price dips) and selling near the resistance (when the price rises).

For example, if Litecoin has been trading roughly between $90 and $110 for weeks, a mean reversion bot could place limit buy orders around $92 and limit sell orders around $108, repeatedly capturing the swings. The key is setting the range and having the patience and consistency that a bot provides.

Grid Trading

This is a popular automated strategy, particularly among crypto traders. You set a price range and instruct the bot to place a grid of buy and sell orders at predefined intervals within that range.

Suppose you expect Ethereum to trade between $1,500 and $1,700 for the next month. A grid bot might place buy orders every $10 down from $1,700 and sell orders every $10 up from $1,500.

As the price oscillates, the bot buys low and sells high in small increments, pocketing the difference each time. Grid bots work well in sideways or mildly volatile markets and essentially automate the process of “buying the dip and selling the rip” across a grid of prices.

Statistical Arbitrage

A more advanced mean reversion approach involves identifying statistically correlated instruments and betting on a divergence reverting.

For instance, if two DeFi tokens usually move in tandem but suddenly diverge (Token A surges while Token B lags), a stat-arb algorithm might short A and buy B, expecting their prices to converge again.

When done quantitatively, this can be complex, but algorithms can crunch the correlation data and execute paired trades far faster than a human.

Mean reversion strategies can generate steady profits in stable markets, but they must be monitored for breakouts – if a true new trend starts, a pure mean reversion bot could accumulate a losing position. Therefore, many such bots include fail-safes or trend filters to avoid getting run over by a runaway market.

Market Making and High-Frequency Strategies

Some algorithms are designed not just to trade based on market moves, but to provide liquidity and profit from the bid-ask spread or short-term fluctuations. These are typically high-frequency strategies that require robust infrastructure.

Market Making Bots

A market-making algorithm places both buy and sell limit orders around the current price, essentially acting like an exchange market maker.

For example, on a token trading around $10.00, a bot might constantly place a buy at $9.98 and a sell at $10.02. If both orders fill, the bot earns the $0.04 spread (minus fees). Even if only one side fills, it can adjust and continue.

Market making provides a stream of small profits and helps the bot accumulate inventory at favorable prices. Some exchanges offer rebates for market makers (paying you to add liquidity), which can make this strategy even more attractive.

However, one needs to manage inventory risk — if the price moves strongly in one direction, the bot could end up holding a large position at a loss. Stop-loss rules or inventory balancing (widening spreads or pausing if inventory gets too long/short) are essential.

High-Frequency Scalping

These bots try to capitalize on very short-term price patterns or imbalances, often holding positions for seconds or less.

For instance, if an algorithm detects a sudden burst of buy orders that haven’t yet moved the price up, it might quickly buy in anticipation and then sell a second later at a slightly higher price.

This requires ultra-fast execution and direct exchange connectivity. Some high-frequency strategies in crypto also exploit anomalies like slight price differences between perpetual futures and index prices or temporary order book imbalances.

This domain borders on the realm of professional firms with low-latency trading engines, but a savvy individual with a good server and a direct connection can attempt simpler versions on lower-volume pairs.

Latency Arbitrage

In certain cases, especially on slower platforms or during volatile times, an algorithm might see a price move on one venue slightly before another and quickly trade on the slower venue to catch up.

This is more common in traditional markets with co-located servers, but even in crypto, differences in API speed or websocket latency can create micro-opportunities. It’s worth noting that many exchanges have tightened these gaps, but opportunities can still occur during extreme volatility or on smaller exchanges.

Market making and HFT strategies highlight how algorithmic trading can generate profits not necessarily by predicting big trends, but by being a clever intermediary and exploiting micro-inefficiencies. They typically require a lot of fine-tuning, and profits per trade are small, but the volume of trades can make it worthwhile.

Learn: Crypto swing trading

(Additional advanced strategies like event-driven news trading and AI-based models also exist, but we will focus on the most common ones.)

Tools and Platforms for Automated Crypto Trading

Having great strategy ideas is one thing; implementing them is another. You need the right tools and platforms to turn these algorithmic strategies into reality. Fortunately, the crypto ecosystem is very developer-friendly, offering multiple ways to build and deploy trading bots.

Coding Your Own Trading Bot

Many advanced traders choose to code their strategies from scratch. Languages like Python, JavaScript, or C++ are commonly used. Python, in particular, is popular due to its extensive libraries and ease of use in prototyping.

For example, you might use Python with libraries like ccxt (which offers a unified API to many exchanges) for API crypto trading, allowing your code to fetch prices and execute trades on exchanges programmatically.

Coding your own bot gives you maximum flexibility – you can implement any strategy exactly as you want. It also means you’re responsible for every aspect, from technical analysis calculations to order execution and error handling.

This route requires programming knowledge and lots of testing, but it’s ultimately very empowering. Many successful crypto trading bots used by individuals start as custom scripts running on a server.

Using Trading Platforms/Software

If you prefer not to build from scratch, some platforms support algorithmic crypto trading through configurable bots or strategy design tools. Some exchanges offer native automation features (for instance, some have built-in grid bot or DCA bot tools).

Additionally, third-party crypto trading platforms allow you to create bots by defining rules via a user interface – for example, “if price crosses above the 100-day moving average, buy X amount”. These can be useful for traders who understand strategy well but aren’t comfortable coding.

However, be cautious when choosing reputable platforms, and remember that using generic bot templates might limit how custom you can get. Also, avoid any platform that seems like a black box or makes unrealistic promises – stick to ones that let you control and understand your strategy.

Exchange APIs and Execution

The exchange API (Application Programming Interface) is at the core of any algorithmic trading. Every major crypto exchange (Binance, Coinbase Pro, Kraken, Bybit, etc.) provides API endpoints that allow software to perform actions like retrieving current order book data, checking your account balance, or placing and canceling orders.

To use these, you’ll generate API keys from your exchange account and plug them into your bot or platform. It’s via these APIs that your algorithm communicates with the market in real time.

When setting up, you should use the exchange’s testnet or sandbox if available to practice sending API orders without risking real funds. Keep your API keys secure (never expose them in code you share) and use IP whitelisting and appropriate permissions (for instance, keys that only allow trading, not withdrawals, for safety).

Backtesting and Simulation Tools

Before unleashing a bot on live markets, you should backtest it on historical data and ideally run it in a simulated environment (paper trading) to see how it behaves.

Tools like Python’s backtrader library or platforms with built-in strategy testers can help. Backtesting involves feeding your algorithm past market data and seeing what trades it would have made and how much profit or loss it would have generated.

It’s crucial for verifying that your idea would have been sound historically. Keep in mind, though – past performance doesn’t guarantee future results, especially in the ever-evolving crypto market.

Still, backtesting will often reveal flaws (maybe a strategy bombs during certain conditions), so you can refine it.

Crypto paper trading in real-time (many exchanges or platforms offer a demo mode) is the next step to ensure the bot works in practice with live data and doesn’t crash or behave oddly.

Deployment and Infrastructure

Running an algorithmic strategy 24/7 means you need a reliable environment for your bot. Many traders use Virtual Private Servers (VPS) or cloud services (like AWS, DigitalOcean, etc.) to host their trading bots.

This ensures your bot runs continuously without interruptions from local power outages or internet issues. A good practice is to set up monitoring – for example, your bot can send you a message on Telegram or email if it encounters an error or if certain thresholds are hit (like drawdown limits, etc.).

Some advanced setups even include failover (a secondary system that can take over if the first one fails). As you scale up, these considerations become more important to avoid any costly downtime.

Prop Trading Platforms

A unique category of platform for algorithmic traders is the proprietary trading firm environment. Instead of trading on your own exchange account, you trade on an account provided by the firm.

HyroTrader is a prime example tailored for crypto. They allow you to connect your trading algorithms to their platform (which hooks into real crypto markets) via API or their interface.

Essentially, you run your strategy on their account with their capital. We’ll dive more into HyroTrader specifically in the next section. Still, it’s worth noting as a tool: it provides not just the tech to trade via API, but also the funding and infrastructure, which can be extremely attractive for a trader ready to scale up their algorithmic trading without committing huge personal capital.

In summary, you have a spectrum of options from building your own bot from the ground up to leveraging existing platforms. Many experienced traders actually combine tools – they might prototype a strategy on a platform for speed, then later code a custom version for efficiency, and then deploy it on a prop firm’s account for scale.

The key is to match the tools to your needs and skills. Ensure you understand how your chosen tools work under the hood, especially if real money is on the line.

Leveraging Prop Firm Crypto Trading for Bigger Profits

Scaling a strategy often requires scaling capital. Prop trading firms have long been a staple in forex and stock trading, and now crypto-focused prop firms are providing a new avenue for traders to grow.

In a prop firm model, the firm gives you access to a funded account to trade – you prove yourself through an evaluation, and once funded, you keep a percentage of the profits while the firm covers the losses beyond your defined risk. It’s a win-win if you’re consistently profitable: you get to trade much larger sums than your own capital would allow, and the firm earns a share of your success.

HyroTrader: A Prop Firm for Algorithmic Crypto Traders

Among the best crypto prop firms, HyroTrader stands out, especially for algorithmic traders. They provide a range of account sizes and are very friendly to API and bot trading strategies.

Here’s why a platform like HyroTrader can be a game-changer for someone looking to scale an algorithmic strategy:

Flexible Payout Structure: HyroTrader allows rapid profit split payouts after minimum periods, enabling traders to quickly access gains and manage cash flow without being tied to a monthly schedule.

High Leverage Access: With leverage up to 1:100, algorithmic traders can adopt more aggressive strategies. A 1% market move can yield significant returns, making strategies like scalping and arbitrage potentially more profitable.

Real Market Connectivity: HyroTrader partners with real exchanges like Bybit, ensuring that trades hit the actual market, enhancing strategies reliant on real market conditions and liquidity.

Support for Algorithmic/API Trading: HyroTrader supports API connections for custom trading bots, allowing for seamless integration of strategies like momentum and arbitrage, under reasonable restrictions to prevent abuse.

Generous Profit Splits: Traders keep 70-90% of profits, providing a significant advantage. For instance, on a $10,000 profit, the trader retains $7,000-$9,000, making it a better deal than trading personal capital alone.

Low Risk to Your Own Funds: Prop firms usually require a small challenge fee, much less than the capital managed. Successful traders control significant funds with limited personal risk, allowing them to leverage their algorithms effectively.

Learn more: HyroTrader reviews

Using a prop firm like HyroTrader does come with an evaluation phase. You need to demonstrate profitable trading under the rules (which often include things like maximum daily drawdown, mandatory stop-loss usage, etc.).

These rules actually enforce good risk management, which is beneficial in the long run. As an algorithmic trader, you’ll need to program your bot to respect these rules (for instance, always set a stop loss, don’t exceed X% drawdown per day).

Once funded, you essentially operate like a professional trader, focusing on strategy while the firm takes care of capital and even tech infrastructure.

In summary, prop firm crypto trading is an excellent path for experienced traders ready to scale up.

HyroTrader, with its crypto-centric approach, is an ideal partner for algorithmic traders: it combines capital, technology, and trader-friendly policies. By successfully leveraging such a platform, you can amplify the returns of your strategy manifold compared to just trading your account.

Risk Management in Algorithmic Trading

Risk management is the cornerstone of long-term success in algorithmic trading, whether you’re trading your own account or a funded account via a platform like HyroTrader.

Scaling up means nothing if one mistake can wipe out your gains. Experienced traders know this well from manual trading, and it’s just as critical (if not more) when running bots.

Here are key risk management principles and best practices for algorithmic crypto trading:

Diversify Strategies and Markets

Just as you would diversify a portfolio, diversify your algorithmic approaches. If all your bots are trend followers on Bitcoin, they might all struggle if BTC enters a prolonged sideways period. Instead, you could run a trend bot on Bitcoin, a mean reversion bot on an Ethereum range, and perhaps an arbitrage bot scanning various altcoins.

When one strategy is underperforming, another might be excelling. Diversification helps smooth your equity curve and reduces the chance of a total account meltdown.

Set Strict Drawdown Limits

Decide on a maximum drawdown (loss from peak) you’re willing to tolerate and program your algorithms to enforce it. For instance, you might decide that if your account equity drops 10% from its high, all trading stops, and you reassess.

Some prop firms enforce daily or overall drawdown limits (HyroTrader, for example, might have rules like 4% max daily loss, 6% overall in evaluation). Even on your own, it’s wise to have these cut-offs. It could be as simple as a script that monitors P&L and disables all trading if the threshold is hit.

This prevents the scenario of a rogue algorithm spiraling into deep losses.

Use Stop Losses and Take Profits

Every trade executed by your bot should ideally have a predefined exit strategy. Stop losses are non-negotiable in automation – you don’t want a bug or unexpected market event to leave a position running indefinitely into a huge loss.

Many prop firms (including HyroTrader) require a stop loss on every trade to protect against catastrophic loss, and that’s a good practice in general.

Similarly, having take-profit levels or trailing stops helps secure gains. An algorithm might automatically trail a stop as a position goes in favor, which locks in profit in case of a reversal.

Limit Leverage and Position Sizing

If you’re given high leverage, it doesn’t mean you should always use it fully. Calculate position sizes such that even if a trade goes wrong, it only costs a small percentage of the account (commonly 1-2% risk per trade for moderate risk appetite).

For example, even with 100x leverage available, you might only risk 1% of capital on each trade’s stop loss distance. Bots can calculate position size on the fly based on account equity and stop distance – implement that formula so risk per trade is controlled.

Overleveraging is a frequent cause of blow-ups in automated accounts.

Monitor and Safeguard Your Bots

Automation doesn’t mean set-and-forget indefinitely. Continuously monitor performance. Set alerts if something unusual happens – e.g., no trades in a period when there should be (bot might have crashed), or trade volume spikes unexpectedly (perhaps indicating a bug or changed market condition).

Also, watch out for things like API errors or exchange downtime. Your bot should be coded to handle exceptions (like retrying a failed order or pausing if it loses connection). Having a manual oversight or at least an alert system ensures a minor glitch doesn’t turn into a major problem.

Regular Strategy Review

Markets evolve, and an algorithm that was profitable last year might falter this year if conditions change (for instance, a regime change from bullish to bearish, or volatility drying up).

Schedule periodic reviews to evaluate if each strategy is performing as expected. Analyze the trades to see if there’s a pattern to any losses – maybe an assumption that no longer holds.

Be ready to tweak parameters or even retire a strategy that isn’t working. The goal is to catch issues early through data analysis rather than letting the market teach you an expensive lesson.

Avoid Over-Optimization

A common pitfall when backtesting is to overfit your strategy to historical data – essentially creating a bot that would have perfectly traded the past but has no edge in the future. To avoid this, use robust validation methods.

Keep a portion of data as out-of-sample (not used in strategy development) to test after you’ve tuned on the in-sample data. If using machine learning, cross-validate thoroughly.

Simplicity often trumps complexity in live trading. A simpler strategy with fewer parameters is less likely to be curve-fit than a complex one with dozens of parameters tweaked to perfection on past data.

Stay Compliant with Platform Rules

If you’re trading on a prop firm account, always be mindful of their specific rules (max lot sizes, news trading restrictions, if any, etc.). Those rules are there to protect both you and the firm. Program your algorithm to respect them.

In essence, think of crypto trading risk management as the brakes on your high-speed trading engine. Without brakes, no matter how powerful your engine (strategy) is, a crash is inevitable.

But with good brakes and a solid seatbelt, you can accelerate with much more confidence. The most successful algorithmic traders are often not those with the flashiest returns in a month, but those who can sustain and compound moderate returns over years by protecting their downside diligently.

Best Practices for Successful Algorithmic Trading

Beyond risk management, there are general best practices and habits that will increase your chances of long-term success in algorithmic crypto trading:

Thorough Testing

Always test your algorithm extensively before trusting it with significant capital. This includes backtesting on historical data, forward testing on live data without real money, and doing smaller-scale live runs. Sometimes a strategy looks great in a backtest but encounters slippage or execution issues in reality that only a live test will reveal. It’s better to catch those on a small account or simulation.

Incremental Deployment

When introducing a new strategy or bot, start with a small allocation or a lower leverage. Monitor how it behaves in the real market for a few weeks. If all goes well, scale it up gradually.

This staged approach ensures you don’t bet the farm on an unproven idea. Even at a prop firm, you might start with a smaller account challenge before attempting a bigger one with the algorithm, just to build confidence.

Keep It Simple (Especially Initially)

Complex algorithms with many moving parts can break in many ways. Whenever possible, start with simpler models. A straightforward strategy that works is better than a convoluted one that might marginally perform better on paper but is fragile. You can always add complexity later if needed, but only after nailing the basics.

Mind the Costs

Trading fees, spreads, and funding rates can quietly erode your profits. Use platforms with low fees (for example, HyroTrader offers competitive fees and even fee rebates) and always factor these costs into your strategy’s performance metrics.

Psychological Detachment but Regular Oversight

One advantage of bots is that they remove emotional execution, but as the designer, you need to remain rational as well. If the bot has a losing streak, don’t rush to change everything or turn it off in panic – assess if it’s within expected strategy behavior.

Conversely, if it’s making money hand over fist, don’t get greedy and double down beyond the strategy’s logic. Trust the process you’ve tested. Maintain oversight but resist knee-jerk reactions. Let data, not emotions, drive tweaks to your algorithms.

Finally, remember that algorithmic trading is a journey of continuous improvement. You might start with one profitable bot and, over time, evolve into managing a small portfolio of algorithms, each doing its part.

Treat it like a business: revenues (profits) need to exceed costs, growth should be planned and managed, and risks need to be controlled.

With dedication and the right tools, algorithmic trading can potentially unlock levels of success that are hard to achieve through manual trading alone, especially when combined with opportunities like prop firm accounts to amplify your strategies.

Conclusion: Embrace the Algorithmic Advantage

Cryptocurrency algorithmic trading can truly supercharge your results. By combining your trading expertise with the speed and precision of automation, you gain a powerful edge in a market where milliseconds matter and opportunities are constant.

We’ve explored how advanced strategies – from arbitrage to trend-following – become even more potent when executed by crypto trading bots. At the same time, we’ve stressed that risk management and discipline remain paramount: automation might remove emotion, but it demands careful oversight and robust safeguards to ensure long-term success.

Importantly, scaling up your trading doesn’t have to be limited by your personal capital. Through prop firm crypto trading programs, such as those offered by HyroTrader, you can access significant funding and institutional-grade trading infrastructure.

This partnership allows you to deploy your algorithms on a much larger scale, with the confidence that you keep the lion’s share of profits. It’s a modern pathway that can accelerate your journey from a solo trader to a high-volume professional.

The crypto landscape is evolving quickly, and staying competitive may soon require algorithmic assistance. Many top traders already leverage API crypto trading tools and automated strategies to stay ahead of the curve. Adopting algorithmic trading is no longer just an experiment – for many, it’s becoming a necessity to thrive in the face of stiff competition.

The road to becoming a successful algorithmic trader is challenging, but the rewards can be substantial. With continuous learning, careful planning, and the right support (both in technology and capital), you can transform the way you trade.

So ask yourself: Are you ready to let algorithms amplify your trading potential? If so, there’s no better time to start. Embrace the power of algorithmic crypto trading – and watch your trading efforts scale beyond what you once thought possible.