Experienced cryptocurrency traders often find themselves hitting a wall with traditional proprietary trading firms. Take FTMO, for example – it’s one of the most reputable prop firms, but when it comes to FTMO crypto trading, there are notable limitations.

FTMO only offers a handful of major cryptocurrencies (the current top 10 coins like Bitcoin, Ethereum, Litecoin, etc.) and its crypto leverage is capped at roughly 1:3. This means an FTMO crypto trader can’t fully capitalize on small price movements due to limited buying power.

Additionally, FTMO crypto payout schedules and methods can feel rigid; typically you wait for set payout dates and receive funds via bank transfers or e-wallets, which might not suit those who prefer instant access to profits. To make matters more challenging, FTMO’s standard accounts require you to close positions by Friday to avoid weekend risk – not ideal for crypto markets that trade 24/7. In short, while FTMO excels for forex, its model leaves many crypto-focused traders searching for a better fit.

If you’re an experienced trader frustrated by these pain points, you’re likely asking: Is there a funded trading program that truly caters to crypto traders’ needs? The good news is yes. HyroTrader has emerged as perhaps the best FTMO alternative for cryptocurrency traders. HyroTrader is a crypto prop firm built by and for digital asset traders.

It addresses the gaps that FTMO and other traditional firms have in the crypto arena – from offering more crypto markets and higher leverage, to providing real-time exchange trading and instant withdrawals.

In this article, we’ll compare FTMO and HyroTrader in detail, focusing on capital offers, profit splits, crypto trading options, payout structures, and unique features like weekend trading. By the end, you’ll see why HyroTrader stands out as a top choice for crypto traders seeking funded accounts, and how it can empower you to trade crypto with significant capital and flexibility.

Let’s dive into the comparison and discover why HyroTrader is positioned as the best FTMO alternative for crypto enthusiasts.

FTMO vs. HyroTrader: A Comparison for Crypto Traders

When evaluating an FTMO alternative, it’s important to compare apples to apples. FTMO and HyroTrader are both proprietary trading firms that fund traders with company capital after a successful evaluation. However, their offerings diverge significantly, especially regarding cryptocurrency trading. Below, we break down the key areas of comparison between FTMO and HyroTrader for crypto-focused traders.

Company Background and Focus

FTMO – Founded in 2015 and based in Prague, FTMO has become a dominant name in prop trading. It started by funding forex and CFD traders, and only later incorporated some crypto trading options. FTMO’s core focus is broad (forex, indices, commodities, etc.), with crypto as a smaller part of its instrument list.

Its reputation is stellar in the industry, known for integrity and a comprehensive two-step evaluation challenge. However, FTMO’s DNA is rooted in traditional markets, which reflects in rules like limited crypto leverage and constrained trading hours for certain account types.

HyroTrader – Launched in 2023 and headquartered in Prague as well, HyroTrader is dedicated solely to cryptocurrency traders. This laser focus means everything about the program is tailored for crypto market dynamics.

The firm was created by experienced crypto traders who noticed how most prop firms (like FTMO) weren’t fully accommodating crypto trading. HyroTrader’s mission is to empower crypto specialists with large capital and a supportive environment.

It even collaborates with real crypto exchanges (like ByBit) to let traders operate in a genuine market setting. In short, FTMO is a veteran prop firm with a generalist approach, whereas HyroTrader is a newer entrant which has solid reputation built specifically as a crypto prop firm.

Trading Capital and Account Scaling

One major factor for any funded trader is the amount of capital you can trade and how you can scale it over time. Here’s how FTMO and HyroTrader compare:

FTMO Capital

FTMO offers various account sizes through its challenges. Traders can choose challenge account sizes up to $200,000. Upon passing the two-phase evaluation, you receive a funded account of that size. FTMO also has an aggressive scaling plan – if you trade consistently well for several months, your account balance can increase by 25% increments, up to a maximum of $400,000 per account.

This means a successful FTMO trader can eventually control a very large capital pool. However, remember that FTMO’s crypto leverage (around 1:3) limits position size on that capital, effectively muting some of the benefit for crypto trading unless you stick to big coins with low volatility.

HyroTrader Capital

HyroTrader’s funding starts at a slightly smaller scale for initial accounts, but still substantial. Traders can begin with account sizes such as $50,000, $100,000, or even up to $200,000 in virtual trading capital during the evaluation. Notably, HyroTrader’s program can fund traders with $100,000 in initial capital and scale up to $1,000,000 based on performance.

In fact, top performers have the opportunity to trade with $1M in firm capital as they prove themselves. This scaling isn’t instant; HyroTrader will increase your account size as you hit profit milestones and demonstrate consistent success.

Bottom Line – Capital

FTMO provides access to very large capital over time, which is appealing if you also trade other assets. For pure crypto traders, HyroTrader’s generous six-figure starting capital and clear path to a million-dollar account is highly attractive.

HyroTrader’s edge is that the capital remains focused on crypto trading and even becomes “real” exchange-traded capital once you’ve proven yourself, whereas FTMO remains a simulated environment regardless of scale (FTMO covers your payouts internally, not by letting you directly trade an exchange). Depending on your goals, both offer plenty of funding, but HyroTrader is built to fuel crypto trading specifically.

Profit Split and Payout Structure

How much profit you get to keep – and how you get paid – can make or break a prop trading experience. Both FTMO and HyroTrader advertise competitive profit splits, but the details differ:

FTMO Profit Split & Payouts

FTMO is known for a generous profit-sharing model. Traders start with a 80% profit split (meaning you keep 80% of the profits you earn, FTMO takes 20%). With consistent performance and adherence to rules, you can qualify for a 90% profit split under FTMO’s scaling plan. In practice, many FTMO traders see their split increased to 90% after a few payout cycles as a reward for longevity and hitting profit targets.

Payouts at FTMO are typically processed monthly, although recently FTMO introduced bi-weekly payouts to stay competitive. Still, you usually need to trade for a minimum period (e.g., 14 days) before your first withdrawal.

FTMO pays out via bank transfer or electronic payment processors. They have started supporting crypto withdrawals through services like Coinbase/crypto wallets in some cases, but payouts are not instant – you request profit withdrawal on a scheduled date and receive it in 1-2 business days.

This structured payout cycle works fine for many, but it means you can’t access profits on-demand. In summary, FTMO offers up to 90% profit share and reliable payouts (they reportedly paid out over $75 million in 2023), but on a fixed schedule and mostly via traditional finance channels.

HyroTrader Profit Split & Payouts

HyroTrader also boasts a lucrative profit-sharing model, tailored for crypto earners. Traders begin with a 70% profit split, but this can scale up as you hit performance benchmarks.

In fact, HyroTrader allows scaling your profit split up to 90% – matching FTMO’s top tier – once you become a consistently profitable funded trader. What really sets HyroTrader apart is the payout structure. Rather than waiting weeks for a profit split day, HyroTrader offers on-demand payouts, even daily. You can withdraw profits as soon as you’ve earned at least $100 in profit, and there’s no need to wait for the month’s end.

Payouts are processed in cryptocurrency (USDT or USDC stablecoins) directly to you, meaning you can literally finish a great trading day and request your share of profits immediately. This instant payout system is a game-changer for crypto traders – it provides quick liquidity and the option to compound gains or secure them without delay.

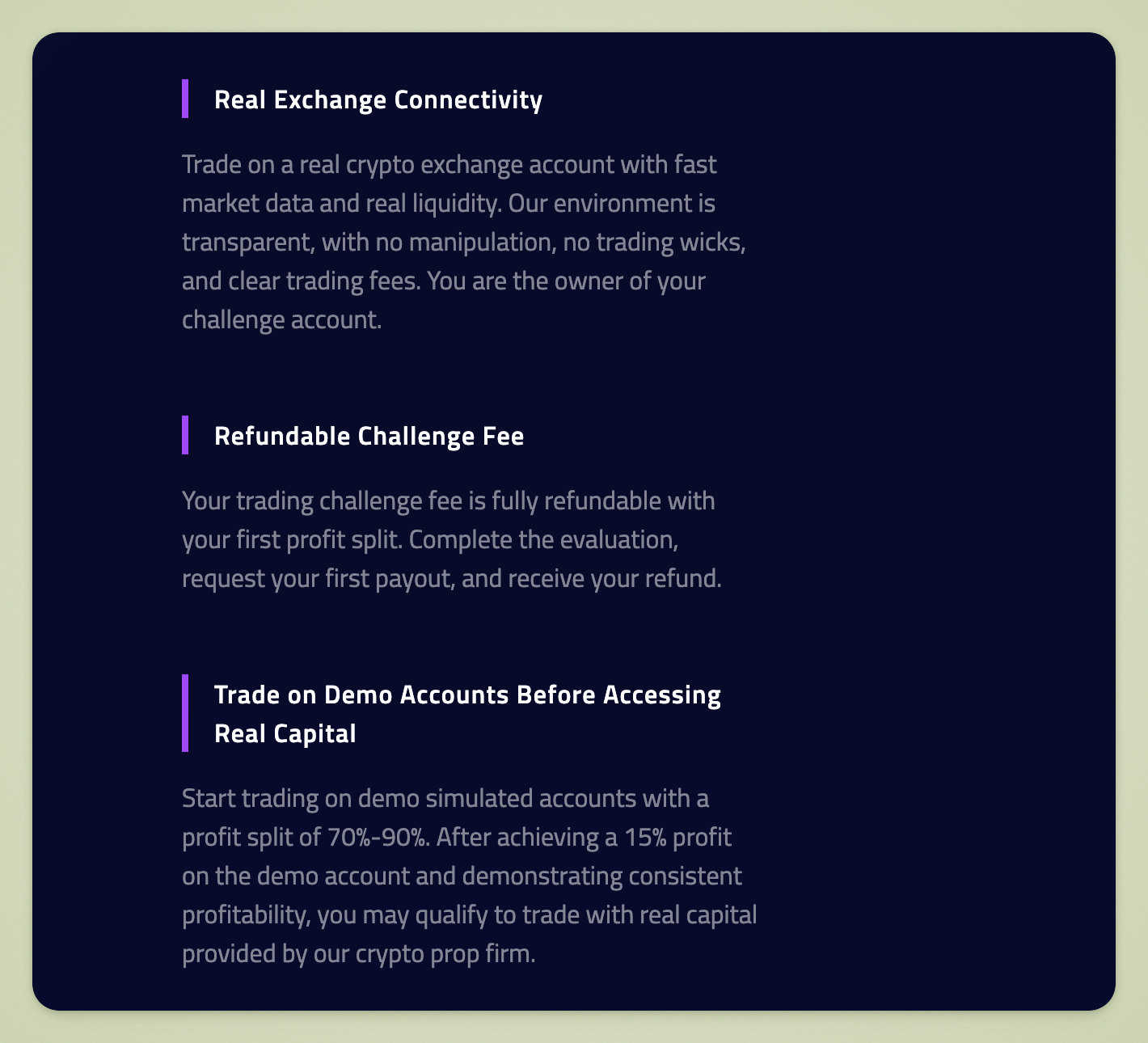

By paying in stablecoins, HyroTrader caters to those who operate in the crypto ecosystem and prefer to keep funds there. Additionally, HyroTrader refunds your challenge fee with your first payout as a nice bonus.

The trade-off to note: HyroTrader starts at a slightly lower split (70%) until you prove yourself, whereas FTMO might start you at 80%. But given how quickly HyroTrader lets you withdraw and scale up to 80% and 90%, most traders find the flexibility well worth it.

Bottom Line – Profit & Payouts

Both firms ultimately let you keep up to 90% of your hard-earned profits. FTMO’s profit split is excellent and time-tested; however, FTMO crypto payout timing might feel slow if you’re used to the fast pace of crypto.

HyroTrader’s instant, crypto-denominated payouts give it an edge for those who want immediate access to funds or who measure success in real-time. If you value getting paid quickly (say to reinvest in other opportunities or simply enjoy your earnings faster), HyroTrader is a clear winner.

Crypto Trading Instruments and Platforms

This is arguably the most crucial comparison for a crypto trader: What can you trade, and on what platform? FTMO and HyroTrader take very different approaches here, due to their core focus.

FTMO’s Crypto Offering

FTMO allows its funded traders to trade cryptocurrencies, but only in the form of CFDs (Contracts for Difference) on a select set of coins.

As mentioned, FTMO provides access to roughly the top 10 cryptocurrencies by market cap – these include the heavy-hitters like BTC, ETH, LTC, XRP, DOGE, ADA, etc. While this covers the most popular assets, it means if you want to trade smaller altcoins or newer tokens, FTMO won’t have them.

All trading is done on platforms like MetaTrader 4/5 or cTrader, which connect to FTMO’s liquidity providers. These platforms are robust for forex but can be clunky for crypto traders used to exchange interfaces.

Another limitation is that FTMO’s crypto trades are effectively simulated – you’re trading a derivative contract, not the actual underlying asset on a blockchain exchange. This can lead to differences in price feeds and sometimes widened spreads or liquidity issues during volatile crypto moves.

Moreover, FTMO’s risk rules for crypto (like the low leverage and possibly stricter stop-loss requirements) reflect their caution in a market they don’t specialize in.

On standard FTMO accounts, you might also be restricted from holding crypto positions over the weekend because the CFD market could close (or if kept open, those positions carry extra risk or margin requirements).

In summary, FTMO offers a way to trade major crypto pairs alongside other assets on a familiar trading platform, but with limited selection and without direct market execution.

HyroTrader’s Crypto Offering

HyroTrader was built from the ground up for crypto, so the range of instruments and the trading environment is much more expansive for a crypto trader. With HyroTrader, you can trade cryptocurrency futures (USDT perpetual contracts), USDC linear contracts, spot markets, and even crypto options on the ByBit platform.

In practice, this means you have access to dozens of crypto trading pairs beyond just Bitcoin or Ethereum. You can trade altcoin futures with high leverage, dive into spot trading if you prefer, or use options strategies – all under the funded account. The trading takes place on real ByBit exchange accounts or via HyroTrader’s CLEO platform that streams real-time data from Binance.

This is a huge distinction: when you place a trade with HyroTrader, you’re interacting with the actual market order books on a leading crypto exchange. The market data is real-time and comes straight from top exchanges, ensuring accurate pricing.

You won’t encounter artificial price “wicks” or broker manipulation because HyroTrader isn’t the counterparty – the trades go to the exchange (or are at least mirrored 1:1 on an exchange account). For a trader, this means more transparent execution, better liquidity on many altcoins, and the ability to use advanced order types and charting tools native to those exchanges.

HyroTrader also supports the TradingView interface and other professional crypto trading tools for analysis, whereas FTMO confines you to traditional forex trading software. If your strategy involves on-chain analysis or quick reaction to crypto news, HyroTrader’s setup keeps you connected to the real crypto market environment.

Finally, HyroTrader imposes very few limits on trading style – scalping, algorithmic trading via API, and other techniques are generally allowed as long as you follow risk rules (since trades occur in a real market, there’s less concern about “abusing” a demo feed). This freedom is a breath of fresh air compared to some prop firms that ban certain high-frequency or news trading strategies.

Bottom Line – Instruments & Platform

For a crypto specialist, HyroTrader clearly offers a richer and more authentic trading experience. FTMO’s crypto trading is suitable if you just want to dabble in major coins or integrate a bit of BTC trading into a broader portfolio, but it doesn’t support a comprehensive crypto trading approach.

HyroTrader not only offers more coins and crypto-specific instruments but does so on the actual crypto market – an invaluable feature for serious traders. This means with HyroTrader you can implement the same strategies you would on your personal crypto accounts, with no adaptation needed for a CFD environment.

If you’re seeking the best FTMO alternative specifically in terms of crypto trading options, HyroTrader is the hands-down winner. You get the breadth of the crypto market at your fingertips and the depth of real exchange liquidity, which FTMO simply can’t match with its limited CFD list.

Trading Rules: Leverage, Drawdowns, and 24/7 Access

Trading rules and allowed strategies can significantly impact your day-to-day trading. Let’s compare how FTMO and HyroTrader handle key rule aspects, particularly those that matter for crypto trading (like leverage, drawdown limits, and weekend positions).

FTMO Trading Rules

FTMO’s evaluation rules are famously strict yet fair – in the two-step challenge, you must achieve +10% profit in Phase 1 and +5% in Phase 2 without violating drawdown limits (typically max 5% daily loss and 10% overall loss) and within a set period (usually 30 days for phase 1, 60 days for phase 2).

Once funded, those drawdown rules remain in place to protect capital. When it comes to leverage, FTMO offers generous leverage for forex (up to 1:100 on normal accounts), but for crypto they severely limit it to about 1:3 as noted earlier. This conservative crypto leverage is likely because of crypto’s volatility and the firm’s risk model.

Additionally, trading hours: FTMO’s standard accounts do not allow holding trades over the weekend for any instrument. They explicitly require funded traders to be flat (no open positions) by Friday market close for forex/indices. FTMO crypto weekend trading falls under this rule too – even though crypto markets don’t close, the FTMO brokerage might stop quoting over the weekend or simply mandates closure to manage risk.

To accommodate swing traders, FTMO offers a separate “Swing” account type. An FTMO Swing account lets you hold trades overnight and over weekends, but it comes with lower leverage (for crypto, a Swing account may allow weekend holding but at only 1:1 leverage on crypto positions – essentially no leverage).

This means an FTMO trader can either have high leverage with no weekend positions (standard account) or hold over weekends with negligible leverage (swing account). For many crypto traders who want to maintain positions during weekend rallies or hedge continuously, this is a tough choice.

In terms of trading styles, FTMO generally allows most strategies (scalping, technical trading, etc.), but they forbid any strategy that exploits technical glitches or latency (e.g., arbitrage between the demo feed and real market). Automated trading with Expert Advisors (EAs) is allowed on FTMO, as long as the strategy abides by the rules. FTMO also used to discourage trading during major news events on standard accounts, but those restrictions were lifted for the swing account type.

Overall, FTMO’s rules are well-defined and aimed at ensuring traders are disciplined; however, the constraints on leverage and weekend holding particularly can limit certain crypto strategies.

HyroTrader Trading Rules

HyroTrader’s rules are designed with crypto’s 24/7 nature in mind. The evaluation process for HyroTrader mirrors FTMO’s structure in many ways – you need to pass a challenge phase and a verification phase.

Typically, HyroTrader requires about a 10% profit in Phase 1 and 5% in Phase 2 (very similar targets to FTMO) to prove you can trade profitably. A notable difference is no time limit on HyroTrader’s challenge phases. You can take as long as you need to hit the profit target, as long as you respect the risk limits (this reduces the pressure and encourages responsible trading over rushing to hit a goal before a deadline).

Risk limits (daily and overall drawdown) are comparable to FTMO’s, ensuring you protect the account. Regarding leverage, HyroTrader shines for crypto traders – they offer up to 1:100 leverage on crypto trades because the trades are executed on crypto futures exchanges where such leverage is standard. Of course, using the full 100x is risky, but the option is there for those who need it for short-term trades or certain arbitrage plays.

This high leverage capability means even with a $100K account, you can take sizable positions in Bitcoin or altcoins (just manage your risk!). Importantly, HyroTrader allows trading around the clock – there are no restrictions on overnight or weekend trading.

Since you’re trading on real crypto markets that never close, you are free to hold positions through weekends and respond to market-moving news anytime. There’s no requirement to close on Fridays; you can keep a trade open for weeks if it fits your strategy.

This flexibility is crucial – crypto doesn’t sleep, and neither does HyroTrader’s platform. In terms of strategies, HyroTrader is quite accommodating. You can scalp on one-minute charts, run algorithmic strategies via API keys (trading on ByBit allows API trading, so you could connect a bot or use advanced order types), and trade news events in crypto (which often happen unpredictably).

Essentially, as long as you aren’t doing something like exploiting a technical flaw, HyroTrader is fine with it – because their model doesn’t require them to “beat” the trader. In fact, HyroTrader’s philosophy is to profit alongside the trader, not from the trader’s failure. They encourage disciplined trading and even provide mentorship, rather than restricting profitable strategies.

Finally, HyroTrader provides real-time risk monitoring tools and performance analytics to help you stay within rules and track your progress, creating a supportive environment.

Bottom Line – Trading Rules & Flexibility

HyroTrader offers more freedom for the crypto trader in nearly every aspect: no time pressure to pass challenges, the ability to trade on weekends and overnight without special accounts, and generous leverage to maximize crypto opportunities.

FTMO’s rules are proven to build discipline, but for a seasoned crypto trader, some may feel like driving with the parking brake on – especially the weekend and leverage constraints in a fast-moving market.

If your trading style involves holding bitcoin through a big weekend move or catching a Sunday altcoin breakout, HyroTrader is clearly superior. That said, FTMO’s rules have a reason: they protect traders from excessive risk. Ultimately, though, for taking full advantage of crypto’s round-the-clock action, HyroTrader’s rule-set is far more accommodating.

Why HyroTrader Stands Out as the Best FTMO Alternative for Crypto

We’ve compared the specifics of FTMO and HyroTrader across various dimensions. Now let’s zero in on HyroTrader’s key benefits that make it an outstanding choice for crypto traders seeking funded accounts. Essentially, HyroTrader took the prop firm model that FTMO popularized and optimized it for the crypto market. Here are the top advantages of HyroTrader in a nutshell:

Crypto-Focused Funding Program

HyroTrader is built by crypto traders, for crypto traders. Unlike general firms, it doesn’t treat crypto as an afterthought. This means all its rules, platforms, and support systems are tailored to the realities of crypto trading. For example, their evaluation (often dubbed the “crypto challenge”) is tuned to crypto volatility – you have flexible time to hit the profit target, recognizing that crypto cycles can be erratic.

The firm’s entire identity revolves around empowering skilled crypto specialists, not just any trader. This focus translates into a program where you won’t feel like a second-class citizen as a crypto trader; instead, you’re the priority. HyroTrader’s team even provides professional guidance and mentorship to their traders, something most prop firms don’t explicitly offer. If you appreciate being part of a community that speaks crypto, HyroTrader provides that in spades.

Real Exchange Trading with Real-Time Data

One of HyroTrader’s slogan-worthy features is its real exchange connectivity.

As discussed, HyroTrader connects you to the ByBit exchange (a top global crypto exchange) or their CLEO interface which uses Binance data. You trade on a sub-account that is tied to the actual market, meaning every tick on the chart is genuine and every order you place can actually interact with the order book.

The benefits of this are huge: no spread markups beyond the exchange’s, no mystery “server issues” during high volatility, and no doubt that your performance is based on real market conditions.

Essentially, HyroTrader eliminates the “demo vs real” gap – what you see is what you get. Even during the evaluation, you’re trading in a live environment (just with virtual funds). This level of transparency builds trust; you can focus purely on trading strategy instead of worrying if the platform might throw you a curveball.

It’s a stark contrast to trading crypto via MT4 on FTMO where you might sometimes wonder if a spike that hit your stop was a real market move or a liquidity blip. HyroTrader proudly advertises that they have “no manipulation, no trading wicks” in their environment, giving traders peace of mind that their skills – not platform quirks – determine the outcome.

Instant, Flexible Payouts in Crypto

For anyone who’s waited weeks for a payout, this cannot be overstated. HyroTrader’s instant payout system means you don’t have to wait to enjoy your profits.

Make $500 profit this week? You could withdraw it today or tomorrow, straight to your crypto wallet in USDT/USDC. This is perfect for those who might want to compound their earnings quickly or simply for financial peace of mind.

There’s also a psychological benefit – frequent, tangible rewards can motivate you and reinforce good trading behavior. You’re effectively getting the “prop firm profit split” experience on a near real-time basis. Many traders also prefer accumulating profits in stablecoins because they can then deploy that capital in DeFi or other investments without conversion.

Additionally, HyroTrader covering the evaluation fee refund upon your first withdrawal shows they’re confident you’ll succeed and stick around (they give you back the challenge fee as soon as you prove yourself). Overall, the payout flexibility is a major plus that few if any traditional prop firms (including FTMO) currently match.

Higher Crypto Leverage & 24/7 Trading

HyroTrader allows up to 100x leverage on crypto futures trading. Even if you’ll rarely use the maximum, having high leverage headroom is useful for certain strategies (like short-term scalps with tight stops) and ensures you’re not hamstrung when a big opportunity arises.

More importantly, weekend trading is fully open. If Bitcoin makes a $2,000 move on Saturday, a HyroTrader funded trader can capitalize on it; an FTMO trader, unless on a special account, likely cannot. HyroTrader essentially never forces you out of the market. Want to hold a position through a big Ethereum network upgrade happening Sunday? Go ahead. Prefer to close everything each day? That’s fine too.

The HyroTrader crypto prop firm places trust in the trader’s judgment to manage positions at all times. This freedom is vital for crypto, where fortunes can change outside of Monday-Friday. HyroTrader recognizes that and imposes no arbitrary schedule on your trading. Many experienced crypto traders operate on their own rhythm – some are night owls, some trade weekends heavily – with HyroTrader, you don’t have to adjust your style to the firm; the firm accommodates you.

Transparent Profit Sharing & Account Growth

With HyroTrader, you start at a 70% profit split which is already a strong deal (you keep the majority of profits). But what’s great is how clearly they’ve structured the path to 80% and 90%. As you hit profit targets and gain more payouts, HyroTrader increases your share, rewarding loyalty and skill. Reaching a 90% split is achievable and not reserved only for the ultra-long-term traders.

The firm is essentially saying: prove you can make money consistently, and we’ll happily let you keep nearly all of it. They also foot the bill for any losses – like FTMO, if you have a losing month, it’s the firm’s capital at risk, not yours. This alignment (they profit when you profit) is healthy and motivating. Also, recall that after a certain number of profitable withdrawals (usually 3-5), HyroTrader can transition you to a live funded account with real capital.

At that stage, you’re not just trading a prop firm’s demo; you’re effectively managing part of their fund on a real exchange. This opens possibilities such as even larger capital allocations and perhaps custom arrangements if you become one of their star traders. It’s a level of trust and investment in the trader that goes beyond what most prop firms do.

FTMO, for comparison, keeps even their best traders on simulated accounts (they just pay out the profits). HyroTrader’s approach of graduating traders to live trading ensures the model is sustainable (they cover losses with real gains from the market) and gives traders the pride of trading real money in crypto markets.

Support and Community

As a dynamic company focused on crypto, HyroTrader has been building a community of like-minded traders. They offer 24/7 support channels (via Discord, Telegram, etc.) where you can get help or discuss strategies. There is also an educational aspect – HyroTrader provides resources and mentorship from seasoned crypto traders.

For example, if you’re struggling with risk management, you might find a mentor or fellow trader in the HyroTrader community to guide you. This kind of support ecosystem can be invaluable, especially when tackling the emotional and technical challenges of trading crypto with large sums.

FTMO has a great support team too and plenty of content (webinars, articles), but HyroTrader’s content is likely more crypto-centric and its community smaller and tighter-knit (at least at this stage). Depending on your preference, you might enjoy being part of a growing community of crypto prop traders where everyone is trading similar instruments and can share relevant tips.

In summary, HyroTrader distinguishes itself through real-time, real-world trading conditions, fast payouts, and a crypto-friendly rule set. It has effectively taken the prop firm concept and aligned it with what an advanced crypto trader would want. That makes HyroTrader a compelling choice if you feel constrained by the traditional offerings of FTMO.

Conclusion: Elevate Your Crypto Trading with the Right Prop Firm

FTMO has set a high standard in the prop trading industry and remains a great choice for many traders – but it’s not one-size-fits-all. If you’re primarily a crypto trader, you may feel that standard prop firms don’t fully understand or accommodate the nuances of trading digital assets. This is where HyroTrader enters the picture as the best FTMO alternative for crypto traders seeking funded accounts.

By directly comparing FTMO and HyroTrader, we’ve seen that while FTMO offers a solid foundation and reputation, HyroTrader provides distinct advantages for crypto trading: more trading freedom (24/7 access and no forced closures), a wider array of crypto instruments (from spot to futures and options on real exchanges), deeper leverage when you need it, and an ultra-flexible payout system that lets you enjoy your profits immediately.

HyroTrader essentially bridges the gap between the prop firm model and the realities of the crypto market. It retains what traders love about prop firms – access to significant capital and a generous profit split – and enhances what was lacking for crypto specialists – real-time market integration and greater freedom.

The result is a funded trading experience where you can truly unleash your crypto trading strategies without the usual constraints.

Whether you’re a high-octane day trader looking to scalp Bitcoin moves with 50x leverage, or a swing trader aiming to hold altcoin positions through a weekend surge, HyroTrader has you covered in ways FTMO might not. Moreover, HyroTrader’s commitment to mentorship and community means you’re not trading alone; you’re part of a growing network of crypto traders pushing the envelope together.

In choosing a funded trading firm, consider your own needs and pain points. If you’ve felt limited by FTMO’s crypto rules or wished for faster withdrawals, it’s a strong sign to explore alternatives like HyroTrader. On the other hand, if you value a long track record and plan to trade multi-asset (not just crypto), you might maintain an FTMO account while adding a HyroTrader account for your crypto-specific strategies – many seasoned traders use multiple prop firms to diversify.

Ultimately, the goal is to find a platform that lets your trading talent shine. For crypto traders hungry for big capital and true market access, HyroTrader offers a refreshing, trader-friendly approach. It’s an opportunity to grow your trading career: you focus on capturing those crypto market opportunities, and let the prop firm handle the capital and risk. As the crypto market continues to evolve, having a prop firm partner like HyroTrader in your corner can be a strategic edge.

Ready to take your crypto trading to the next level?

If the idea of instant payouts, real exchange trading, and a possible $1M funded crypto account excites you, it might be time to give HyroTrader a try. While FTMO opened the door for funded trading, HyroTrader is carving a new path through that door – one that is specifically paved for crypto traders’ success.

Embrace the tools and capital available, do your due diligence with the factors we discussed, and you’ll be well on your way to finding the perfect prop trading firm for your needs. In the fast-paced world of crypto, the right partnership can make all the difference.

Explore what HyroTrader has to offer, and you could be the next crypto prop trading success story.