“The goal of a successful trader is to make the best trades. Money is secondary.” – Alexander Elder. As I stand before the vast ocean of proprietary trading, I am reminded of Elder’s words. My mission isn’t merely to navigate these waters but to conquer them with finesse and strategy.

To pass the prop firm challenge, you need to be persistent and strategic. It takes about two to five months, and only 1% to 5% make it. After overcoming this, you can earn a share of profits with funding from $10,000 to $100,000.

Getting ready for these challenges takes months of hard work, practice, and careful risk management. Risking only 0.5-1% of your account value lowers the risk of big losses. This careful approach is key to trading success.

My trading tools include ICT and SMC trading methods. However, strategy and entry methods are just an edge. Risk management is key.

Through my collaboration with HyroTrader, I’m trading on ByBit which stands out with its easy-to-use interface, strong security, and fast transactions. It offers futures and spot trading, helping traders pass prop firm challenges and succeed in prop trading.

Crypto Prop Firm Trading

Key Takeaways

- Adopting a strategic plan for succeeding in prop trading, recognizing the low success rates but high rewards.

- Embracing a patient approach to preparation, realizing long-term gains override immediate success.

- Implementing astute risk management to preserve capital and foster consistent trading growth.

- Leveraging effective trading strategies like support and resistance levels, combined with tools like the RSI, to navigate market conditions.

- Benefiting from trader-friendly features such as account recovery options when facing setbacks.

- Selecting leading platforms tailored to specific trading or investment requirements.

A Guide on How to Pass Prop Firm Challenge

Starting a prop firm challenge can seem tough, but with the right steps, you can grow and achieve a lot. Knowing the prop firm challenge requirements helps you match your trading with success. This is the first step to doing well.

Only about 1% of traders pass prop firm challenges and get funded. This shows how important it is to have good successful prop trading strategies. Being well-prepared is key to doing well in these tough tests.

- Thoroughly review the profit targets, maximum allowable drawdown, and minimum trading days.

- Engage in rigorous practice sessions using demo accounts to hone your skills without financial risk.

- Study and implement a top-down analysis to accurately predict price movements.

- Risk no more than 1% per trade to maintain a solid risk management protocol.

Starting with smaller challenges can up your chances of winning. Many traders have done this and then made big payouts. For example, Willis Capital has a 10% drawdown limit, which lets you trade in different ways. Choosing the right trading platform is also key. ByBit and HyroTrader offer easy-to-use interfaces and strong security. They support many cryptocurrencies and give you the tech you need to do well in fast markets.

Crypto Prop Firm Trading

The goal of how to pass prop challenge is more than just finishing. It’s about doing it well, using learning tools, and improving your strategy with market insights and your own performance checks.

Prop firm challenges are very appealing. With a focus on learning and changing your strategy, you can increase your chances of becoming one of the top traders. This path is not easy, but it’s very rewarding.

Prop firm challenges are a great learning experience. They push traders to make their strategies better and improve their trading style. Prop trading is not just about making money. It’s a constant effort to be the best in a very competitive field.

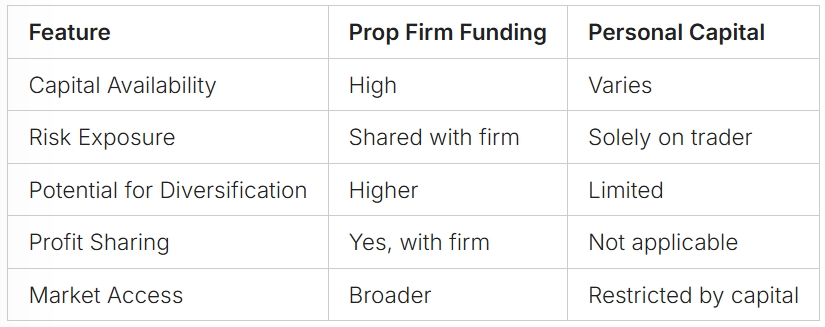

Funding Your Trading Ambitions: Prop Firms vs. Personal Capital

Financial markets change, so do the ways to fund traders. Looking at prop firm funding versus using personal money, each has its own pros and cons. This is especially true in complex areas like futures contracts crypto prop firm trading.

Prop firm funding gives traders a lot of trading capital. This can be tempting for those wanting to grow their market presence without risking too much of their own money. But, using a lot of money from a firm comes with its own rules. For those thinking about jumping into such trading, it’s key to understand what firms offer. Learn more about prop firm details here.

Using personal money lets traders control their trading and money management fully. But, not having much money can limit how you can spread out your investments and manage risks. This is a big deal in markets like crypto prop firms, where how much you invest can affect how much you make—and lose.

Trading futures contracts with a crypto prop firm has shown me the benefits of having a lot of money. It lets you try different strategies and can help cover losses. With places like ByBit offering easy operations and safety, traders with prop firms can get into top markets. This is key for doing well in trading.

In conclusion, each funding way has its own benefits. Your choice between prop firm funding and personal capital depends on how much risk you can take, your trading style, and your financial goals. Taking time to look at both options can help you make a better choice for your trading goals.

Developing a Winning Mindset for Prop Trading

Starting your journey in proprietary trading means you need a winning mindset in trading. Prop firms look for traders who can handle stress well. They want people with strong mental strength.

Cultivating resilience in trading means more than just getting through tough times. It’s about learning from those times to make more money. Trading is not just about numbers; it’s also a test of your mind and heart.

Crypto Prop Firm Trading

Resilience is key for a strong trading mindset. It helps traders get back up after they fall. By using platforms like ByBit, traders can work on their skills and mental strength.

Prop firm challenges show how important psychological fortitude in trading is. Traders get more money, mentorship, and market insight. But, they must perform well and meet goals, testing their skills and mental strength.

Here are ways to build your psychological resilience:

- Maintain discipline to stick to your trading plans.

- Practice emotional detachment to keep your judgment clear.

- Use losses to learn and improve your strategies.

- Do mindfulness exercises to focus better and feel less anxious.

Follow these tips and remember, a winning mindset is not just about making trades. It’s about being ready and strong in every decision. As you trade with a prop firm, let each challenge make you better. Face market ups and downs with confidence, knowing you’re improving your trading skills.

Strategizing Your Approach to the Prop Firm Challenge

Making a trading plan is key for traders in a proprietary trading firm challenge. This plan helps you navigate market ups and downs and make smart choices. At HyroTrader, we focus on creating a strategy that can handle different market conditions.

Being able to adapt in a changing market is vital. We test our strategies with historical data to improve them. This makes our trading plan strong against market changes, boosting our success chances in prop trading.

Crypto Prop Firm Trading

Real Strategies from Real Traders: Optimizing for Success

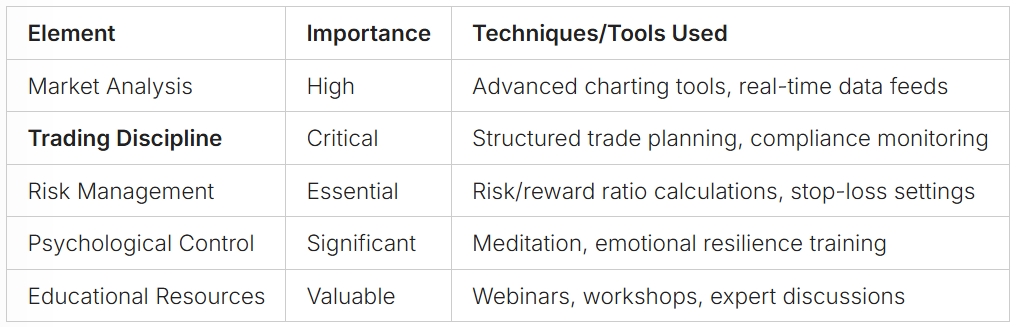

In the world of prop trading, I’ve learned how important market analysis techniques, trading discipline, and sharpening analytical skills are. I

Learning about prop trading’s rules and structure was key. It’s not just about knowing the market. It’s also about controlling your emotions and using advanced tools to make better choices. Being part of a trading community and always learning has changed my trading for the better.

Here’s what makes prop firm trading work:

- Trading Psychology and Emotional Control: It’s about staying calm and making clear decisions.

- Risk Management Strategies: These help balance the chance of making money with the risk.

- Consistent Trading Discipline: Sticking to a plan helps avoid mistakes like trading too much or too little.

- Continuous Skill Enhancement: Keeping up with new market analysis and strategies is key.

- Adaptivity to Market Changes: Being able to change strategies when the market changes is important.

Using ByBit’s trading platform has changed the game for us. It’s known for its user-friendly interface, robust security measures, and fast transaction speeds. This makes trading easy and secure, covering many cryptocurrencies in futures and spot trading.

Each part of these strategies is crucial for prop firm trading. This leads to smarter and more disciplined investment choices.

Conclusion

Thinking about prop trading, I see it’s a mix of skill and strategy. I’ve learned that success comes from a full approach to the markets. It’s not just luck. It’s about managing risks well and keeping an eye on market changes.

My trading plan has been key, and Hyro Trader has been my safe place. It’s secure and fast.

Learning from pros has also been crucial. Real money prop firms teach that being steady is better than taking big risks. Only a few traders make it, facing tough challenges.

But with hard work and discipline, I’ve grown a lot. Planning and treating each trade like art is important. ByBit has been great for me, making sure I’m in good trading conditions. Wisdom, strategy, and the right tools have opened doors for me.

Now, I’m not just trading. I’m shaping my financial future. Here’s to mastering the markets and growing with each challenge.

FAQ

What are the key strategies to pass a prop firm challenge?

To pass a prop firm challenge, learn the firm’s rules and requirements. This includes knowing the minimum trading days and drawdown limits. Make a trading plan that fits your style and risk level. Use risk management to keep your capital safe.

Keep learning by using the firm’s resources and adapting your strategies. This helps you stay competitive.

Why do traders find crypto proprietary trading firms attractive?

Crypto prop firms like Hyro Trader are popular because they offer easy-to-use platforms and fast trade execution. They give traders access to many cryptocurrencies. These firms also provide more capital than personal funds, letting traders make bigger trades and earn more.

How can I meet the requirements of a prop firm challenge?

To meet a prop firm challenge, understand the firm’s rules well. This means following the trading days, hitting profit targets, and not going over drawdown limits. Make a plan that suits your trading style and risk level. Learn from successful traders to improve your skills.

What’s the advantage of opting for prop firm funding over my own capital?

Prop firm funding lets you trade with more money than you could on your own. This means you can make bigger trades and earn more. It also lets you try out different strategies and avoid the risks of small personal funds.

How can I develop a winning mindset for prop trading?

To win at prop trading, be resilient and confident. Keep your emotions in check, even when things get tough. These skills help you make smart decisions and stick to your plan, even when the market is hard.

What are the best practices for risk management with a prop firm?

Manage risk well in prop trading by setting clear limits and diversifying your investments. Use stop-loss and take-profit orders. Avoid overtrading and making emotional decisions. Keeping your capital safe is key to doing well in prop trading.

How do I craft an effective strategy specifically for a prop firm challenge?

For a prop firm challenge, set clear rules for entering and leaving trades. Keep an eye on your risk and be ready to adjust your strategy as needed. Always analyze the market and update your plan based on new information to stay ahead.

What can I learn from successful prop firm traders?

Learn from top prop firm traders about market analysis and discipline. Understand how to improve your analytical skills. Using their strategies and insights can boost your trading performance and help you succeed in the prop firm challenge.

What educational resources and support are available for aspiring prop traders?

Prop firms offer many educational tools and support, like market analysis and trading tips. You can join mentorship programs, webinars, and trader communities. These resources help you improve your strategies and understand the market better.

How crucial is the psychological aspect while trading with a prop firm?

Psychology is very important in prop trading. It affects how you trade. You need to stay calm, disciplined, and open to feedback. These skills help you follow your plan and make smart decisions, even when the market is unpredictable.