Experienced cryptocurrency traders understand that having significant trading capital and the right platform can amplify their success in the volatile 24/7 crypto market. Proprietary trading firms have opened new avenues for these traders by providing funded accounts, but finding the best prop firm for crypto trading can be challenging.

Not all prop firms are created equal, especially when it comes to accommodating the unique needs of crypto traders. In this comprehensive guide, we delve into the key features that top crypto prop firms offer, compare some well-known firms like FTMO, FundedNext, and HyroTrader.

Key Features of an Ideal Crypto Prop Trading Firm

When evaluating crypto-focused proprietary trading firms, experienced traders tend to look for specific features that will support their strategies. The best prop firm for crypto trading should combine excellent financial incentives with robust technology and support. Here are the key features to consider:

Generous Profit Splits and Rewards

One of the biggest draws of a prop firm is the profit split – the percentage of trading profits the firm pays out to the trader. Top firms offer high profit splits so traders are well-rewarded for their skills. Ideally, a crypto prop firm should offer profit splits in the range of 70% or higher, allowing traders to keep the majority of their earnings.

For example, a firm might start traders at a 70% profit share and increase it as they prove consistent profitability. High profit splits ensure that your hard work and successful trades translate into substantial personal profit.

Equally important is the payout structure. The best firms provide flexible and frequent payouts with minimal waiting time. Unlike traditional arrangements that pay out monthly or on fixed schedules, a crypto-focused firm might allow withdrawals as soon as certain profit thresholds are met.

This is especially valuable in crypto trading, where profits can accumulate quickly during favorable market conditions. Fast payouts (in crypto or stablecoins) mean traders can reinvest or enjoy their earnings without long delays. In short, a top crypto prop firm will let you keep a large share of your profits and access those funds quickly.

Advanced Trading Platforms & Crypto Market Access

Experienced crypto traders often use advanced platforms and need access to a wide range of digital assets. An ideal crypto prop firm will support professional-grade trading platforms that are reliable, fast, and feature-rich. This includes offering connections to major crypto exchanges or trading interfaces that handle cryptocurrency instruments seamlessly.

For instance, many traders prefer platforms like MetaTrader, cTrader, or direct exchange platforms for crypto futures and spot trading. A firm that integrates with leading crypto exchanges (or provides equivalent infrastructure) allows traders to execute strategies on real market data with minimal latency.

Crypto market access is another crucial aspect. The firm should offer a broad selection of cryptocurrency pairs and derivatives (such as BTC, ETH and altcoin pairs, perpetual futures, etc.), not just forex or stocks. The ability to trade crypto 24/7 with live pricing is essential – crypto markets don’t close, and neither should the platform access.

In summary, the best crypto prop firms give traders cutting-edge tools and unrestricted access to trade digital assets just as they would on a traditional exchange.

Account Scaling Opportunities

Professional traders aren’t just looking for a one-time funded account; they want the opportunity to grow that account over time. Leading prop firms have account scaling programs that increase the trader’s capital if they perform well. In an ideal scenario, a trader who consistently hits profit targets and manages risk over a period (e.g. a few months) should be rewarded with a larger account allocation. For crypto prop trading, this might mean starting with, say, a $50,000 account and scaling it to $100,000, $200,000 or more over time.

Look for firms that outline clear scaling rules – for example, a plan to boost your account by a certain percentage (like 25%) every quarter that you meet specific profit and drawdown criteria.

The most ambitious firms allow cumulative scaling up to a defined cap, which could be six or seven figures. A strong scaling plan shows that the firm is invested in long-term partnerships with traders, not just short-term fees. It also means you, as a trader, can dream bigger – potentially managing a very large crypto portfolio if you continue to trade profitably.

Responsive Customer Support and Guidance

In fast-moving crypto markets, issues need to be resolved quickly. Top prop firms back their trading programs with responsive customer support, ideally 24/7, to assist traders in any situation. Whether it’s a technical glitch on a platform, a question about rules, or a payout inquiry, prompt and knowledgeable support is invaluable.

The best firms provide multiple channels of support, such as live chat and email, with staff who understand trading. For crypto traders who might be trading at odd hours (given the market runs around the clock), having support available at any time is a major plus.

Beyond basic customer service, leading firms often foster a community and provide educational resources. This might include trader chat rooms or Discord groups, webinars, or one-on-one mentorship for funded traders. Such resources help traders continue learning and feel supported, which can improve their performance.

A prop firm that actively wants you to succeed – evident through supportive communication and perhaps coaching or lenient evaluation rules – stands out from those that are indifferent. In summary, an ideal crypto prop firm is not just a funding source but a partner in your trading journey, offering help and guidance when needed.

(Now that we’ve outlined what to look for, let’s briefly examine some of the well-known prop trading firms that offer crypto trading, and see how they stack up.)

Popular Prop Trading Firms Offering Crypto

Over the past few years, several proprietary trading firms have gained popularity among retail traders. Many of these firms started in forex or stock trading and have since extended their offerings to include cryptocurrencies. Three notable names often mentioned are FTMO and FundedNext. Each has its own model and reputation. Let’s take a brief look at these firms and their crypto prop trading features, before comparing them to HyroTrader.

FTMO

FTMO is an established prop trading firms, known for its two-step evaluation challenge. It has a strong reputation among forex traders and offers accounts up to hundreds of thousands of dollars. FTMO does allow trading in cryptocurrencies (typically as CFD instruments on their platforms), and it offers a generous profit split once you’re funded.

Traders with FTMO keep up to 80% of their profits by default, and this can increase to 90/10 with consistent performance and scaling. This profit share is competitive, reflecting FTMO’s trader-friendly approach to payouts.

However, crypto-focused traders might find a few limitations. FTMO’s primary focus is still on forex, indices, and commodities, and the trading conditions for crypto can be restrictive.

For instance, FTMO historically imposed lower leverage or special rules for crypto trades. In some cases, the leverage for cryptocurrencies on FTMO accounts is significantly reduced (even as low as 1:1 on certain account types), which means you cannot take large crypto positions relative to account size.

Additionally, FTMO’s evaluations and funded accounts are done on demo servers with simulated trading conditions. While FTMO is a reliable firm with a proven payout record, its setup isn’t tailored exclusively to the nuances of 24/7 crypto trading (e.g., standard FTMO accounts have restrictions on holding trades over weekends or during major news).

In short, FTMO is a good prop firm overall and does include crypto trading, but it treats crypto as an add-on market rather than a core specialty. Crypto traders using FTMO will get good profit splits and a platform (MT4/MT5 or cTrader), but they may not experience the same level of flexibility (in leverage or trading conditions) that a crypto-specific prop firm could provide.

FundedNext

FundedNext is a newer prop firm that launched with some innovative twists in its funding programs. It offers two main models: an Evaluation model and an Express (instant funding) model. FundedNext has made a name by advertising profit splits up to 90% or even 95% in certain cases, which is among the highest in the industry.

Notably, FundedNext even offers a small profit share during the challenge phase (around 15% of profits) as a bonus for traders, which is uncommon. This shows a commitment to rewarding traders early. Crypto trading is allowed on FundedNext’s platforms (they support MT4/MT5 with crypto CFD instruments), meaning traders can take crypto positions as part of their account.

For crypto traders, FundedNext’s conditions are similar to other multi-asset firms. They have some leverage options for crypto (though not extremely high), and their account rules are relatively flexible (e.g., no strict daily drawdown on one of their account types, and no time limit in some cases).

One thing to note is that FundedNext’s Express model (which skips the evaluation for a lower profit split initially) might attract crypto traders who want immediate funded capital; however, in that model, the starting profit split can be lower (around 60%) and then increases to 90% after a few payout cycles. This step-up structure rewards longevity, but initially, traders keep a smaller share.

Overall, FundedNext is quite prop-trader-friendly with high potential profit splits and a willingness to accommodate crypto trading. Yet, like FTMO, it is not exclusively crypto-focused.

The trading environment is via MetaTrader with price feeds that may not exactly mirror a specific crypto exchange order book. For an experienced crypto specialist, FundedNext provides a solid option with great financial terms, but one might still crave a more direct crypto trading experience (for example, trading on an actual crypto exchange interface or having payouts directly in crypto without conversion).

However, these firms were built with a broad focus (mainly forex trading) and have added crypto as part of a larger instrument lineup. They may not provide the dedicated crypto trading ecosystem – such as direct exchange connectivity or crypto-specific features – that a specialized firm might offer. This is where HyroTrader comes into play.

(Next, we will explore HyroTrader in detail, to see how it caters specifically to crypto traders and why it has an edge in the crypto prop trading arena.)

Why HyroTrader Stands Out as the Best Prop Firm for Crypto Traders

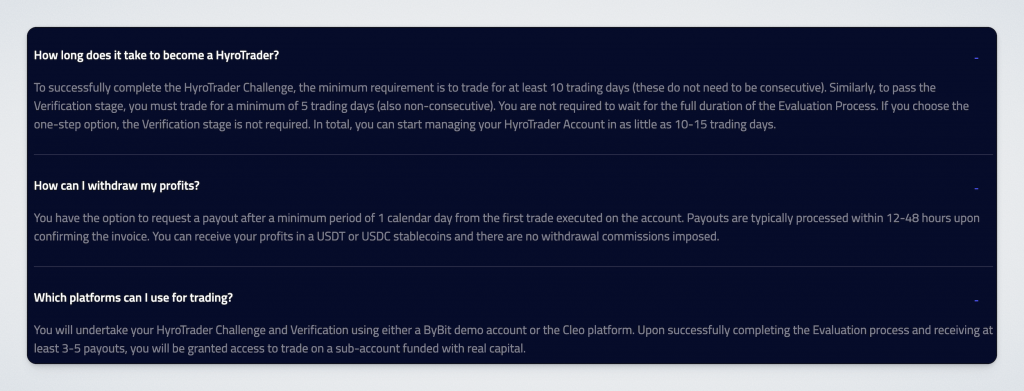

Among the options available, HyroTrader has quickly emerged as a top choice for cryptocurrency-focused prop traders. Founded in 2023, HyroTrader was created exclusively for crypto trading, setting it apart from older firms that primarily centered on other markets.

HyroTrader’s entire model – from technology to payout mechanisms – is designed with the crypto trader in mind. It blends all the ideal features discussed earlier, and adds unique advantages that directly address the pain points crypto traders often face at prop firms.

Unlike many competitors that operate on simulated broker feeds or white-label platforms with limited liquidity, HyroTrader allows clients to trade on real crypto exchanges with deep liquidity and transparent conditions.

This means when you trade with HyroTrader, you’re tapping into actual market prices and order books (for example, via ByBit or Binance data) rather than a potentially laggy or manipulated simulation. The result is a trading experience that feels authentic and fair – crucial for veteran crypto traders who know the differences in execution can be significant.

Let’s break down HyroTrader’s key strengths and see why it’s considered by many as the best crypto prop firm for crypto trading:

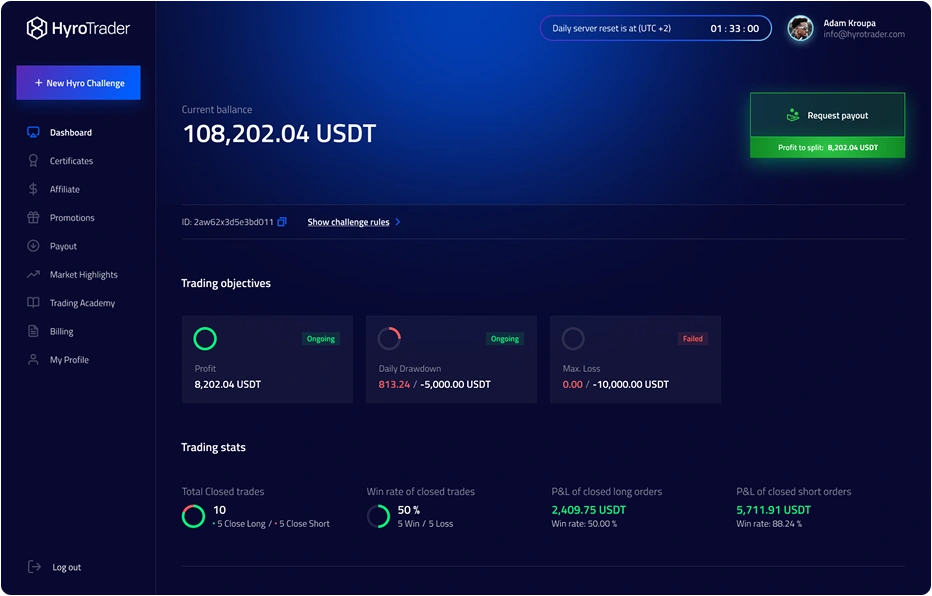

High Profit Splits Up to 90%

HyroTrader offers one of the most attractive profit-sharing schemes in the industry, enabling traders to keep the lion’s share of their gains. Traders start with a 70% profit split, meaning you retain 70% of the profits you earn while the firm takes 30%. This in itself meets the high standard set by top firms.

However, HyroTrader doesn’t stop there – it features a dynamic system to scale your profit split up to 90% as you demonstrate consistency. In practice, this could mean your profit share increases in steps (for example, rising by a few percent after each successful month or milestone) until you reach a 90/10 split in your favor. A 90% profit split is essentially allowing you to keep almost all of your profits, which is a huge benefit for traders once they reach that level.

What’s equally impressive is how quickly you can capitalize on those profits.

HyroTrader supports daily profit payouts, setting it apart from many firms that have bi-weekly or monthly payout cycles. You can request a payout as soon as you’ve achieved at least $100 in profit, as long as you’ve adhered to the trading rules.

There’s no need to wait for the end of the month – if you had a great trading day and locked in significant gains, you can withdraw your share immediately. Payouts are processed in popular stablecoins (USDT or USDC) within roughly 12-24 hours, so crypto traders get their money fast and in a crypto-native form. This rapid payout system is a major plus for those who want liquidity or wish to compound their earnings quickly.

By combining a high ceiling on profit splits with ultra-fast payouts, HyroTrader ensures that traders feel directly rewarded for every win. The firm even refunds your challenge fee with your first payout as an extra perk, effectively eliminating the cost of joining once you’re profitable.

These policies reflect a trader-centric approach: you’re not just earning monopoly money on a demo, you’re actually pocketing substantial amounts of your crypto profits almost in real-time. For a serious crypto trader, that financial incentive and immediacy can be very motivating.

Trading on Leading Crypto Exchanges (Real Market Connectivity)

HyroTrader’s platform offering is tailor-made for crypto enthusiasts. When you trade through HyroTrader, you are trading on renowned crypto exchanges or exchange-grade platforms, rather than a traditional CFD broker setup.

In fact, HyroTrader currently provides access to ByBit and CLEO, and has integration with Binance data, with plans to add OKX and support for the top 10 crypto exchanges in the near future. This is significant because it means as a funded trader you can execute orders in an environment virtually identical to what you would use as an independent crypto trader.

ByBit

ByBit is a major crypto derivatives exchange known for its user-friendly interface and deep liquidity in perpetual futures. Through HyroTrader, you can trade USDT-margined perpetual contracts on ByBit, benefitting from the exchange’s fast matching engine and robust infrastructure.

ByBit’s popularity among crypto traders means you likely already trust its tools and charting – HyroTrader lets you continue using those familiar tools while trading the firm’s capital.

CLEO

CLEO is a professional trading platform that leverages Binance’s price feed for an institutional-grade experience. It offers advanced features like sophisticated backtesting, custom drawing tools, multiple stop-loss and take-profit options, and detailed performance analytics.

Essentially, CLEO provides an edge for traders who want to fine-tune their strategy with high-end tools. HyroTrader’s choice to include CLEO indicates their focus on giving traders every advantage in terms of technology.

Real Exchange Accounts

The key difference with HyroTrader is that the trading isn’t happening on a isolated demo account that only simulates trades internally.

We emphasize real exchange connectivity, meaning trades are executed with real market liquidity and there are no price manipulations or artificial spikes (“no trading wicks”) that sometimes plague less transparent prop setups.

One of HyroTrader’s testimonials even highlights this uniqueness, with a funded trader noting they haven’t seen any other prop firm that provides an actual exchange account for trading.

This transparency builds trust – you can even connect your own personal exchange accounts to monitor or replicate your trades if you wish, reinforcing that what you see is what you get.

No Restrictions on Crypto Trading

Because HyroTrader is crypto-exclusive, it doesn’t impose some of the common restrictions that multi-asset prop firms might. Crypto trading on HyroTrader is available 24/7 (since crypto markets never close), and you can hold positions as long as you want, even over weekends or through major market events.

There are no forced flat periods unless they are inherent to the exchange (which in crypto, they typically aren’t). This freedom is crucial for crypto strategies like swing trading or arbitrage that might require holding assets for days or weeks.

In summary, HyroTrader equips you with direct access to world-class crypto trading venues and tools. You’re essentially trading under crypto prop firm terms (using their capital, sharing profits) but on the same playing field as if you were a regular ByBit or Binance trader.

For experienced crypto traders, this is a dream setup: you don’t have to adjust to a new, possibly inferior platform or worry about whether the prop firm’s data is reliable. HyroTrader’s approach ensures a seamless trading experience that leverages the best of the crypto exchange world.

Scalable Accounts Up to $1,000,000

HyroTrader is built for traders with long-term ambitions. It offers a clear and rewarding account scaling plan that can take a successful trader’s account to very high levels.

Upon getting funded, traders who consistently profit have the opportunity to increase their account size in stages. HyroTrader’s scaling program operates on a four-month cycle: after every 4 months of profitable trading, you can request a scale-up.

If you met the performance benchmarks (which include achieving at least 20% total profit over those months and having at least two profitable months out of four), your account balance will be boosted by 25%.

Consider an example: you start with a $100,000 funded account. If you trade consistently well for four months, your account could be increased to $125,000. Four months later, it could rise to roughly $156,000, and so on.

HyroTrader allows this compounding growth up to 10 times the initial account size, with an upper limit of $1 million USDT per trader.

In other words, a trader who starts at $100k could potentially reach a million-dollar account after several successful scaling cycles. Even someone starting smaller – say $20k – could grow that to $200k given enough time and consistent performance.

What makes HyroTrader’s scaling especially appealing is that your profit split remains high as you scale. Many firms might give you more capital but at a cost of reducing your percentage.

HyroTrader maintains that you can keep up to 90% of profits even at the larger account sizes, which means your earning potential grows exponentially. Furthermore, they continue to provide up to 1:100 leverage on the larger accounts, so you’re not forced to trade smaller size relative to capital – you truly get the benefit of a bigger account when it scales.

This focus on scaling indicates HyroTrader’s commitment to being a long-term partner. They want their traders to graduate to managing seven-figure accounts, which ultimately is a win-win (traders earn more, and the firm’s share of profits also grows in absolute terms).

For experienced crypto traders, the possibility of handling $1M in trading capital is a huge opportunity – it could allow strategies that require larger position sizes to be executed, or enable participation in bigger market moves without being limited by account size. HyroTrader’s reliable and structured path to that level sets it apart from firms that might cap your growth. It essentially means with HyroTrader, your “ceiling” as a trader is much higher.

Lightning-Fast Payouts and Funding Process

In the world of trading, getting your profits out quickly can be just as important as earning them. HyroTrader understands this, which is why it has one of the fastest payout systems available.

As mentioned earlier, traders can request payouts as frequently as daily, and these withdrawals are processed in as little as 12 to 24 hours. This speed is not common among prop firms – many competitors have set payout days (often monthly) or require waiting periods after a request.

HyroTrader paying in stablecoins (USDT/USDC) is another benefit for crypto traders, since it means you receive your funds directly in a crypto format that you can easily trade or convert further. There’s no need to deal with bank wires or payment processors, which can take days or incur fees; everything stays within the crypto ecosystem for efficiency.

Another aspect to highlight is HyroTrader’s evaluation and funding process itself. They offer a trading challenge (evaluation phase) like most prop firms, but with a few crypto-friendly twists.

You start on a demo account to prove your skills, aiming for a profit target (15% profit, according to their rules) without breaking drawdown rules. During this phase, you already operate under the profit split system (70% to you) – meaning if you are profitable in the demo phase, you can actually earn money from those profits as a bonus.

This is relatively unique; most firms don’t share profits on demo trades. It shows HyroTrader’s philosophy of treating traders as partners from the get-go.

Once you pass the challenge, you’re moved to a funded account with real capital. Because of the real exchange connectivity, this transition is smooth – it’s like moving from simulation to live on the same platforms. From there, the fast payouts kick in, and your challenge fee is refunded with your first withdrawal.

Traders have noted that HyroTrader’s team is quite prompt in handling payout requests and any account updates, reflecting well on their operational efficiency. Visit testimonials page for more.

In essence, HyroTrader ensures that the road from signing up to actually making money in your pocket is as short and straightforward as possible. There are minimal bureaucratic delays, and the policies are set to favor the trader earning (refund of fees, profit share even during evaluation, immediate withdrawals).

This is a breath of fresh air for traders who may have experienced slow support or delayed payouts elsewhere. When you trade with HyroTrader, you can focus on trading strategy, knowing that the backend processes are taken care of and your profits are truly yours to withdraw at any time.

Conclusion: Elevate Your Crypto Trading with the Right Prop Firm

The world of crypto trading offers immense opportunity for those with the skill and discipline to navigate its waters. Proprietary trading firms have become key players in empowering traders, by providing capital and a structured environment to operate in.

As we’ve discussed, the best prop firm for crypto traders will offer high profit splits, excellent platforms, room for growth, and dependable support.

While established firms like FTMO and FundedNext have extended their models to include crypto trading, a specialized firm like HyroTrader can provide a more tailored edge for dedicated crypto traders.

HyroTrader combines everything an experienced crypto trader could ask for in a prop firm: a crypto-first approach with real exchange trading, earnings that heavily favor the trader (up to 90% profit share), rapid scaling to dream account sizes, and practically instantaneous payouts in cryptocurrency.

Importantly, it fosters a professional yet trader-friendly culture, as evidenced by its community of successful traders and positive testimonials. The advantages that HyroTrader offers – from daily profit payouts to multi-platform access – can significantly enhance a trader’s ability to capitalize on market opportunities without being hindered by the typical prop firm limitations.

For seasoned traders who have honed their strategies, the question is often how to amplify results. This is exactly where a firm like HyroTrader can become a game-changer. By providing substantial capital and a conducive trading environment, HyroTrader lets you focus on what you do best: trading the crypto markets. The firm’s success stories show that when the partnership between trader and prop firm is strong, the sky is the limit in terms of what can be achieved.

In choosing a prop firm, it’s crucial to align with one that matches your trading style and goals. If you are primarily a crypto trader, it makes sense to go with a firm that lives and breathes crypto. HyroTrader’s crypto-centric model means every aspect of the service is designed for assets like Bitcoin, Ethereum, and beyond – no compromises needed. This focus could very well give you the edge over traders at other firms who might be dealing with less ideal conditions for crypto.

In conclusion, HyroTrader stands out as a leading contender for the title of best prop firm for crypto traders. It offers a compelling blend of high rewards, cutting-edge trading access, and supportive management that experienced traders will appreciate.

If you’re looking to take your crypto trading career to new heights and need a prop firm that truly understands the crypto game, HyroTrader is certainly worth exploring. With the right skills and the right prop firm backing you, there’s no limit to how far your crypto trading journey can go.