In the volatile world of cryptocurrency trading, practicing your strategies without financial risk is invaluable. Whether you’re refining existing skills or starting your journey, a quality demo crypto trading account provides the perfect training environment.

This comprehensive guide explores the best demo accounts available, how to maximize their benefits, and why HyroTrader stands out as a premier option for both new and experienced traders seeking to develop their skills risk-free while preparing for real-market success.

The Value of Demo Crypto Trading

Demo trading accounts (also known as paper trading) provide simulated environments where you can practice cryptocurrency trading using virtual funds in real market conditions. These platforms serve as essential training grounds before committing actual capital to the markets.

The primary benefit of demo crypto trading is obvious – you gain practical experience without financial risk. This risk-free environment creates psychological safety, allowing you to make the inevitable mistakes that come with learning without suffering real monetary consequences. For experienced traders, demo accounts provide a sandbox to test new strategies or adapt to changing market conditions without risking their capital.

What truly sets high-quality demo accounts apart is their ability to accurately replicate real trading conditions. The best platforms update in real-time, include realistic spread and slippage factors, and offer the same tools and features as their live trading counterparts. This authenticity ensures that the skills you develop will transfer directly to live trading.

Cryptocurrency markets present unique challenges compared to traditional markets – extreme volatility, 24/7 operation, and distinct market cycles. Demo accounts allow you to experience these dynamics firsthand, helping you adapt to the cryptocurrency ecosystem’s particular rhythms before putting real money on the line.

Essential Skills Developed Through Demo Trading

Demo accounts provide the perfect environment for building fundamental crypto trading skills without financial pressure. This risk-free practice allows you to focus entirely on improvement rather than worrying about protecting your investment.

Technical analysis is one of the most valuable skills you can develop through demo trading. These accounts allow you to practice identifying chart patterns, applying indicators, and making predictions based on historical data. You can test different analytical approaches to see which ones align with your trading style and provide the most accurate signals. Over time, you’ll develop an intuitive sense for market movements that will serve you well when trading live.

Risk management – arguably the most crucial aspect of successful trading – can be thoroughly developed in demo environments. You can experiment with position sizing, stop-loss placement, and profit targets to find the optimal balance between risk and reward. This practice helps establish the discipline to adhere to predetermined risk parameters, a defining characteristic of profitable traders.

Order execution technique is an often overlooked skill that significantly impacts trading results. Demo accounts let you practice placing different types of orders (market, limit, stop, etc.) and understand how they execute under various market conditions. You’ll learn to minimize slippage and maximize fill quality, skills that directly translate to better performance when trading with real money.

Advanced Strategy Testing Without Risk

Beyond basic skill development, demo accounts shine when it comes to strategy validation. They provide a consequence-free environment to test trading ideas before risking actual capital – an approach that separates professional traders from amateurs.

When testing a trading strategy, it’s essential to evaluate its performance across different market conditions. Cryptocurrency markets can quickly shift from trending to ranging patterns, and strategies that work well in one environment often fail in another. With a demo account, you can backtest your strategy against historical data and then forward-test it in real time to ensure consistent performance across varying market conditions.

More advanced traders can use demo accounts to develop and test algorithmic trading strategies. Many platforms allow for API connections that enable automated trading. You can code your strategy, run it on the demo account, and monitor its performance without risking capital during the development and debugging process. This methodical approach helps identify flaws in your algorithm before deploying it in live markets.

Portfolio management strategies can also be effectively tested in demo environments. You can experiment with different asset allocations, correlation effects, and rebalancing techniques. This higher-level strategic thinking extends beyond individual trades to optimize your entire crypto portfolio for the best risk-adjusted returns.

Key Features of Top-Tier Demo Trading Platforms

Not all demo trading accounts offer equal value. The best platforms provide specific features that maximize learning opportunities and deliver an authentic trading experience. Understanding these key elements will help you select the right demo account for your specific needs.

The foundation of any quality demo platform is accurate market data. Premium demo accounts use real-time price feeds that precisely match live market conditions. This authenticity ensures that the skills and strategies you develop will translate directly to live trading. Platforms that use delayed data or simplified simulations don’t provide the same quality of practice experience.

Comprehensive trading tools represent another essential feature. Look for platforms that offer advanced charting capabilities, multiple timeframe analysis, and a wide range of technical indicators. These tools allow you to conduct thorough market analysis and develop sophisticated trading strategies. The more closely the demo environment mirrors professional trading tools, the more valuable your practice becomes.

Account customization options enhance the training experience significantly. Top platforms allow you to adjust starting capital, reset your account when needed, and select which assets you can trade. This flexibility lets you create various scenarios to test different approaches and risk management strategies under controlled conditions.

Real Market Conditions and Data Integrity

The quality of market data integration makes a significant difference in how valuable your demo trading experience will be. Real-time data is essential for developing accurate trading skills that will transfer effectively to live markets.

High-quality crypto demo trading platforms connect to the same data feeds as their live trading counterparts, ensuring you see identical price action, volatility, and market depth. This synchronization allows you to practice under authentic conditions, recognizing genuine market patterns rather than simplified simulations. The best platforms even include realistic spread and slippage factors to prepare you for actual trading conditions.

Market depth information is particularly important for larger trades. Quality demo accounts display the order book, showing available liquidity at different price levels. This visibility helps you understand how your orders might impact the market and teaches you to consider liquidity when planning entries and exits – a crucial skill for serious traders operating with significant capital.

Some advanced platforms also include sentiment indicators and social trading features in their demo environments. These tools provide additional context for price movements and help you develop a more comprehensive market analysis approach. By incorporating these alternative data sources into your practice, you build a more sophisticated trading perspective that considers both technical and sentiment factors.

Analytics and Performance Tracking Tools

The analytical tools available on your demo platform will significantly impact the depth of your learning experience. Professional-grade charting packages and analytical capabilities transform simple practice into genuine skill development.

Advanced charting tools should include multiple chart types (candlestick, line, bar), drawing tools for trend lines and patterns, and the ability to save and organize different chart layouts. These features let you develop and refine your technical analysis skills, a fundamental aspect of successful trading. The ability to switch between timeframes seamlessly helps you understand how market structures evolve across different periods.

Performance analytics track your trading results and provide insights into your strengths and weaknesses. Look for platforms that offer detailed trade statistics, including win rates, average profit/loss, maximum drawdown, and performance by time of day or market conditions. These metrics help identify patterns in your trading that might not be obvious otherwise, accelerating your improvement through data-driven feedback.

Journal integration features allow you to document your trading process directly within the platform. The ability to add notes to charts, record your analysis for specific trades, and review past decisions streamlines the learning process. This documentation creates a valuable resource for refining your approach based on both successful and unsuccessful trades.

Best Crypto Demo Account Providers

These accounts, also known as paper trading accounts, allow you to practice trading cryptocurrencies using virtual funds in a simulated market environment. They mirror real-time market conditions, providing a risk-free way to hone your skills and test strategies.

Key benefits include:

- Risk-free learning and experimentation

- Real-time market experience

- Strategy validation before live implementation

- Familiarization with trading platforms and tools

Now, let’s explore the top 5 demo crypto trading accounts available today.

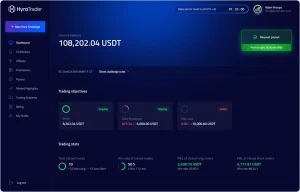

HyroTrader Dashboard

1. HyroTrader: The Ultimate Demo Trading Solution

HyroTrader stands out as a premier option for serious crypto traders seeking a comprehensive demo trading experience. As a respected crypto prop firm, HyroTrader offers more than just a practice environment – they provide a potential pathway to funded trading accounts for those who demonstrate skill and discipline.

Link: HyroTrader Testimonials

The HyroTrader demo account replicates their Challenge evaluation process, giving you authentic experience with the same conditions you’ll face when pursuing a funded account. This alignment between practice and evaluation creates a seamless progression path for traders looking to advance from simulation to professional trading. The platform offers access to sophisticated trading tools used by professional traders, providing an educational experience that goes beyond basic practice.

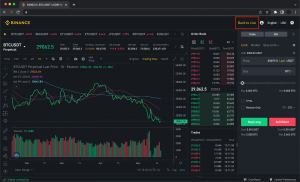

One of HyroTrader’s standout features is multi-platform support. Their demo accounts allow you to practice on several leading exchanges, including ByBit, CLEO, and OKX. This flexibility is invaluable for traders who want to compare different trading environments or who plan to operate across multiple exchanges. Rather than learning a single platform’s quirks, you develop adaptable skills that transfer across the crypto trading ecosystem.

The ByBit integration is particularly noteworthy, offering a user-friendly interface combined with powerful features. You’ll experience the same rapid execution and reliable performance that makes ByBit popular among active traders, all without financial risk. The platform supports both futures and spot trading, allowing you to practice across different market segments and develop specialized skills for each.

2. ByBit: User-Friendly with Advanced Features

ByBit provides a demo account that balances user-friendliness with advanced trading options.

Key Features:

- Intuitive interface suitable for beginners and experienced traders

- Both futures and spot trading capabilities

- High-speed trade execution simulation

ByBit’s demo environment is especially valuable for those interested in crypto derivatives trading, offering a realistic simulation of their advanced trading features.

3. Binance: Comprehensive Crypto Coverage

Binance, one of the largest cryptocurrency exchanges, provides a comprehensive demo trading environment.

Key Features:

- A wide range of cryptocurrencies is available

- Futures and spot trading options

- Regular updates to match the live trading platform

Binance’s demo account benefits traders looking to practice with a diverse array of cryptocurrencies, including less common altcoins.

4. Kraken: Advanced Charting and Analysis Tools

Kraken’s demo account is notable for its sophisticated analytical capabilities.

Key Features:

- Advanced charting tools

- Multiple order types for practice

- Simulated margin trading options

Traders focused on technical analysis will appreciate Kraken’s demo account for its comprehensive charting and analytical tools.

The HyroTrader Challenge and Funding Pathway

The connection to their prop trading ecosystem truly separates HyroTrader from standard demo accounts. Successful demo traders can progress to funded accounts, where HyroTrader provides the capital, and you keep a significant portion of the profits – up to 90% in their top profit-split arrangements. This creates a clear progression path from practice to professional trading without requiring substantial personal capital.

The free trial challenge allows you to experience the evaluation process without financial commitment. This trial mirrors the actual challenge conditions, giving you authentic practice with HyroTrader’s performance metrics and trading requirements. While completing the free trial doesn’t automatically qualify you for a funded account, it provides invaluable preparation for the official challenge.

Link: HyroTrader Challenges

When you’re ready for the official challenge, you’ll already understand the evaluation criteria and have practiced under the same conditions. This familiarity significantly increases your chances of success compared to entering the challenge without preparation. The demo account essentially serves as a rehearsal for the evaluation, allowing you to refine your approach before being formally assessed.

The prospect of a funded account provides powerful motivation for developing disciplined trading habits. HyroTrader’s profit-sharing model aligns the interests of traders and the prop firm, promoting sustainable trading practices rather than excessive risk-taking. This incentive structure accelerates skill development by connecting practice directly to tangible opportunities.

Multi-Platform Trading Experience

HyroTrader’s multi-platform approach offers unique advantages for comprehensive trader development. By supporting ByBit, CLEO, and OKX, they provide experience across different trading environments within a single demo ecosystem.

This platform diversity allows you to compare different trading interfaces, execution systems, and feature sets to identify which best aligns with your trading style. Rather than committing to a single platform before gaining experience, you can make an informed decision based on hands-on practice across multiple options.

Each supported platform offers distinct advantages. ByBit provides a user-friendly interface combined with advanced features, making it accessible yet powerful. CLEO offers innovative tools and unique market perspectives. OKX delivers a comprehensive feature set with strong analytical capabilities. This variety ensures you can find the right environment for your specific trading approach.

The multi-platform experience also develops adaptability – a valuable skill in the rapidly evolving crypto market. As exchanges update features or change their interfaces, traders who have experience across multiple platforms adapt more quickly than those familiar with only one environment. This flexibility represents a competitive advantage in professional trading.

Maximizing Your Demo Trading Experience

Having access to a quality demo account is just the first step – how you use that resource determines its value. Implementing effective practice strategies transforms basic simulation into genuine skill development. Let’s explore approaches that maximize the educational benefits of demo trading.

The most fundamental principle is treating demo trading with the same seriousness as live trading. Many traders fall into the trap of taking excessive risks or abandoning their strategies in demo environments because “it’s not real money.” This mindset undermines the value of practice. Approach each demo trade as if your actual capital were at risk, following the same analysis, risk management, and emotional discipline you would use in live trading.

Structure accelerates improvement significantly. Create a specific learning curriculum for yourself rather than randomly placing trades. Focus on mastering one concept or strategy at a time, thoroughly documenting your results before moving to the next challenge. This methodical approach builds a solid foundation of skills rather than a fragmented understanding of many concepts.

Regular review sessions enhance the learning process dramatically. Schedule time to analyze your demo trading performance, identifying patterns in both successful and unsuccessful trades. Look beyond the profit/loss result to understand the quality of your decision-making process. This reflective practice accelerates improvement by highlighting specific areas for development.

Creating a Structured Trading Plan

A structured trading plan transforms random practice into purposeful skill development. Your demo trading should follow a clear plan that defines your overall strategy, risk parameters, and performance goals.

Start by establishing specific objectives for your demo trading period. Are you trying to master a particular strategy? Improve your risk management? Become familiar with a new platform? Clear goals create focus and provide benchmarks for measuring your progress. Without defined objectives, practice can become aimless and less productive.

Develop a comprehensive trading plan that includes:

- The specific markets or cryptocurrencies you’ll focus on

- Your timeframe (day trading, swing trading, etc.)

- Entry and exit criteria for trades

- Position sizing rules and risk limits

- Performance metrics you’ll track

- Schedule for trading sessions and review periods

Consistency is crucial for effective practice. Establish a regular schedule for your demo trading that aligns with the time you’ll eventually dedicate to live trading. This consistency helps develop the discipline and routine that successful trading requires. It also ensures you experience different market conditions rather than cherry-picking favorable times.

Document everything meticulously. Keep detailed records of each trade, including your analysis before entry, your emotional state, and the outcome. This documentation creates a valuable database for identifying patterns in your trading performance. Over time, this data reveals strengths to leverage and weaknesses to address, guiding your continued development.

Advanced Techniques to Test in Your Demo Account

Demo accounts provide the perfect environment to experiment with advanced trading techniques that might be too risky to implement immediately in live trading. These sophisticated approaches can significantly enhance your trading capabilities once mastered.

Multiple timeframe analysis is a powerful technique worth practicing in your demo account. This approach involves analyzing the same market across different timeframes (hourly, daily, weekly) to identify confluences of signals. Start by establishing the trend on higher timeframes, then look for specific entry opportunities on lower timeframes that align with the broader movement. This hierarchical analysis often produces higher probability trades than single-timeframe approaches.

Correlation trading strategies can also be effectively tested in demo environments. These strategies involve monitoring relationships between different cryptocurrencies or between crypto and traditional markets. For example, you might look for divergences between Bitcoin and altcoins, or between crypto prices and broader market indicators. These complex relationships are difficult to track intuitively but can provide valuable trading signals when systematically analyzed.

Volatility-based position sizing represents another advanced concept worth exploring. Rather than using fixed position sizes, this approach adjusts your trade size based on current market volatility. During high-volatility periods, position sizes decrease to maintain consistent risk; during low-volatility periods, they increase. This dynamic sizing helps optimize your risk-reward profile across changing market conditions. A demo account allows you to fine-tune the parameters of this approach without risking capital during the learning phase.

Common Demo Trading Pitfalls to Avoid

Even with the best demo platform, certain pitfalls can undermine the value of your practice. Being aware of these common mistakes helps ensure your demo trading experience translates effectively to live market success.

Perhaps the most prevalent mistake is treating demo trading as a game rather than serious practice. Without real money at stake, many traders take excessive risks, ignore their trading plans, or trade impulsively. This approach creates habits that will prove disastrous when trading live. Always treat demo trading with the professional attitude you’ll need for actual trading.

Another common error is focusing exclusively on win rates or profits without analyzing trade quality. A profitable demo period might result from a few lucky trades rather than a sound strategy. Evaluate your trading process – the quality of your analysis, discipline in following your rules, and consistency in risk management. These factors predict long-term success better than short-term results.

Neglecting to simulate realistic trading conditions undermines the transferability of skills. If you’re practicing with unrealistic position sizes or trading at times when you wouldn’t usually be available, you’re not preparing correctly for live trading. Ensure your demo trading mirrors the conditions you’ll face when trading with real money, including account size, available trading hours, and typical market conditions.

Many traders also fall into the trap of platform-hopping – constantly switching between different demo accounts rather than developing proficiency on one platform. While exploring options is valuable initially, expertise comes from depth rather than breadth. Once you’ve selected a platform that meets your needs, focus on mastering it completely before considering alternatives.

Transitioning from Demo to Live Trading

The ultimate purpose of demo trading is to prepare for success in live markets. This transition represents a critical juncture in your trading journey, requiring careful planning and psychological preparation. Let’s explore how to bridge the gap between simulation and real trading effectively.

The transition should be gradual rather than abrupt. Consider starting with a minimal live account alongside your demo account, applying the same strategies to both. This parallel approach allows you to experience the emotional aspects of real trading while still refining your skills in a consequence-free environment. As your confidence and consistency grow, you can gradually increase the allocation to your live account.

A crucial element of a successful transition is maintaining strict consistency between your demo and live trading approaches. The same analysis methods, risk parameters, and decision-making processes should apply in both environments. Any deviation undermines the value of your practice and introduces unpredictable variables to your performance.

Technology and execution systems should be thoroughly tested before fully transitioning. Ensure your internet connection, trading platform, and any auxiliary tools function reliably under actual trading conditions. Technical failures can derail even the best trading strategy, so eliminate these variables through careful preparation.

Managing Psychological Challenges

The most significant challenge in transitioning from demo to live trading lies in the psychological domain. Understanding these differences prepares you to manage the emotional aspects of risking real capital.

The introduction of financial consequences fundamentally changes the trading experience. Even experienced traders feel heightened emotional responses when their own money is at stake. Anticipate increased anxiety, decision paralysis, or impulsivity when you begin live trading, and develop specific strategies to manage these reactions. Mindfulness techniques, pre-defined decision rules, and smaller initial position sizes can help navigate this adjustment period.

Loss aversion – the tendency to feel losses more intensely than equivalent gains – becomes particularly relevant in live trading. This psychological bias can lead to premature profit-taking and reluctance to cut losing positions, even when your analysis suggests otherwise. Being aware of this tendency helps you counteract it through strict adherence to your predefined exit criteria.

The fear of missing out (FOMO) intensifies when trading live, particularly in volatile crypto markets. Watching potential profits disappear can trigger impulsive entries against your trading plan. Combat this by maintaining a trading journal that documents your analysis and decision process, creating accountability to your predetermined strategy rather than reacting to market movements.

Implementing Proper Risk Management

Effective risk management becomes even more critical when transitioning to live trading. Proper risk controls protect your capital during the inevitable adjustment period and create sustainability for your trading career.

Start with significantly smaller position sizes than you used in demo trading. Many professionals recommend beginning with 25-50% of your planned eventual position size, gradually increasing as you demonstrate consistency. This conservative approach provides a buffer for the learning curve of trading with real money while still allowing you to gain experience.

Implement strict percentage-based risk limits at multiple levels:

- Per trade risk (typically 1-2% of account)

- Daily maximum drawdown (perhaps 5%)

- Weekly maximum drawdown (perhaps 10%)

- Monthly maximum drawdown (perhaps 15-20%)

These nested risk parameters prevent catastrophic losses and provide circuit-breakers that prompt reflection after difficult periods. When you reach a limit, take time to analyze what happened before resuming trading.

Diversification represents another important risk management strategy. Avoid concentrating your capital in single positions or highly correlated assets. Spread your risk across different cryptocurrencies, strategies, and timeframes to reduce the impact of any single failed trade or market event. This portfolio approach creates more stable returns and reduced drawdowns.

The Professional Trading Pathway with HyroTrader

For traders committed to developing professional-level skills, HyroTrader offers distinct advantages beyond standard demo accounts. Our ecosystem creates a pathway from practice to professional trading that addresses many common barriers to trading success.

The core advantage lies in HyroTrader’s business model as a crypto prop firm. Rather than simply providing a trading platform, we identify and support talented traders through a structured development process. Our demo account serves as both a practice environment and an evaluation tool, helping traders prepare for the exact conditions they’ll face in funded trading.

This alignment between practice and professional opportunity creates powerful incentives for disciplined trading. When you know your demo performance might lead to a funded account, you’re more likely to treat the process with appropriate seriousness and follow professional trading standards. This incentive structure accelerates skill development by connecting practice directly to tangible opportunities.

Understanding that the challenge evaluates more than just returns helps you prepare appropriately. HyroTrader assesses risk management, consistency, drawdown control, and other professional trading standards. The demo account allows you to practice all these aspects of trading, developing a well-rounded skill set that meets professional requirements.

Community Support and Learning Resources

Trading development accelerates in a supportive community environment. HyroTrader’s ecosystem connects you with other serious traders via Discord, creating opportunities for shared learning and mutual support.

Access to trading professionals provides valuable guidance during your development. While the demo account offers practical experience, connecting with experienced traders helps you interpret that experience correctly and avoid common pitfalls. This mentorship element adds significant value beyond what isolated practice can provide.

Peer learning represents another community benefit. Sharing experiences with other traders at similar development stages creates a collaborative learning environment. You can discuss strategies, analyze market conditions, and troubleshoot challenges together, accelerating everyone’s progress through shared insights.

The community aspect also provides accountability and motivation during challenging periods. When markets become difficult, or your performance temporarily declines, connection with fellow traders helps maintain perspective and commitment to the process. This support system increases resilience – a crucial trait for long-term trading success.

Setting Realistic Expectations and Goals

Managing expectations is crucial when pursuing trading development. Unrealistic assumptions about performance can lead to disappointment, frustration, and poor decision-making. Establishing appropriate benchmarks helps maintain perspective throughout your journey.

Expect some performance degradation initially when moving from demo to live trading. Nearly all traders experience a temporary decline in results when switching from demo to live trading due to the psychological adjustments involved. This decline doesn’t indicate failure or insufficient preparation – it’s a normal part of the learning curve. Anticipating this pattern helps you stay committed to your process during the adjustment period.

Focus on process metrics rather than outcome metrics in the early stages of live trading. Measure your adherence to your trading plan, risk management discipline, and quality of analysis rather than solely focusing on profits. These process indicators provide more reliable feedback about your development as a trader and will ultimately lead to improved financial results.

Understand that consistency takes time to develop. Professional traders typically measure their performance over months and years rather than days or weeks. Short-term results contain too much random variation to provide meaningful feedback. Commit to evaluating your trading over longer periods, looking for gradual improvement rather than immediate success.

Conclusion

Demo crypto trading accounts represent an essential tool for trader development, offering a risk-free experience that builds both technical skills and psychological resilience. The best demo accounts, like HyroTrader’s offering, provide authentic market conditions, comprehensive tools, and clear paths to professional trading opportunities.

Your approach to demo trading significantly impacts its value. By treating the process with appropriate seriousness, following a structured learning plan, and systematically analyzing your results, you transform simple practice into genuine skill development. This disciplined methodology prepares you for the challenges of live trading far more effectively than casual experimentation.

The transition from demo to live trading requires careful management of both practical and psychological factors. Expect some adjustment period as you adapt to the emotional aspects of risking real capital, and implement appropriate risk controls to protect your account during this learning phase. With proper preparation and realistic expectations, this transition can be navigated successfully.

HyroTrader offers distinct advantages through its integrated ecosystem for traders seeking a comprehensive development path. Our demo account serves as both a practice environment and preparation for funded opportunities, creating a clear progression from learning to professional trading. The multi-platform support, authentic market conditions, and community resources further enhance the value of their offering.

Whether you’re new to crypto trading or an experienced trader looking to refine your edge, a quality demo account represents one of the most valuable investments you can make in your trading journey. The skills, habits, and insights developed through structured practice create a foundation for sustainable success in the challenging but rewarding world of cryptocurrency trading.