In 2008, trader Jane Smith faced a tough time. The Lehman Brothers collapse shook the Crypto markets. She turned to the win-loss ratio and risk-reward management to guide her. These tools helped her not just survive but thrive.

Win ratio and risk-reward are key for any trader’s Crypto strategy. Jane’s story shows why these metrics are vital. They help make smart investment choices and lead to lasting success.

Key Takeaways

- Trader Crypto strategy is key for long-term success.

- The win-loss ratio helps track performance.

- Risk-reward management informs investment decisions.

- Balancing the win ratio and risk reward is essential.

- Experienced traders rely on these metrics to refine strategies.

Solid Crypto Strategy

Creating a solid crypto trading strategy is key to success in the Crypto markets. It starts with understanding the basics, doing thorough market analysis, and making smart trading decisions.

Market analysis is the foundation of a good trading plan. It means looking closely at Crypto market data, trends, and patterns to guess future prices. Traders use both technical and fundamental analysis to make informed choices.

It’s also important to know the financial instruments you’re working with. Crypto Spot or Futures, both have their own rules. Futures trading lets you bet on price changes without owning the actual asset, giving you flexibility and the chance for big gains.

A good Crypto strategy must match the trader’s risk level, goals, and the Crypto market’s conditions. There’s no single strategy that works for everyone. It’s all about learning and adjusting as you go. A Crypto strategy that fits your risk and goals helps you stay focused on your long-term goals.

Building a strong trading Crypto strategy is a continuous process. It combines basic trading knowledge, ongoing Crypto market analysis, and strategic decisions with a growing understanding of Crypto tools. By improving their approach, traders can tackle the financial markets with more confidence and skill.

Understanding Win Ratio in Trading

In trading, the win ratio is key. It shows how well a trader does by comparing wins to total trades. This ratio gives deep insights into a trader’s skill and Crypto strategy.

The win ratio significance is huge. It’s a first sign of trading success. It also helps improve trading plans. For example, a trader with many wins but poor position sizing might face profit issues.

Learning probability theory helps us understand win ratios better. Knowing this theory lets traders spot patterns and predict results. Using probability with a good win ratio leads to better decisions and higher trader performance.

“Win ratio is not just about the number of wins but about leveraging those wins to optimize overall trading success.” – Unknown

Managing a trading account well means looking at everything together. The win ratio significance must be balanced with position sizing and risk control. Focusing too much on one thing can hurt results.

To wrap it up, getting the win ratio right mixes probability theory and smart Crypto strategy changes. For lasting success, the win ratio is a must for traders.

Exploring Risk Reward

Understanding risk-reward is key for traders aiming for quick wins and lasting success. It’s about looking at the risks and rewards of each trade. This helps traders make smart choices and stay true to their trade expectancy.

A good trade balances the risk with the reward. For example, if a trade could double your risk, it’s seen as a good deal. Good risk management is key here. It helps traders not just survive but thrive in changing Crypto markets.

In trading, trading psychology is as vital as technical skills. Traders need to follow their plans and avoid acting on fear or greed. By focusing on risk-reward, traders can boost their success and make consistent profits.

Traders should often check their risk-reward ratios. They should look for the best trades and stick to their risk plans. This careful approach, backed by strong trading psychology, is the foundation of lasting success.

“Great traders understand the importance of managing risk, evaluating every trade from a risk-reward perspective, and maintaining psychological resilience.”

How to Calculate Risk Reward Ratio

Learning to calculate the risk-reward ratio is vital for traders. It starts with setting your trade entry and exit points. Your entry point is when you buy, and your exit point is when you sell. Getting these right helps you see your chances of losing or gaining.

Then, use stop-loss orders to control risks. A stop-loss is a limit on how much you can lose on a trade. It stops small losses from growing into big ones, protecting your money.

Setting clear profit targets is also key. A profit target is the price at which you exit for a profit. Combining your profit targets with stop-loss orders helps you calculate the risk-reward ratio well. A higher ratio means you might gain more than you risk, making you want to trade.

Keep your reward expectations in check by considering Crypto market conditions and your trading history. By carefully choosing your entry and exit points, setting stop-loss orders, and aiming for realistic profits, you get a solid way to figure out the risk-reward ratio.

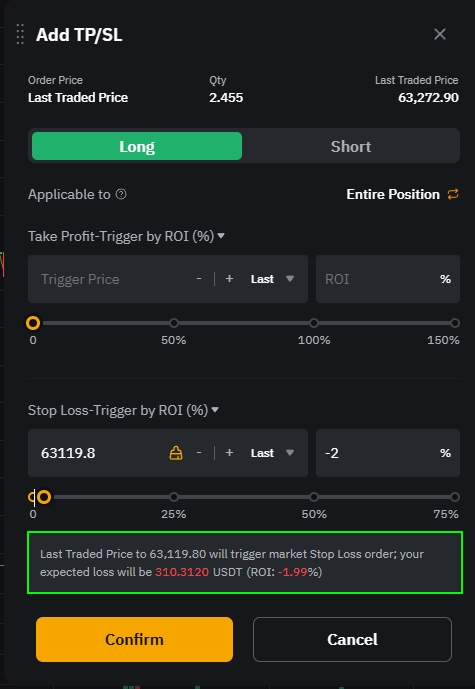

It’s not difficult you can just simply use the Risk reward tool in the Bybit exchange which is the main partner for Hyro Trader. While setting your trade you will see how much is risk

“A disciplined trader never underestimates the power of a well-configured risk reward ratio,” – Warren Buffett.

For trading consistency, understanding and checking these metrics often is essential. Traders who keep an eye on and tweak their strategies based on trading metrics tend to trade more steadily and reliably.

In short, a detailed Crypto strategy assessment is key. It should focus on win ratio optimization and balancing risk and reward. These are the foundations of successful trading.

Impact of Win Ratio and Risk Reward on Trading Performance

Understanding win ratio and risk reward is key for traders aiming for long-term success. These factors greatly affect how much money you can make and how to handle losses.

Real-world trading shows how these ratios impact results. For example, a high win rate but poor risk-reward can limit growth. On the other hand, a good risk reward and balanced win rate can lead to better performance.

Drawdown management improves when traders match their risk tolerance with these metrics. Keeping a close eye on these helps achieve long-term success. Finding the right balance between win ratio and risk-reward helps keep and grow your capital.

In summary, aligning win ratio and risk reward is essential. Traders who grasp how these elements work together can better manage risks and increase their earnings.

Benefits of Using HyroTrader

The HyroTrader crypto platform brings together many benefits for experienced traders. It ensures transparent trading conditions, allowing for direct crypto platform trading without hidden fees. This means no complicated structures to deal with.

One of the key features is the easy personal account integration. This lets traders link their current accounts without hassle.

HyroTrader gives traders the tools they need. It’s all about transparent trading conditions, giving users a clear view of their transactions. This builds trust and reliability.

The platform also offers direct crypto platform trading. This means traders get real-time data and fast trade execution. This is key in the fast-changing crypto market.

Being able to connect personal accounts is a big plus. It lets users manage their assets in one place. This makes trading easier and faster, helping users make quick, informed decisions.

The HyroTrader benefits are clear. There’s enhanced transparency, direct access to major crypto platforms, and easy account management. It’s a top choice for professional traders.

Tips for Managing a Funded Account

Managing a funded account well mixes financial responsibility and trading discipline. It’s important to have a plan for both crypto and traditional trading. This plan should be detailed and structured.

- Embrace Financial Responsibility: Treat the funded account as your own. Keep detailed records of trades and know your funds. Never risk more than you can afford to lose.

- Maintain Trading Discipline: Stick to your trading plan without wavering. Emotional decisions can harm your results. Discipline also means setting achievable goals and being patient. Consistency is key.

- Smart Use of Account Leverage: Leverage can increase profits but also risks. Choose the right leverage level before trading. This prevents risking too much.

- Effective Profit Withdrawal: Plan how you’ll withdraw profits. Set aside a portion regularly. Don’t leave all profits in the account to avoid overtrading and loss.

- Risk Mitigation Practices: Use strategies like stop-loss orders and asset allocation. These protect your account from big losses. They help in growing your account over time.

Managing a funded account well means following some key points. It also involves learning and adapting to Crypto market changes. Being disciplined, responsible, and smart with profit withdrawal and leverage is key. These habits are the foundation for long-term trading success.

Conclusion

Understanding win ratio and risk-reward is essential for trading success. This article has provided a detailed look at these important aspects. It shows how calculating risk-reward helps traders make better, more confident choices.

Successful traders know a lot about win ratio and risk-reward. These two are critical for building strong trading plans. By balancing risks and rewards, traders can improve their performance over time.

Good trading habits come from practice and knowing the basics. This knowledge boosts individual success and helps in the long run. By using these principles, traders can handle the trading world’s challenges, leading to lasting success.