In the fast-changing world of crypto prop trading, having an edge is crucial. Top prop traders use advanced breakout strategies to quickly spot important support and resistance levels. This article will explore how these strategies help traders make the most of big price changes in crypto derivatives.

- Breakout strategies help traders capitalize on significant price movements.

- Support and resistance levels are key indicators in crypto prop trading.

- Professional traders employ specific patterns to predict market behaviour.

- Understanding different breakout patterns enhances trading efficacy.

- Utilizing technology can improve the effectiveness of trading strategies.

Understanding Market Breakouts

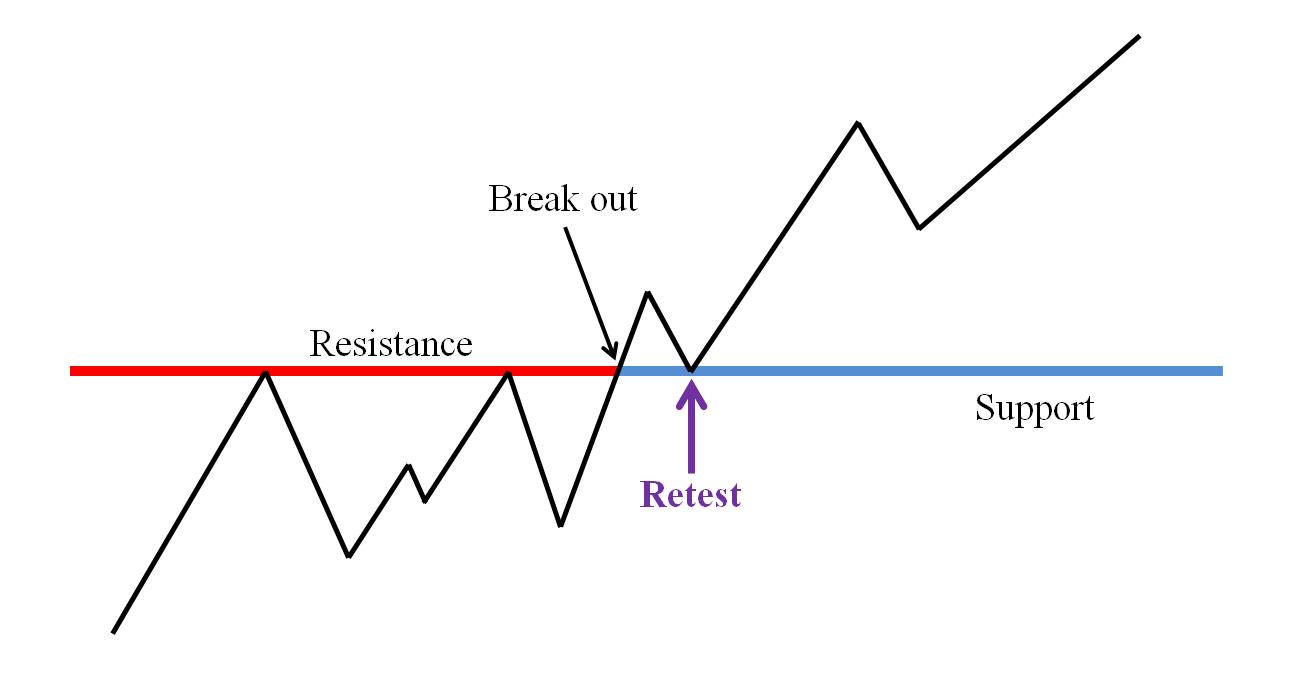

In the world of cryptocurrency trading, a market breakout means a big price move past support or resistance levels. For a crypto-funded trader, these moments are key to making the most of market changes. It’s vital to know when these events happen to trade well.

Support and resistance levels are like mental barriers in trading. Support is where prices stop falling and start going up. Resistance is when prices stop rising and start falling. Knowing these levels well can help a crypto-funded trader spot strong trends.

Volatility is also key in understanding market breakouts. When volatility is high, prices change a lot. This means breakouts could happen more often. A crypto-funded trader needs to watch these changes closely to make quick, smart decisions.

Breakout Crypto prop trading

Market momentum, or the speed and volume of trading, is also important. When momentum is high, breakouts are more likely to stick and start new trends. Checking momentum indicators like the Relative Strength Index (RSI) helps see how strong breakouts might be.

Knowing about support and resistance, volatility, and momentum helps spot breakouts. For a crypto funded trader, using this info can really improve trading results in the fast-changing crypto markets.

Break out Strategies for the Crypto Prop Traders

In the world of cryptocurrency trading, using effective break-out strategies is crucial for making the most of our trades. As crypto prop traders, we need to spot key breakout signals and patterns. These are key for making quick, smart decisions.

First, finding the right entry and exit points is crucial. These strategies focus on watching resistance and support levels, checking volume indicators, and looking at price trends.

How we size our positions is also key. We want to use our money wisely to reduce risk and increase potential gains. This means spreading out our investments and adjusting trade sizes based on how strong the breakout signal is.

Stop-loss orders are vital for protecting our money. By setting these orders, we can control our losses if the market suddenly changes. This helps us stay within our risk limits.

Crypto prop trader

Let’s look at a trade example. Say we’re watching Bitcoin against the US Dollar (BTC/USD) for an upward breakout. Our strategies would be:

- Identifying a clear resistance level.

- Waiting for a high-volume breakout above this resistance.

- Entering the trade at or near the breakout point.

- Setting a stop-loss just below the new support level.

- Determining an exit strategy based on price targets or trailing stop-losses.

By using these strategies, we can improve our trading skills and handle the unpredictable crypto market better. Knowing and using these tactics is essential for our success as crypto prop traders.

Common Breakout Patterns in Crypto Markets

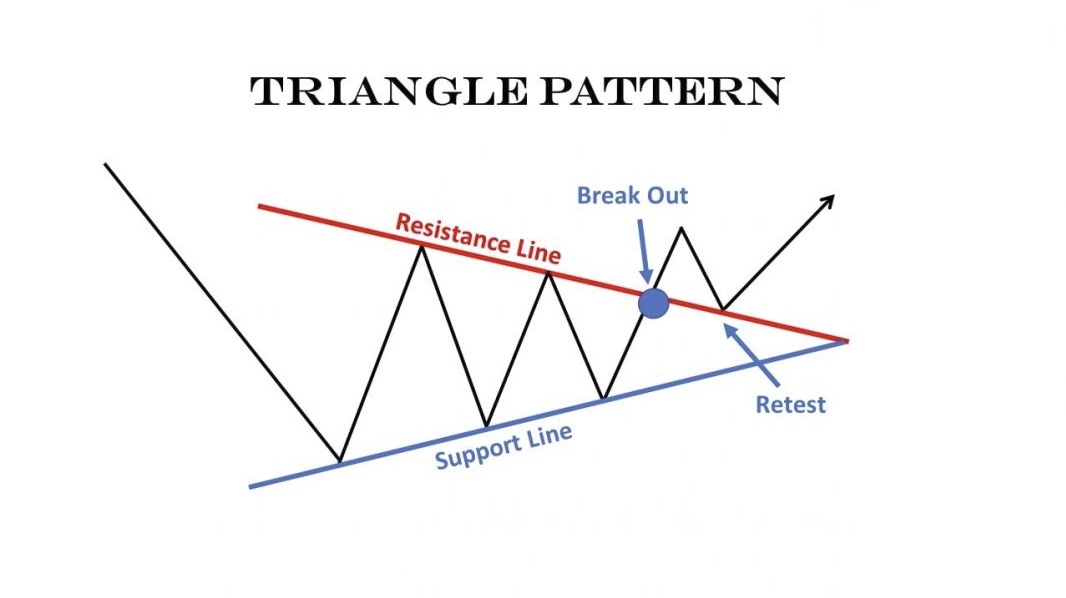

Breakout patterns are key in the unpredictable crypto markets. Knowing these patterns can boost our trading plans. Symmetrical triangles and ascending triangles are two main patterns used.

Symmetrical triangles happen when prices set higher lows and lower highs, meeting at a single point. This shows a consolidation phase before a breakout. Traders keep an eye on these triangles. They can mean the trend will keep going or change, based on the breakout direction.

Ascending triangles have a flat top trendline and a rising bottom trendline. This pattern is often seen as bullish, meaning the price might break through the resistance. When the top trendline is broken, it shows strong buying and likely price increases.

Spotting these patterns helps us guess market moves and make smart trading choices. By watching these patterns form and break, traders can guess future price changes. This improves their trading success in the crypto markets.

Trading Ascending Triangle Breakouts

In our journey through crypto prop trading strategies, ascending triangle patterns are key. They appear in uptrending markets, signaling a possible move up. Let’s explore how to spot and trade these patterns.

Brak out Crypto prop

Identifying an ascending triangle means looking for a horizontal resistance line and rising bottoms. This happens when traders buy more, making higher lows.

The psychology behind this pattern is quite interesting. As the price keeps hitting a resistance but making higher lows, traders start to expect a breakout. This expectation brings more buying, making the pattern stronger.

Volume confirmation is crucial in trading ascending triangles. Volume usually goes down as the pattern gets ready to break, then jumps up when it does. Seeing a big volume increase when the price breaks through the resistance confirms the breakout.

- Look for the main parts: horizontal resistance and rising lows.

- Watch for volume confirmation patterns.

- Think about the psychology and market feelings behind the pattern.

Many examples exist in the crypto markets. Bitcoin often shows ascending triangle breakouts during its upswings. By looking at past charts, we see how these triangles lead to profitable trades.

Mastering trading breakouts like ascending triangles takes effort and practice. By focusing on volume confirmation and understanding the market’s psychology, we get better at making successful trades.

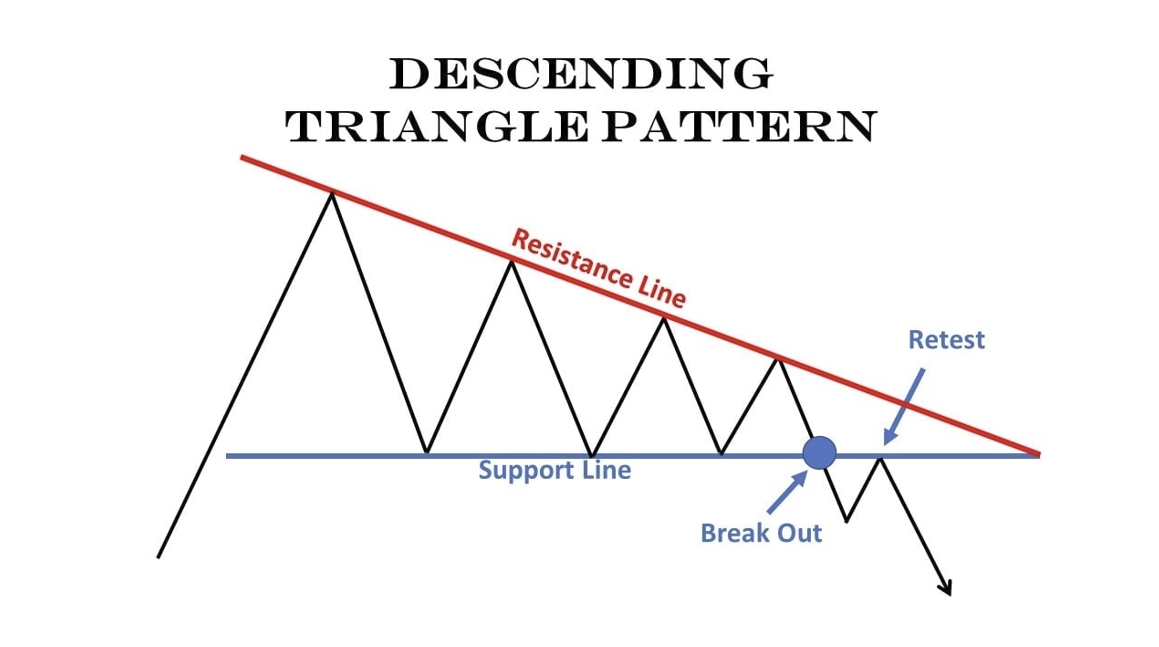

Descending Triangles: Risks and Rewards

Descending triangles are often seen as bearish patterns in crypto trading. They have a unique shape, with lower highs meeting a horizontal support line. This setup offers both chances and challenges for traders.

Descending Triangle Pattern in crypto prop Trading

The bearish nature of descending triangles can be good for traders. But, they also bring risks. A big worry is false breakouts. These happen when prices go below the support line, making it seem like the price will keep falling. But then, it can turn back up. This can trick traders into making bad moves, leading to losses.

To deal with these risks, strong risk management plans are key. Good risk management means setting stop-loss orders, knowing important support and resistance levels, and watching the market’s mood.

When looking at descending triangles, traders should be careful yet precise. It’s important to wait for clear signs before trading. Also, being disciplined about risk can lessen the effects of false breakouts.

Understanding descending triangles and using good risk management can help traders make the most of these patterns. This way, they can reduce the downsides.

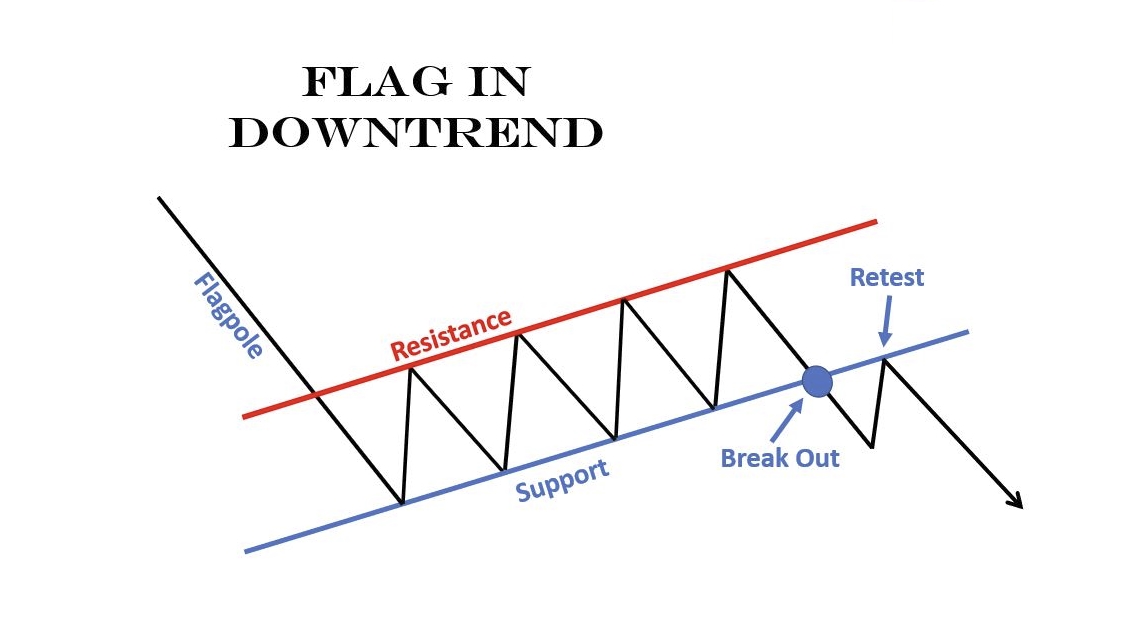

Flag Patterns in Crypto Breakouts

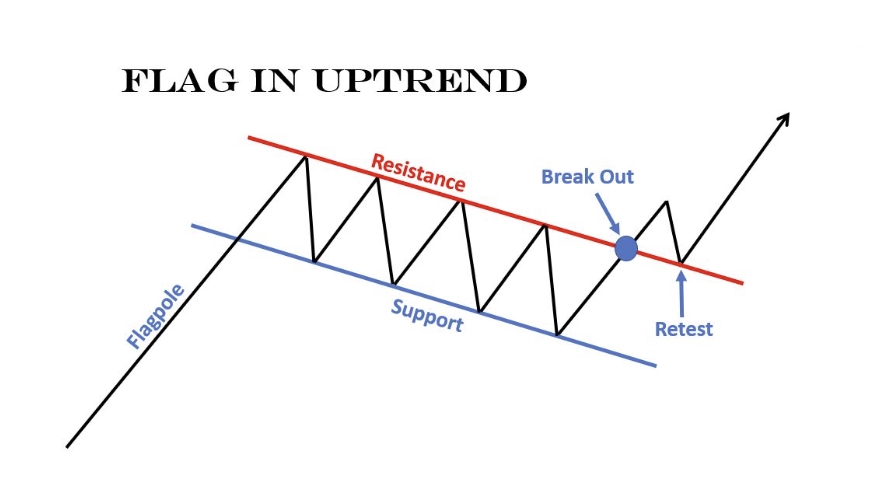

Flag patterns show short periods of consolidation within a trend. They help breakout traders predict market moves. It’s key to know both bullish and bearish flags to make the most of our trading plans.

Time confirmation is vital for these patterns. Quick price consolidation followed by a breakout hints at the trend’s continuation. This brief pause forms a flag shape on the chart, hence the name “flag patterns.”

Flag pattern in crypto trading

Traders look for certain signs in flag patterns:

Breakout: A sharp move starts the flagpole.

Consolidation: Prices move sideways or slightly opposite the trend.

Time Confirmation: If the flag’s length matches the flagpole’s time, it confirms the pattern.

After the breakout from consolidation, traders bet on the trend’s direction.

Flag patterns with time confirmation help us make smart trading choices. By checking these setups carefully, we boost our chances of catching big market moves.

Flag Pattern in Crypto Trading

Steering Clear of False Breakouts

It’s key for crypto prop traders to avoid false breakouts. We can use several strategies to tell real breakouts from fake ones. This helps lower risks. One good way is to look at multiple time frames together. This helps us check if a breakout is real before we act.

Volume and price confirmations are also important. Real breakouts usually have more trading volume and a steady price rise. Without these, it might be a false signal. Using strong risk management strategies helps protect against false breakouts too. By setting stop-loss orders and managing our positions well, we can limit losses if the market doesn’t go as planned.

“A critical aspect of breakout trading is distinguishing between real and fake signals. Utilizing multiple time frames can aid in identifying true breakouts, ensuring we do not fall prey to market traps.”

By using multiple time frames, watching volume and price, and managing risks, we get a solid way to deal with crypto trading’s challenges.

Crypto Prop Trading

Introduction to Crypto Prop Trading

Crypto prop trading has become very popular in recent years. It offers traders a special way to make money. Unlike regular trading, traders use the firm’s money, not their own. This means they can make a lot of money without risking their funds.

The Hyro Trader prop firm is a great example in this area. They offer trading accounts with $5,000 to $100,000 in cooperation with Bybit and there are rumours that more Crypto exchanges will be introduced soon.. This makes Hyro Trader a top choice for those starting. Using a prop account lets traders work on their skills without worrying about losing their own money.

HyroTrader is known for its profit-sharing model. At the best prop trading firm, traders can keep up to 90% of their profits. The firm covers any losses. This approach creates a safe trading space and motivates traders to do their best.

To get into crypto prop trading, you need to understand key terms like funded accounts and evaluation processes. Many firms make traders go through a trading challenge and verification to show they’re good at it. This ensures only skilled traders get to use the firm’s money, keeping trading safe and responsible.

Crypto prop trading is a great way to make money with less risk. By learning about it and firms like Bybit, traders can do better and increase their chances of making money.

Conclusion

As we end our look at breakout strategies in crypto prop trading, let’s review the key points. We learned about the importance of breakout trading for many traders. It’s a key way to make money in the crypto market.

We looked at different breakout patterns like symmetrical and ascending triangles. These patterns help traders find good opportunities and avoid risks. Technology has also become a big help, giving traders tools to trade better.

To be successful in crypto trading, you need to understand breakout strategies well. It’s important to keep learning and use technology to your advantage. We hope this article has helped traders improve their skills. With each successful trade, we all get better at navigating the crypto market.