Day trading can be an exciting way to profit from financial markets, but one of the biggest hurdles for new and experienced traders alike is having enough capital. This is where funded trading accounts come into play.

A day trading funded account allows you to trade with a firm’s capital once you prove your trading skills, meaning you don’t need to risk tens of thousands of dollars of your own money upfront. Instead, you use the firm’s money to trade, and in return, you split a percentage of the profits with them.

Funded accounts have surged in popularity because they offer a win-win scenario: traders get access to larger amounts of trading capital and reduce their personal financial risk, while proprietary trading firms (also called “prop firms”) find skilled traders to partner with.

In this comprehensive guide, we’ll explain what funded trading accounts are, how to secure one, and the best practices for managing risk and developing strategies as a funded trader.

We’ll also highlight HyroTrader – a leading option for day traders looking for a crypto-focused funded account – and walk you through how to get started. By the end, you’ll understand everything you need to know to decide if a funded trading account is right for you.

What is a Funded Trading Account?

A funded trading account is an account provided by a proprietary trading firm that supplies you with trading capital after you pass an evaluation. In simple terms, it’s a trading account backed by someone else’s money – the firm’s.

You trade the account just as you would your own, but under certain rules, and you get to keep a large share of the profits you generate. If you lose, the losses are covered by the firm (up to predefined limits), so your personal risk is limited to possibly an evaluation fee or not getting a payout if things go wrong.

For day traders, having a funded account means access to more capital than they might personally have. This can be a game-changer, allowing you to leverage larger positions and potentially earn more from each trade.

It also means you can day trade without worrying about meeting strict minimum balance requirements or using leverage in a personal account that could wipe out your savings. Essentially, the firm is investing in you as a trader, hoping that you will trade profitably so both parties can make money.

What are the main benefits of using a funded trading account?

The main benefits include significantly reducing your personal financial risk and gaining access to large trading capital. With a funded account, you’re trading with the firm’s money, so you don’t have to risk a lot of your own savings. This allows day traders to focus on strategy without the fear of losing their nest egg.

Another benefit is profit potential – because you can trade a larger account, the dollar gains from successful trades are higher (even after splitting profits with the firm). Funded accounts also enforce good trading habits through their rules, which can help traders develop discipline and consistency.

How to Get a Funded Account for Day Trading

Securing a funded trading account isn’t as simple as asking for one – you have to earn it by proving you can trade responsibly and profitably. Prop trading firms typically have an evaluation process for day traders, which often includes simulated trading phases (on demo accounts) that mirror real market conditions. Here’s a step-by-step look at how to get a funded account:

Choose a Prop Firm and Account Size

First, research and select a proprietary trading firm that suits your needs. Firms offer different account sizes (e.g. $25,000, $50,000, $100,000 or more) and charge an evaluation fee. Pick an account size that matches your comfort level and potential.

Sign Up and Start the Challenge

Enroll in the firm’s evaluation program (often called a “challenge”). You’ll typically trade on a simulated account with the initial virtual balance of the account size you chose. The firm will set specific targets and rules you must follow during this phase.

Meet the Profit Target Under the Rules

During the evaluation, your goal is to achieve a certain profit target (for example, 8–10% of the starting balance) without breaking any risk rules. You must do this within the given time frame, if there is one (some challenges have 30 days, others offer unlimited time).

Common rules include not exceeding a daily loss limit (e.g. no losing more than 4–5% in a single day) and not exceeding a maximum drawdown (total allowed loss, say 10–12% of the account). You may also need to trade a minimum number of days (to show consistency rather than one lucky win).

Verification Phase

Many firms have a second phase after the initial challenge, often called the verification stage. In verification, the profit target might be smaller (for instance, half of the first phase’s target) and you have to continue following the rules for a longer period or another set duration. This phase ensures that your winning streak wasn’t a fluke and that you can maintain discipline and profitability over time.

Get Your Funded Account

If you successfully pass the evaluation (and verification, if applicable), congratulations – you’re offered a funded trading account. At this point, you’ll typically sign an agreement with the firm, and they’ll provide you with credentials to trade the firm’s capital. Now you’re trading with real money on the line, and any profits you make can be withdrawn according to the profit-sharing model.

Common requirements and skills needed to pass

To earn a funded account, day traders should demonstrate solid risk management and consistent strategy execution. This means you should be comfortable setting stop-loss orders, sticking to a reasonable position size, and not chasing losses.

Discipline is key – one reckless trade can violate a rule and end your evaluation. It helps to have a tried-and-tested trading strategy (whether it’s scalping, trend following, or another method) and to practice it extensively on a demo account before attempting a challenge.

Patience and emotional control are also crucial; you need to avoid overtrading or panicking under pressure. Essentially, prop firms want traders who can show profitability with control – even modest but steady gains achieved within the rules will make you a strong candidate for funding.

Risk Management and Trading Strategies for Funded Traders

Successful funded traders treat risk management as non-negotiable. When you’re trading a funded account, protecting the capital is just as important as hitting profit goals. Proprietary firms have strict rules to minimize losses, and as a trader you should internalize those rules as part of your strategy.

Risk Management for Funded Trading

Risk management is all about controlling losses so that no single trade or day can knock you out. Here are some essential risk practices and rules that funded trading programs enforce:

Daily Loss Limit

Funded accounts often impose a daily loss cap (for example, 4–5% of the account). This means if you hit that limit in losses for the day, you must stop trading. It protects you from a day where nothing goes right. As a trader, you should plan to stay well under this limit in normal conditions, so one bad trade doesn’t suddenly end your day.

Maximum Drawdown

In addition to the daily cap, there’s usually an overall drawdown rule (say 10% of the account). If your account equity falls below this threshold from the starting balance or from a peak value, you violate the account rules.

Always know where you stand relative to your max drawdown – consider it the “point of no return” you never want to reach. This might involve reducing your trade size if you’re in a slump, to avoid sliding too deep into drawdown.

Use Stop-Loss Orders

Many funded trader programs require a stop-loss on every trade. Even if not explicitly required, it’s a wise practice. A stop-loss order will automatically cap the downside of your trade, ensuring you don’t let a small loss turn into a huge one. Good risk management means predetermining how much you’re willing to lose on each trade (often a small percentage of the account, like 0.5% to 2%).

Leverage and Position Sizing

Day trading on a funded account might allow high leverage (some prop firms offer leverage like 1:50 or 1:100). However, just because you have access to large leverage doesn’t mean you should max it out. Control your position size so that your potential loss on a trade stays within your comfort zone and the firm’s rules. Remember, trading is about consistent profits, not gambling on one big win.

Stick to a Plan

Emotions can tempt you to deviate from your strategy – for example, to revenge trade after a loss or to double down on a hunch. Funded traders must stick to their plan and respect the rules at all times. If you hit your daily loss limit or even a personal loss threshold (which might be tighter than the firm’s), step away. Consistency and discipline will keep you in the game long enough to make profits.

Trading Strategies for Funded Day Traders

Having a solid trading strategy is vital to pass evaluations and to profit as a funded trader. Different strategies can work, but the key is that your approach aligns with the risk rules and your own skills. Here are a couple of popular day trading strategies funded traders often use:

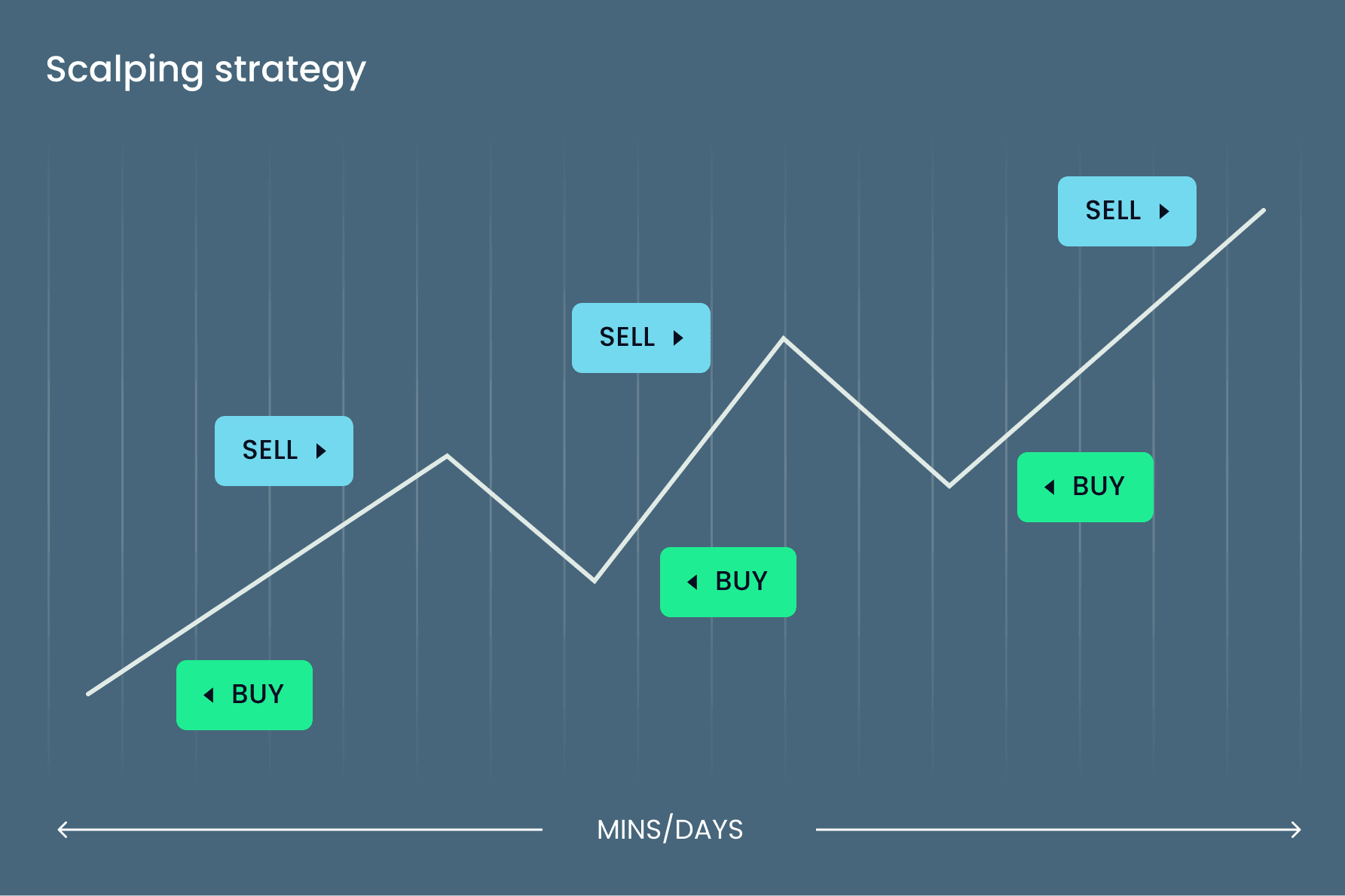

Scalping

This is a fast-paced strategy where traders aim to take many small profits throughout the day. Scalpers might enter and exit trades within seconds or minutes, capturing tiny price movements.

In the context of a funded account, scalping can be effective because it often involves very tight stop-loss levels (keeping risk per trade small) and it doesn’t require holding positions for long (reducing exposure to market-moving news).

However, scalping requires quick decision-making and excellent execution. You also have to be mindful of any trading platform limitations or minimum trade duration rules (some firms discourage extremely short-duration trades).

Scalping Techniques: Maximizing Profits from Quick Intraday Price Movements

Momentum Trading

Momentum traders look for assets that are moving strongly in one direction on high volume and try to ride the wave. As a day trading strategy, this might involve identifying a stock or crypto coin that’s breaking out of a range or hitting new highs, and joining the trend.

The idea is to jump in when momentum is on your side and exit before the trend fizzles out. Risk management is crucial here: momentum trades often use trailing stops or tight stops below the entry to lock in gains or cut losses if momentum fades. This strategy can yield larger individual wins than scalping, but it usually results in fewer trades per day.

Other Strategies

Some funded traders use strategies like range trading (buying lows and selling highs of a sideways price range), breakout trading (trading the break of key support/resistance levels), or algorithmic strategies if allowed. The best strategy for you is one that you have practiced extensively and that fits the funded account’s parameters.

For example, if the account has an overnight holding rule (many prop firms don’t allow holding trades overnight or over weekends for day trading accounts), you’d stick to intraday strategies only.

No matter the strategy, remember that consistency is king. It’s better to have a strategy that makes steady gains and adheres to the rules than one that swings for home runs but risks violating risk limits. Many traders combine elements of multiple strategies and continually refine their approach as they gain experience.

HyroTrader: The Best Option for Funded Day Traders

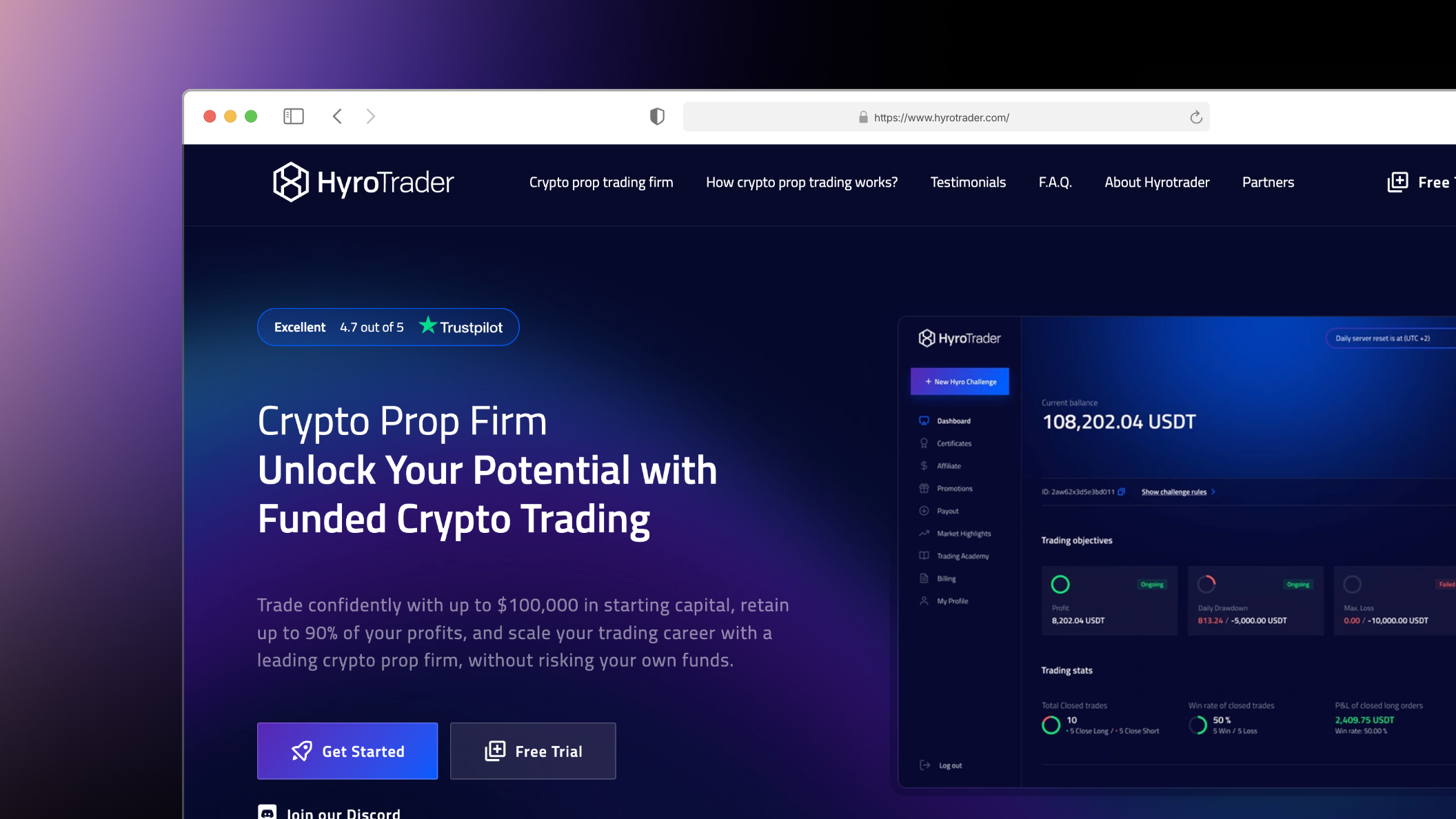

With several funded trader programs available, one platform that stands out for day traders – especially those who trade cryptocurrency – is HyroTrader.

HyroTrader is a crypto-focused proprietary trading firm that has built a unique model for funding traders. Unlike traditional prop firms that might focus on forex or stocks, HyroTrader specializes in crypto day trading, giving traders access to the volatility and opportunity in digital asset markets.

HyroTrader Challenge and Verification

To get funded by HyroTrader, traders go through a two-step or three-step evaluation.

First is the HyroTrader Challenge, where you must demonstrate your skills on a simulated crypto trading account. You’ll be tasked with reaching a set profit target (for example, around 10% gain on the account) without violating risk rules like daily loss or max drawdown. Once you pass this phase, you move to a Verification stage – essentially a second round that confirms you can repeat your performance reliably (often with a smaller profit target, like an additional 5%, and the same risk constraints).

A great perk is that HyroTrader does not impose a trading period on completing these phases, unlike many other firms that give 30 or 60 days. This means you can trade at your own pace and avoid taking bad trades just to race a clock. Upon successfully completing verification, you become a funded HyroTrader and can trade with the firm’s capital on a live account.

HyroTrader offers one of the most competitive funded account programs for crypto traders. The firm provides robust support and tools to help its funded traders succeed, making it a top choice for those seeking a day trading funded account in the cryptocurrency market. With features like high profit splits, loss protection, and a focus on trader development, HyroTrader has quickly become a leader among prop trading firms.

Key benefits of HyroTrader for day traders:

High Profit Sharing (Up to 90%)

HyroTrader offers a profit split that ranks among the best in the industry. Traders start with a generous share (for instance, 70% of profits), and with consistent performance, this can scale up to 90%. In other words, you keep the vast majority of what you earn. The firm only succeeds when you do, aligning their interests with yours.

Loss Coverage

Trading crypto can be risky, but HyroTrader’s model ensures you won’t be financially on the hook for trading losses. If you have a losing trade or even a losing month, the firm absorbs those losses – your downside is limited to not progressing in the program or losing the funded account if rules are broken. This safety net allows traders to operate with confidence and focus on proper risk management without fear of going into debt.

Scaling Opportunities

HyroTrader actively rewards successful traders by scaling up their accounts. Every few months of profitable trading, your account size can be increased, giving you more capital to trade with. This means a trader who starts with a $50,000 account could see it grow to six figures over time. The scaling plan, combined with the high profit split, provides a clear pathway to growing your earnings as you prove yourself.

Crypto Market Access with Real Liquidity

As a crypto prop trading firm, HyroTrader lets you trade on real crypto exchanges (using platforms like ByBit through API connections). You have the freedom to trade major cryptocurrency pairs (all USDT futures pairs) with real market data – no artificial trading environment. This is crucial for day traders who want reliable trade execution and pricing. You’re essentially trading under authentic market conditions, so your skills directly translate to actual profits.

Trader Support and Tools

HyroTrader isn’t just a “here’s your account, good luck” kind of firm. They provide internal tools and resources to help traders perform. For example, they offer a proprietary trading platform for those who prefer it, and easy API linking for those who trade via exchanges. They also foster a community (with a dedicated Discord channel for traders) and provide performance coaching and feedback. This means you can get guidance on your trading, learn from peers, and continually improve. If you hit a rough patch, the support team can help analyze your trades and suggest improvements. This level of support can significantly improve a trader’s odds of long-term success.

Fast Payouts and Fair Policies

Once you’re funded with HyroTrader, withdrawing your profits is straightforward. They have a reputation for quick payouts (often within 24 hours) via cryptocurrency (such as USDT or USDC). All their trading rules are transparent and aimed at encouraging good trading habits, not catching you out. If you follow the rules, you can trade with a lot of flexibility – any crypto pair, any strategy, at any time of day.

All these features make HyroTrader an attractive option for day traders seeking funded accounts, particularly if you are interested in the high-growth potential of crypto markets. It combines the profit potential of crypto trading with the risk mitigation of a funded account structure, giving traders the best of both worlds.

Conclusion

Day trading with a funded account can be a transformative opportunity. It allows you to bypass the common capital constraints that many traders face and jump straight into trading larger accounts under the guidance of a prop firm. However, your success will heavily depend on choosing the right funded account program and adhering to sound trading practices. Always do your due diligence: look at the firm’s reputation, rules, profit split, and the support they provide traders.

In this article, we covered how funded accounts work and why they’re appealing for day traders seeking to minimize risk while maximizing potential. We also walked through what it takes to earn a funded account – underscoring the importance of risk management and consistent strategy execution during the evaluation phases. Once you earn funding, the journey has only begun; you need to stick to your trading plan, respect the risk limits, and steadily grow your account.

Among the various options out there, HyroTrader stands out as a top choice, especially if you are interested in crypto trading. Its generous profit sharing, firm-covered losses, and commitment to trader development provide an environment where skilled day traders can truly thrive. HyroTrader’s model proves that when the firm and the trader work together, both can benefit greatly.

In conclusion, a day trading funded account can fast-track your trading career if you approach it with discipline and the right partner firm. Whether you’re a scalper or crypto momentum trader, having access to someone else’s capital with a fair profit split is a compelling proposition. Just make sure to practice diligently, manage risks, and align yourself with a reputable prop firm like HyroTrader that has your best interests in mind. With dedication and the right support, you could be well on your way to trading professionally with a funded account.