Cryptocurrency proprietary trading, commonly shortened to “crypto prop trading”, is more than just speculating on Bitcoin or Ethereum. It’s a discipline where individuals or specialized firms deploy their own capital (or capital allocated to them by a prop trading firm) into digital assets to generate returns.

While it may initially seem similar to traditional prop trading in forex or stocks, crypto prop trading presents unique complexities: 24/7 markets, rapid price swings, and evolving regulations create an entirely new environment. If you’re an experienced trader hungry for advanced insights, you’re in the right place. This article goes far beyond the fundamentals to reveal deeper strategies, risk controls, and practical steps for succeeding in this dynamic realm.

The Dynamics of Crypto Proprietary Trading

Crypto proprietary trading involves trading cryptocurrencies with the goal of capturing price movements for profit. Because cryptocurrencies operate continuously, even on weekends and holidays, crypto prop traders must adapt to a market cycle that never sleeps. Liquidity can vary widely between different coins, and unanticipated events can spark extreme volatility. While that volatility is a magnet for opportunity, it also demands a higher level of skill and discipline.

The concept of “proprietary” means you’re either using your own money or, more often, funds allocated by a specialized crypto prop firm. Instead of managing client capital, you’re responsible for risk in a manner that must directly protect the capital you’ve been entrusted with. This arrangement frequently comes with guidelines and drawdown limits set by the firm. You may start with a smaller account (e.g., 50k or 100k in allocated funds) and scale up as you prove your consistency.

Because the crypto sphere boasts remarkable profit potential, you’ll see a surge of interest from active traders. However, the unique structure of digital assets, everything from altcoins with thinner liquidity to decentralized exchanges, means that the strategies used in traditional prop trading require adaptation. Timing, leverage, and an understanding of blockchain-centric risks are crucial.

Key Differences from Traditional Prop Trading

It’s easy to assume that if you have experience in forex or equities prop trading, you can replicate the same strategies one-to-one in crypto. While certain trading principles remain universal, such as technical analysis and risk management, there are significant differences:

- 24/7 Market Access: Traditional markets close on weekends and holidays, giving traders breathing room. Crypto, on the other hand, never stops. This continuous market means potential opportunities can arise at any time, but it also necessitates rethinking how you manage positions when you’re not watching the screen.

- High Volatility: Sudden double-digit price movements in the crypto world are not uncommon. This volatility can reward skillful traders with outsized profits, but it also increases the risk of major drawdowns if positions are not managed with strict stops.

- Market Structure: Crypto markets can be more fragmented, with multiple exchanges offering slightly different prices. This fragmentation can be exploited through arbitrage or advanced cross-exchange tactics.

- Technological Nuances: Although most modern prop firms use sophisticated software, crypto trading places special emphasis on fast, reliable data feeds and cross-exchange execution. You may need to manage wallets, address on-chain transaction times, and keep track of decentralized finance (DeFi) tools.

- Regulatory Ambiguity: Unlike the heavily regulated world of stocks and forex, crypto regulation is still evolving in many regions. This uncertainty affects compliance, tax treatment, and risk exposure. Traders must stay abreast of any shifts in policy that might affect their strategies.

The Evolving Regulatory Landscape

Regulation in crypto is both a challenge and an opportunity. Certain jurisdictions are friendly to crypto and might even offer frameworks that encourage prop firms to establish themselves there, while other countries enact stricter rules that can stifle innovation.

- Compliance: Prop traders often need to adhere to local anti-money laundering (AML) and know-your-customer (KYC) requirements. When you’re trading with a funded prop account, your firm will likely have to verify your identity thoroughly.

- Taxation: Crypto can be taxed differently depending on whether it’s classified as property, currency, or commodities. Misunderstanding tax implications can eat into your profits or even cause legal headaches later.

- Legal Ramifications of Leverage: Some jurisdictions limit the maximum leverage allowed in crypto trading, affecting the feasibility of certain high-octane strategies.

Staying informed is non-negotiable. Top crypto prop traders keep a close eye on proposed legislation, guidelines from global regulatory bodies, and even announcements from major centralized exchanges. While it might seem daunting, traders who position themselves correctly in light of regulatory shifts often find new and profitable edges, especially if other market participants are slow to adapt.

Core Strategies in Crypto Prop Trading

Succeeding as a crypto prop trader requires a diverse toolkit. Relying solely on one tactic, such as scalping or arbitrage, can limit your upside or expose you to unbalanced risk. An integrated approach that spans multiple strategies is often the most powerful way to navigate the crypto ecosystem’s continuous fluctuations.

Below, we’ll explore both mainstream and time-tested strategies. You’ll notice each can be augmented with advanced analytics or technology solutions. The overall goal: seize opportunities that align with your strengths while keeping potential drawdowns controlled.

Source: Kinesis

Arbitrage Opportunities

Arbitrage is one of the most straightforward strategies in crypto. Prices can vary from one exchange to another, often only briefly, due to differences in liquidity, order-book depth, or even regional demand.

- Cross-Exchange Arbitrage: You buy a coin cheaply on one exchange and sell it at a higher price on another. While the concept is simple, the execution can be complex due to transaction fees, withdrawal times, and required KYC verifications.

- Triangular Arbitrage: Rather than directly comparing one coin’s price across exchanges, you look for discrepancies between three currency pairs on the same exchange. For example, if the BTC/USD, ETH/USD, and BTC/ETH pairings are mispriced relative to each other, you execute a series of trades to net a risk-free profit.

- DeFi Arbitrage: Decentralized exchanges (DEXs) frequently feature token price dislocations due to liquidity pools being out of balance. Swiftly swapping tokens across multiple DEXs can lock in gains. However, gas fees and front-running are concerns.

While arbitrage is seen as “low-risk,” there are pitfalls. Transaction times in blockchain networks can cause slippage in fast-moving markets. Additionally, bots are constantly scanning for arbitrage openings, so competition is fierce.

Scalping Tactics

Scalping is about hitting small profits consistently by taking advantage of micro-movements in price. Whereas swing traders might hold positions for days or weeks, scalpers open and close trades within minutes or even seconds.

- High-Volume, Low-Profit: Each successful scalp might earn only 0.1% or 0.2%, but after dozens of scalps, those small gains can accumulate.

- Order Book Depth: Successful scalpers pay close attention to order books, looking for “walls” of buy or sell orders that can create temporary support or resistance levels.

- Tight Stops: Volatility can be both a friend and an enemy for scalpers. With such short timeframes, you have to cut losses almost immediately when a trade moves against you.

Tip: For scalpers, speed is everything. Using an exchange that offers robust liquidity and quick order execution is vital. Many proprietary trading firms, including HyroTrader, allow scalping as part of their funded trading challenges, just be sure to verify there are no restrictions on frequent trades or minimal holding times.

Swing Trading and Mid-Term Plays

For those who find scalping too frantic, swing trading might be more appealing. Swing traders typically hold positions from a few days to several weeks, capitalizing on broader market movements. In crypto, price swings can be dramatic, so well-timed entries and exits can yield significant returns.

- Technical Analysis: Candlestick patterns, moving averages, and momentum indicators are popular tools. Traders often wait for a clear signal, like a breakout from a consolidation pattern, before entering.

- Fundamental Catalysts: With the pace of innovation in crypto, announcements like protocol upgrades or partnerships can act as price catalysts. Swing traders often watch news feeds closely, combining fundamentals with technical signals.

- Risk Parameters: Since positions remain open overnight, you risk exposure to potentially large gaps. Using protective stops and position sizing is critical to ensure a single adverse move doesn’t wipe you out.

- Cyclical Nature of Altcoins: Many altcoins experience hype cycles, especially during bull markets. A swing trader might exploit the run-up in altcoin prices and then exit before the inevitable correction.

Leveraging Long-Term Positions

In a world where day-to-day price moves can be extreme, some prop traders opt to maintain longer-term holdings, often focusing on projects with strong fundamentals. This approach is about capturing multi-fold returns over months or years, rather than day-to-day fluctuations.

- High-Conviction Projects: You might identify a coin or token that solves a real market problem, has reputable developers, and is building traction. The premise is that short-term volatility is noise in the path to much higher valuations.

- Managing Drawdowns: The crypto market can go through brutal bear phases. Long-term traders must have both the conviction and the risk management protocols to avoid panic-selling during steep corrections. Some choose to hedge using futures or options to offset potential drawdowns.

- Staking and Yield: A perk unique to crypto is that certain tokens let you stake or earn yield while holding, potentially offsetting negative price action. Staking is especially useful for long-term holders who want some passive returns in addition to capital appreciation.

Advanced Strategy Implementations

Beyond the foundational strategies, the crypto markets present a range of sophisticated tactics typically reserved for more experienced traders or institutional desks. These approaches often require specialized knowledge, robust technology, or both.

Market-Making and Liquidity Provision

Market-making is the art of continuously placing buy and sell orders around the current market price to capture the bid-ask spread. Successful market-making can be highly profitable, especially in less-liquid markets, but it demands consistent monitoring and well-tuned algorithms.

- Spread Capture: The core profit source in market-making is the difference between your buy (bid) and sell (ask) orders. In highly liquid markets like BTC/USDT, the spreads may be razor-thin, but the trading volume is immense.

- Inventory Management: You must balance your holdings to avoid accumulating a large, unintentional position. If your bot consistently buys more than it sells, you could end up holding excess inventory that might drop in value.

- Competition with HFT Firms: High-frequency trading (HFT) firms use advanced infrastructure and co-located servers to place orders in microseconds. While market-making can be profitable, you’ll be competing with some of the fastest algorithms in the space.

Market-making typically appeals to traders with a quantitative background or a team capable of developing sophisticated software. Given the lower barrier to entry in crypto, compared to traditional equities markets, skilled developers can carve out a niche by market-making on smaller altcoin pairs.

Statistical Arbitrage and Pair Trading

Statistical arbitrage (stat arb) involves using quantitative models to identify temporary dislocations between related assets or derivatives. Pair trading, where you go long one asset and short another, can be considered a subset of stat arb.

- Correlation Analysis: Many crypto assets exhibit correlation. For example, if you believe ETH and ETC (Ethereum Classic) should maintain a certain price relationship, you can buy one and short the other when the spread deviates from the norm.

- Mean Reversion: You hypothesize that any divergence from historical correlation is likely to revert back. Your profit is the gap between the two converging again.

- Risk: If the spread continues to widen, you can suffer losses on both sides. Stop-loss triggers and dynamic rebalancing are crucial.

Stat arb strategies can be powerful but often require strong coding skills and a data-science approach. Proprietary firms that excel in stat arb typically have a background in traditional quantitative trading and adapt their models to the idiosyncrasies of crypto.

Source: ByBit

High-Frequency Trading in Crypto

High-frequency trading (HFT) revolves around ultra-fast execution, capitalizing on micro-level price discrepancies that can exist for mere milliseconds. In crypto, HFT traders might attempt strategies like latency arbitrage, placing trades milliseconds before slower participants can adjust their prices.

- Infrastructure: HFT demands low-latency data feeds, co-location (if available), and advanced order routers. Achieving the necessary speed is beyond the scope of most retail setups.

- Costs: Setting up an HFT environment can be expensive, but the payoff can be significant when your system can outpace others. Exchanges that cater to institutional clients sometimes provide the co-location and direct market access needed for HFT.

- Risk-Reward: HFT margins might be razor-thin on each trade, but the frequency is extremely high. The strategy’s success often hinges on how quickly you can detect and act on fleeting opportunities.

For ambitious traders with a background in coding and systems architecture, HFT in crypto can be a frontier of immense possibility. Just be aware that it’s a technological arms race, and profitability can erode as competition grows.

Risk Management Fundamentals

In crypto prop trading, controlling risk often matters more than capturing gains. The market’s volatility can lead to significant profits, but without rigorous risk management, even a few missteps can be devastating.

Remember: Preserving your trading capital is an essential first step to long-term profitability.

Stop-Loss and Take-Profit Mechanisms

Stop-loss orders allow you to exit a losing position automatically once a specific price is hit, preventing small losses from spiraling into account-threatening drawdowns. Take-profit orders, on the other hand, secure gains when a pre-defined profit target is reached.

- Placement Accuracy: If stops are too tight, normal price oscillations may trigger premature exits. If they’re too wide, losses can become painful. Finding the sweet spot is as much an art as it is a science.

- Trailing Stops: A trailing stop adjusts with favorable price movement, locking in increasing profits without you having to manually shift the stop level.

- Emotional Discipline: Stop-loss orders force discipline. Many traders sabotage themselves by “giving a trade more room to breathe,” then watch a small loss balloon into something catastrophic.

Diversification Across Assets and Markets

While cryptocurrency is already a niche sector, diversifying across different crypto assets, or even across strategies, can mitigate risk. The old adage “don’t put all your eggs in one basket” holds true, especially in markets known for their erratic behavior.

- Multiple Crypto Pairs: By trading BTC, ETH, and various altcoins, you reduce reliance on one asset’s price trajectory. If one coin tanks on news of a smart contract exploit, you may offset losses with profits from another coin unaffected by that event.

- Combining Short-Term and Long-Term Approaches: You might scalp BTC while maintaining a multi-week position in ETH. Each approach targets a different type of market movement.

- Hedging with Derivatives: Platforms allow you to short-sell, use options, or deploy various futures contracts. These tools let you hedge your portfolio when volatility spikes or you anticipate a downturn.

Leverage Control and Margin Requirements

Crypto exchanges often offer eye-popping leverage (up to 100x or more in some cases). While leverage amplifies gains, it also magnifies losses. A single over-leveraged position can trigger liquidation during a sudden price swing.

- Position Sizing: Adhere to a consistent rule, such as risking no more than 1-2% of your overall capital on a single trade.

- Margin Calls: Understand the margin call or liquidation process of your chosen exchange. Know exactly how and when positions might be automatically closed out.

- Volatility Buffers: Given crypto’s potential for drastic hourly or daily price moves, maintain enough free margin to withstand these swings without hitting forced liquidation.

Ultimately, controlling leverage is about longevity. Many talented traders have seen their accounts wiped out simply because they traded too large, too soon.

The Role of Technology in Crypto Proprietary Trading

One of the most prominent shifts in modern trading, especially in crypto, is the reliance on technology. From data analysis to rapid order execution, tech-driven solutions can be the difference between success and failure.

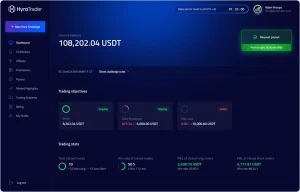

HyroTrader Dashboard

Algorithmic Trading and Automated Tools

Algorithmic trading isn’t just for quants on Wall Street. In crypto, numerous solutions let you build, test, and deploy automated strategies without needing a PhD in computer science.

- Bots and Scripting: Platforms like TradingView can integrate with exchanges, letting you automate entries and exits based on custom indicators. More advanced users might create Python scripts that constantly monitor multiple markets.

- Backtesting: Before going live, you can run your strategy against historical price data to gauge performance. While historical success doesn’t guarantee future returns, backtesting is critical for refining parameters.

- Event-Driven Trading: Some traders automate signals around major news or on-chain metrics, such as large wallet transfers. If a whale moves a massive amount of BTC to an exchange, that’s often a precursor to volatility.

Real-Time Risk Monitoring and Analytics

Gone are the days when you could just glance at a candlestick chart a few times a day. Modern crypto prop trading calls for continuous oversight of positions, volatility indicators, and correlation metrics.

- Dashboards: Custom dashboards can show your real-time exposure across multiple coins, your unrealized P/L, and how close you are to drawdown limits.

- Alerts: You can set up alerts (via SMS, email, or push notifications) for specific price levels or portfolio drawdowns. For instance, if your total equity drops by 3% in a day, you receive an urgent alert reminding you to reassess your positions.

- Scenario Testing: Some advanced risk management tools let you run “what-if” scenarios. If BTC plunges 20% overnight, how does that affect your ETH positions, your total margin usage, or your ability to hold open trades?

Leveraging technology effectively separates the top-performing prop traders from those who are perpetually chasing the market. Even if you only partially automate your trading, real-time visibility and rapid execution can boost your edge significantly.

How Firms Like HyroTrader Empower Prop Traders

If you’re serious about crypto prop trading but don’t want to risk all your personal funds, or you simply want access to higher capital, joining a dedicated firm can be a game-changer. HyroTrader is a prime example, specializing in crypto trading challenges that, once passed, grant you access to a funded account.

- Funded Capital: HyroTrader begins with account sizes like $50,000 or $100,000 and can ultimately scale profitable traders up to $1,000,000. This scaling model rewards consistent performers who demonstrate skill and discipline.

- Generous Profit Splits: Traders can keep 70% to 90% of their profits, which is especially lucrative in an asset class like crypto that can yield big moves in short periods.

- Instant Payouts: One of HyroTrader’s standout features is the ability to withdraw profits on-demand in stablecoins (USDT or USDC). No need to wait for a “profit split day” once a month.

- Real Market Execution: HyroTrader’s environment connects directly to major crypto exchanges like ByBit. This integration ensures you experience real liquidity, real order books, and no artificial pricing wicks.

- No Time Limit Evaluations: Some prop firms push you to hit profit targets in a short window. HyroTrader lets you take as long as you need to meet the challenge parameters, significantly reducing pressure to force trades.

- Advanced Tools and API Access: Because trades mirror real market conditions, you can use advanced order types, scalp or run HFT strategies, or even connect a custom bot. HyroTrader’s risk rules revolve around daily and overall drawdowns, but they do not heavily restrict trading styles.

- Mentorship and Community: HyroTrader goes beyond mere funding. They have a supportive community and often provide resources to help traders refine their strategies. This collaborative environment can be a significant advantage.

In essence, a specialized crypto prop firm like HyroTrader aligns its success with yours. They supply the capital and infrastructure while you bring skill, discipline, and innovation. It’s a symbiotic relationship: the firm profits when you profit, so everyone is motivated toward sustainable growth rather than short-lived gains.

Practical Steps to Build a Profitable Crypto Prop Trading Career

Even if you grasp all the strategies, risk controls, and technology solutions, success in crypto prop trading also hinges on your mindset and daily routines. This final section focuses on the practical, real-world habits that separate thriving traders from those who struggle.

Skill Development and Continuous Learning

Crypto markets evolve at an astonishing pace. While some skills, like chart reading and fundamental analysis, transfer from traditional markets, you must remain open to new techniques.

- Stay Updated: Subscribe to reputable crypto news outlets or aggregator platforms. Follow protocol updates, exchange listings, and macroeconomic trends.

- Networking: Interacting with other traders in communities (like a prop firm’s Discord or Telegram group) exposes you to fresh perspectives and fosters collaboration. You can learn a lot from the failures and successes of others.

- Specialize, Then Diversify: Start by mastering one or two strategies, maybe scalping plus a mid-term swing approach. After gaining consistent success, branch out. Overcommitting to multiple strategies too soon can dilute your focus.

- Embrace Analytics: Use advanced analytics, from on-chain data to sentiment analysis. Tools like Glassnode or Santiment can offer insight into real wallet flows and network usage.

Crafting a Personalized Trading Plan

A robust trading plan goes beyond just “buy here, sell here.” It details your approach, risk limits, performance metrics, and even mental frameworks for dealing with stress or losses.

- Define Your Edge: What do you do better than the average market participant? Maybe it’s identifying breakout altcoins early. Or perhaps you’re excellent at reading price action on lower timeframes.

- Set Clear Profit and Drawdown Goals: For instance, you might aim for 10% monthly returns while ensuring you never exceed a 5% daily drawdown. This clarity keeps you accountable.

- Periodic Reviews: Allocate time weekly or monthly to review your trades, analyzing what worked, what didn’t, and how you can improve. Record metrics like win rate, average risk-to-reward ratio, and maximum drawdown.

- Implement Psychological Safeguards: Trading can be emotional, especially in a volatile market. Have a cooldown plan for losing streaks, such as reducing position sizes or taking a day off to reset.

- Utilize Firm-Specific Resources: If you’re trading with a prop firm like HyroTrader, leverage their educational content, mentoring sessions, and community channels.

By combining continuous learning, a solid plan, and disciplined execution, you lay a foundation for consistent gains. Yes, the crypto market is unpredictable, but that unpredictability often translates to heightened opportunity, provided you’re prepared.

Conclusion

Crypto proprietary trading isn’t just about chasing pumps or shorting dumps. It’s a multifaceted endeavor that requires a strong grasp of strategies ranging from basic arbitrage to complex pair trading, coupled with an unwavering commitment to risk management. The round-the-clock nature of crypto markets, coupled with extreme volatility, introduces both unique challenges and unprecedented profit potential.

When implemented correctly, a combination of your personal skill, reliable technology, disciplined risk protocols, and supportive funding resources, like those offered by HyroTrader, can accelerate your journey. Remember that consistency, not short-lived gains, is what separates professionals from amateurs. As you hone your craft, remain adaptable, keep learning, and foster resilience in the face of volatility.

Ultimately, a well-executed approach to crypto prop trading can unlock both financial and personal freedom. Whether you’re scalping BTC price oscillations, arbitraging altcoin pairs across multiple platforms, or employing advanced stat arb strategies, the key is methodical execution coupled with risk discipline. If you’re willing to invest in your skill set and approach this field strategically, the rewards can be substantial.

Is crypto proprietary trading riskier than trading traditional assets?

Crypto often exhibits greater volatility than traditional markets, so while the risk can be higher, skilled traders who apply strict risk management can also find more opportunities. The key is understanding the unique dynamics and implementing adequate safeguards such as stop-losses and diversified portfolios.

How do I choose the right crypto prop firm to partner with?

Look for transparent funding models, fair profit splits, strong technology infrastructure, and supportive trader communities. Make sure the firm offers real market conditions without inflated spreads or fake price wicks. For example, HyroTrader connects you with major crypto exchanges like ByBit, ensuring authentic trade execution.

Can algorithmic trading strategies be profitable in crypto?

Absolutely. Algorithmic trading, including market-making bots or statistical arbitrage systems, can be very profitable when tuned to crypto’s specific volatility and liquidity conditions. However, you must have robust coding skills or use reliable third-party tools, and continuously adapt your models to market shifts.

What kind of leverage is recommended in crypto prop trading?

Leverage is a double-edged sword. Although some platforms offer up to 100x, most experienced traders use far less, perhaps 2x to 10x, depending on the strategy. Prop firms typically enforce drawdown limits, effectively preventing you from recklessly over-leveraging positions.

How do I handle 24/7 market operations as a crypto prop trader?

Many traders rely on automated alerts, trading bots, or partial automation to manage positions during off-hours. If you’re part of a prop firm, they may provide risk monitoring systems. It’s also important to set boundaries, such as stop-loss orders, so you’re not forced to monitor screens around the clock.