Proprietary trading (prop trading) involves trading financial assets using a firm’s capital rather than your own. In the crypto market, known for its extreme volatility and 24/7 trading cycles, risk management becomes the lifeline of every successful prop trader.

Risk management is crucial because it protects traders from catastrophic losses in unpredictable markets. Crypto prop traders face wild price swings, sudden liquidity drops, and an ever-changing regulatory landscape. Without disciplined risk controls, even a skilled trader can quickly lose capital.

In this article, we’ll explore the importance of risk management in crypto prop trading, identify the various types of risks involved, and discuss essential strategies to mitigate those risks. Whether you’re an aspiring funded trader or an experienced crypto prop trader, understanding and implementing robust risk management practices is key to long-term success.

Types of Risks in Prop Trading

Proprietary trading involves various risks, including market risk, liquidity risk, operational risk, and regulatory risk. Let’s examine these risks individually and consider how a trader can enhance their risk management strategy.

Market Risk

Market risk is the danger of losses from adverse price movements. Crypto prices are infamous for extreme volatility, values can jump or crash by double digits within hours. A surprise news event or a large sell-off by a “whale” (big trader) can send prices tumbling. If the market moves sharply against your position, it can rapidly inflict heavy losses.

To mitigate market risk, use stop-loss orders to automatically cap your loss on each trade. Also, adjust your position size according to volatility: for very volatile coins, trade smaller sizes so a big swing doesn’t blow up your account. Finally, consider spreading your trades across multiple cryptocurrencies (don’t bet everything on one asset) so that no single price move can wreck your portfolio.

Liquidity Risk

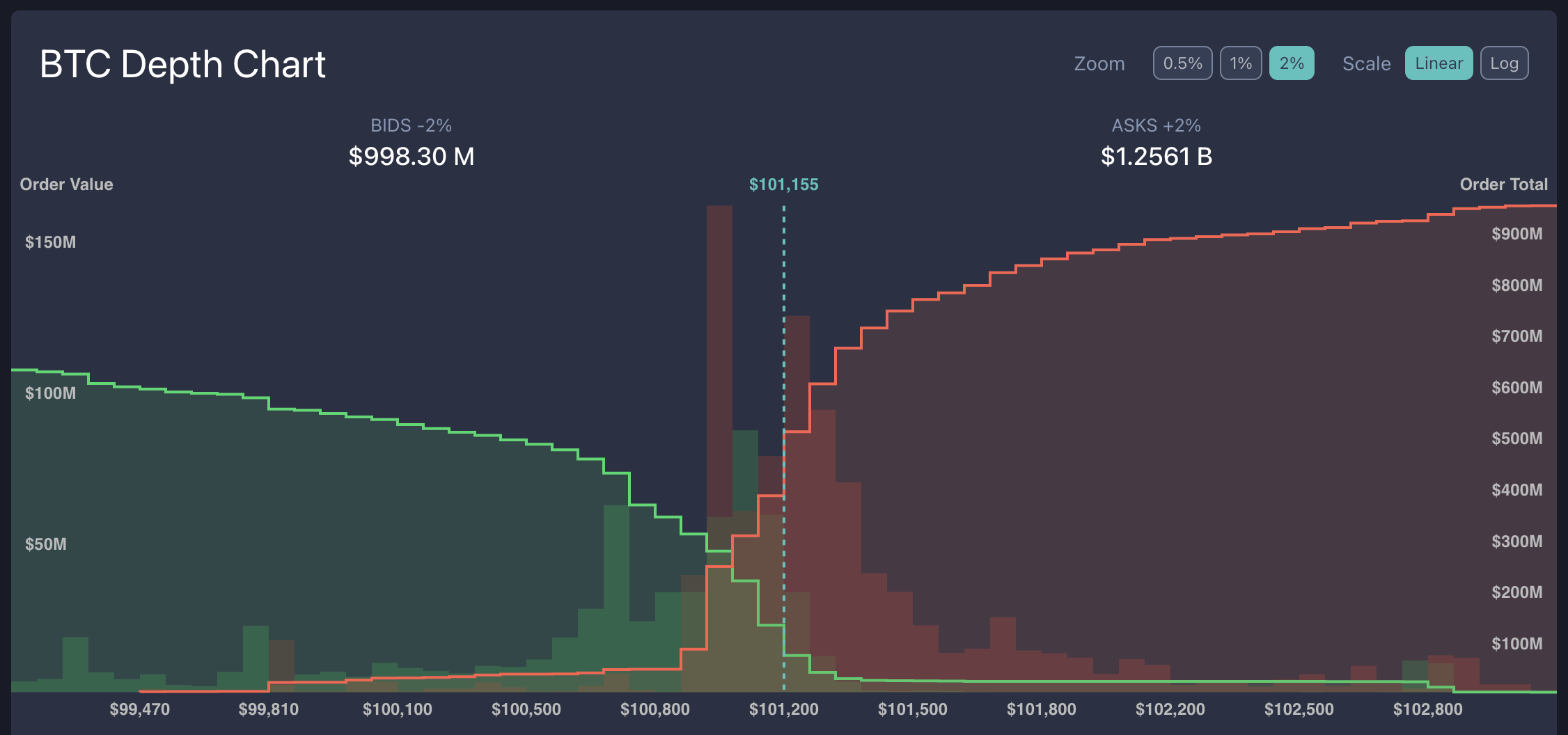

Liquidity risk refers to the risk that you can’t execute trades at the expected price due to thin market volume. Some smaller altcoins or trading pairs have low liquidity, so a large order might not find a buyer or seller at the current price, leading to slippage (your order fills at a worse price than anticipated). This makes it hard to enter or exit big positions without moving the market or incurring extra cost.

To avoid liquidity issues, stick to high-volume coins and exchanges. If you must trade a low-liquidity asset, consider breaking up large orders into smaller chunks or use limit orders to control the price you get. Always check the order book depth and bid-ask spread before trading; a wide spread or shallow order book is a warning sign. By focusing on liquid markets, you ensure your trades can be executed more smoothly at intended prices.

Operational Risk

Operational risk involves the potential for losses from system failures or human mistakes. In crypto trading, your exchange or API could go down at the worst time, a trading algorithm might malfunction, or a simple typo could lead to an unintended large trade. Additionally, cybersecurity threats like hacks or phishing attacks are operational risks in the crypto world.

To mitigate operational risk, use reliable technology and have backups. Maintain a stable internet connection and consider a backup (such as a mobile hotspot or a second exchange account) in case your primary platform fails. Always double-check order details before confirming a trade to avoid costly errors. On the security side, enable two-factor authentication (2FA) on your accounts and keep your software updated to guard against hacks. By anticipating technical issues and having contingency plans, you can prevent a glitch or mistake from derailing your trading.

Regulatory Risk

Regulatory risk is the uncertainty and potential loss from changes in laws governing crypto trading. The crypto industry is evolving, and new rules can appear with little warning. For example, a government might ban crypto derivatives trading or impose strict licensing requirements that affect how and what you can trade. Even the announcement of a regulatory crackdown can cause market volatility or restrict access to certain exchanges.

To manage regulatory risk, stay informed and compliant. Keep tabs on legal developments in the countries where you and your exchanges operate. Use reputable trading platforms like HyroTrader that follow KYC/AML regulations to reduce the chance of sudden disruptions to your account. The key is flexibility: be ready to adjust your trading approach if the rules change. Being proactive, like having alternative exchanges or tradeable assets in mind, can help you continue trading in the face of regulatory shifts.

Essential Risk Management Strategies

In crypto prop trading, certain risk management strategies are essential. These include diversification, position sizing, stop-loss and take-profit limits, hedging, and careful planning. Let’s take a closer look at each of these.

Diversification

Diversification means spreading your trades across different assets or strategies to reduce reliance on any single one. In crypto prop trading, this often means trading multiple cryptocurrency pairs instead of just one. If one asset plunges due to bad news, others in your portfolio might be stable or even rise, which helps offset the loss. In practice, don’t put all your capital into a single coin or trade. By diversifying (across different coins or even different trading strategies), you reduce the impact of one trade or one asset on your overall performance. It’s the classic advice: don’t put all your eggs in one basket.

Position Sizing and Leverage Control

Deciding your trade size is at the heart of risk management. With proper position sizing, you limit each trade’s potential loss to a small percentage of your capital. Many prop traders risk no more than 1-2% of their account on a single trade. This way, even if you hit a string of losses, your account survives.

Leverage magnifies both gains and losses, so it must be used carefully. Crypto exchanges might offer very high leverage, but remember that high leverage can wipe you out on even a small market move. The idea is to size your leveraged positions such that if the trade goes wrong, you still only lose that 1-2% of your capital. By keeping trade sizes reasonable and not maxing out leverage, you ensure that no single trade can blow up your account or violate your firm’s risk rules.

Stop-Loss and Take-Profit Strategies

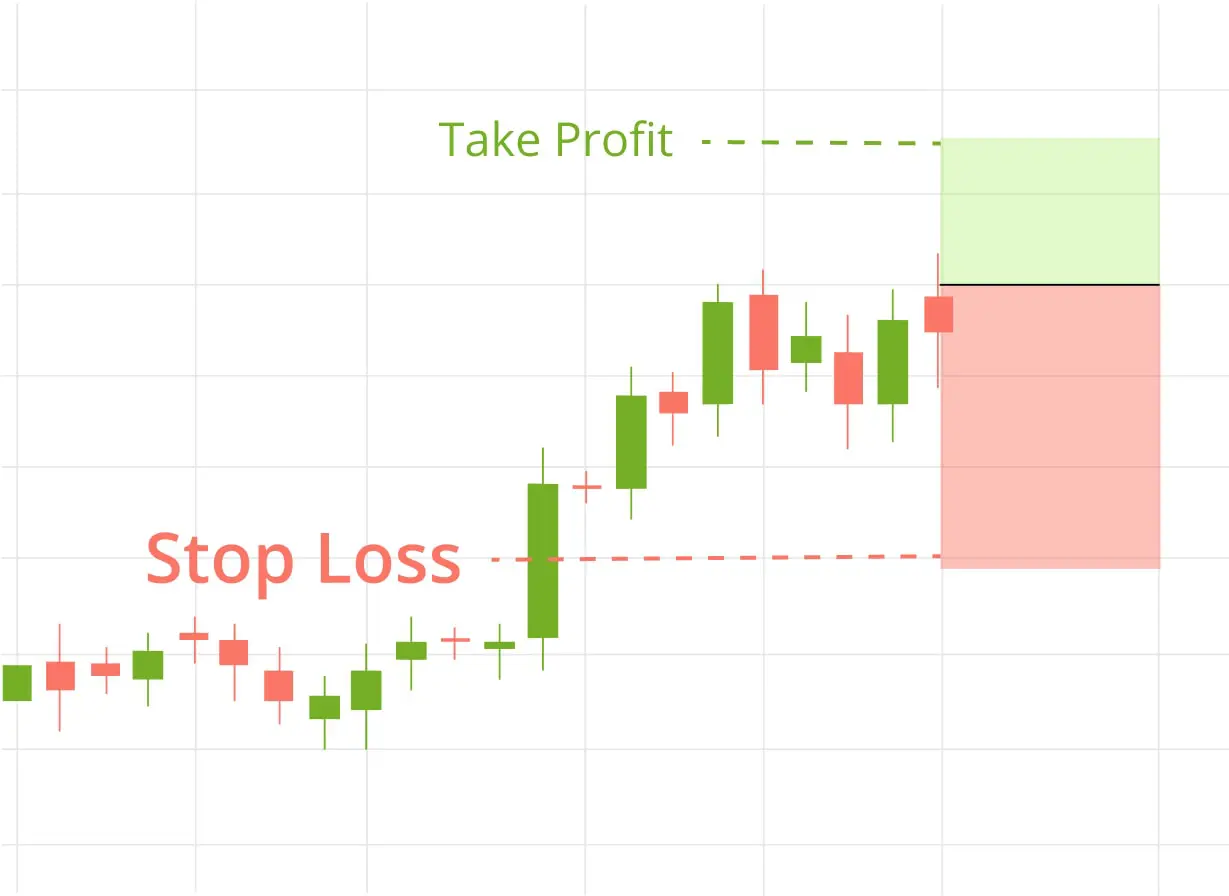

Using stop-loss and take-profit orders is a straightforward way to enforce risk limits on every trade. A stop-loss order automatically closes your position if the price hits a certain level against you, capping the loss. A take-profit order does the opposite: it closes the trade once a target profit level is reached. These tools remove emotion by presetting your exit points for both worst-case and best-case scenarios.

For example, say you buy Ethereum at $1,800. You might place a stop-loss at $1,700 (to risk roughly 6%) and a take-profit at $2,100 (to aim for about a 16% gain). If the price falls to $1,700, the stop-loss triggers and limits your loss. If the price rises to $2,100, the take-profit secures your profit. By planning these exits in advance, you avoid the emotional rollercoaster of making decisions on the fly. Consistently using stop-losses protects your capital from unexpected market swings, and take-profits help ensure you actually lock in gains before the market can reverse.

Risk-Reward Ratio and Trade Planning

Before entering a trade, ensure the potential reward outweighs the risk. Many prop traders won’t take a position unless the possible profit is at least 2-3 times greater than the potential loss (a 1:2 or 1:3 risk-reward ratio). With such a cushion, you can win only half your trades (or even less) and still be profitable overall.

Equally important is going in with a trade plan. Decide on your entry, stop-loss, and take-profit levels ahead of time, and maybe even note down why you’re taking the trade. This preparation acts as a checklist and helps remove spur-of-the-moment decisions. Once the trade is live, stick to your plan. A well-defined plan with a good risk-reward ratio keeps you disciplined and prevents emotions from taking over (for example, it stops you from moving your stop-loss further out in hope of a reversal, or from taking profit too early out of fear).

Hedging Strategies

Sometimes the best way to manage risk is to take an offsetting position, known as hedging. Hedging aims to reduce the impact of an adverse move on your main trade. One common method is shorting: if you hold a cryptocurrency long (expecting it to rise) but worry about a potential drop, you could open a short position on that same coin (or a closely related asset). If the price falls, the gains from the short help offset the losses on your long position.

Another way to hedge in crypto is by using stablecoins. For example, during times of high uncertainty, you might convert some of your holdings into a stablecoin like USDT, which won’t fluctuate if the market crashes. The goal of any hedge is to limit losses on your primary position, providing a safety net during extreme market moves.

Risk Management Example for Crypto Prop Traders

When it comes to successfully passing Crypto prop challenges, an effective risk management strategy is crucial. Finding the right balance between risking too little and too much is key. Both extremes have their downsides; risking too little may result in prolonged evaluation phases while risking too much can lead to blowing through challenges quickly and struggling with the emotional aspects of trading.

Therefore, you can employ a dynamic risk management approach that combines the strengths of both methods. The specific risk management protocols may vary within different phases of the funded account, typically consisting of two evaluation phases and the funding stage upon successful completion of both.

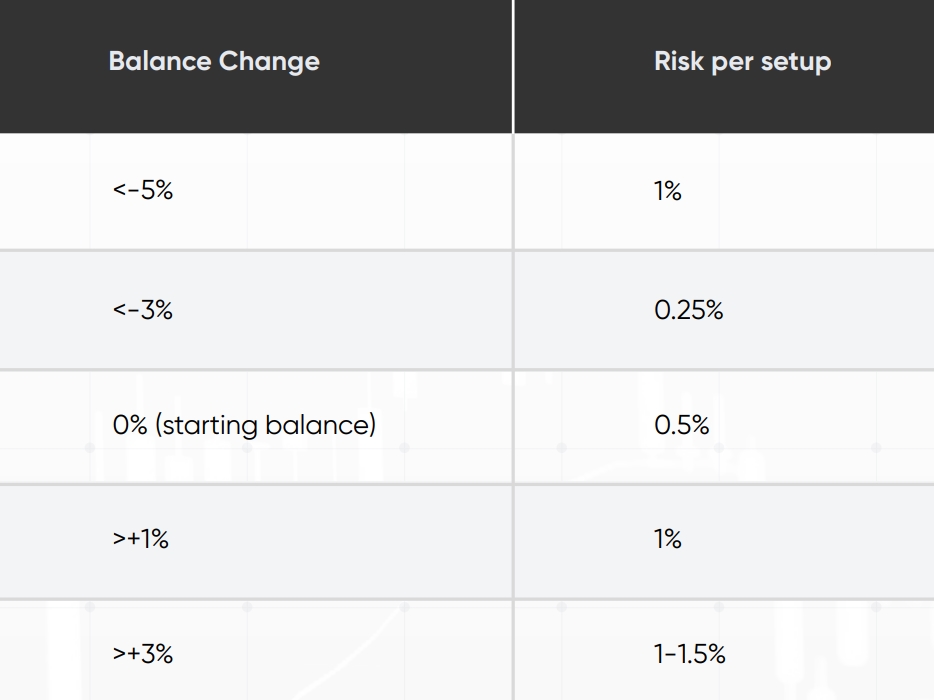

The 1st Challenge Phase:

In this phase, where a 10% profit target is required for quick progress, you can adopt an aggressive risk management approach. For example you can use the following dynamic risk management.

You might wonder why the risk per trade increases to 1% even when the drawdown exceeds 5%. This is to minimize time opportunity costs. Rather than slowly trading out of drawdown, you can prefer to increase risk and attempt to either break even quickly or accept the possibility of losing the challenge.

If you can not afford to lose a challenge, sticking to lower risk like 0.25% per setup until the account returns to break even might be a better option.

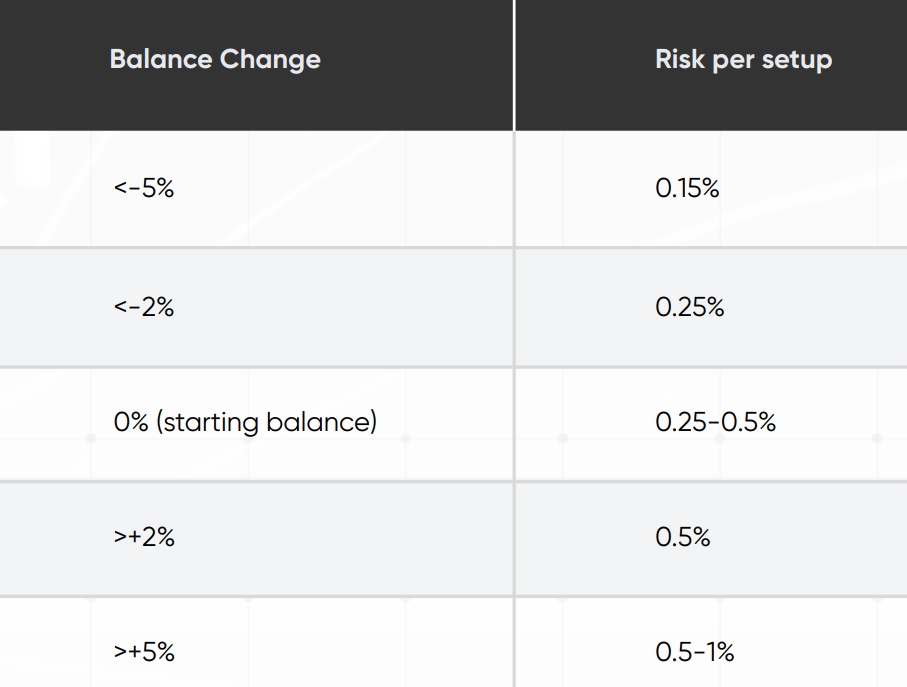

The 2nd Evaluation Phase – Verification

Once phase 1 is completed, and a lower profit target is required, a less aggressive risk management approach is employed:

We aim to keep our time-based opportunity costs relatively low in the 2nd evaluation phase. Losing the 2nd phase account would mean having to repeat the 1st phase, which is why we adopt a more cautious approach and strive to minimize potential drawdown.

Risk is only increased when we have a cushion of at least +2%. If the drawdown falls below -2%, we maintain a risk of a quarter percent until the drawdown is fully recovered and back above the -2% threshold. This approach is designed to create a balance between preserving capital and meeting the objectives of the 2nd evaluation phase.

The Crypto Funded Account:

In the funded account, where both phases have been passed, preserving the account becomes the top priority, followed by receiving the first pay-out and refund of the signup fee. Funded accounts should be approached conservatively, and the risk management protocol is adjusted as follows:

Lowering the risk per setup as the drawdown increases serves as a protective measure to prevent breaching the maximum drawdown rule. This approach may result in a longer process of trading out of drawdown, but it is a more favourable alternative to losing the account altogether.

It is crucial to ensure you have some funded accounts on the side or engage in different setups on separate accounts. For instance, you might allocate one account for swing trades and another for day trades. This diversification is just one example; there are various possibilities to explore.

Maintaining a consistent approach is vital. Using the same risk and the same trades across all accounts can lead to synchronized drawdowns, which can be risky. Your objective should always be consistency, not only in your trading performance but also in the frequency of your pay-outs. Therefore, having accounts that do not experience the same drawdown as the others is essential for receiving regular pay-outs. Think of it as ensuring you have enough “bullets” to keep trading effectively and managing risk across your various accounts.

Best Practices for Risk Monitoring and Control

In prop trading, conditions change fast, so it’s vital to monitor your risk in real time. Use trading dashboards and set alerts so you always know your open positions, current P/L, and how close you are to any risk limits. For example, you can configure an alert if a trade goes beyond a certain loss threshold or if your daily drawdown approaches a set limit. By keeping an eye on these metrics tick-by-tick, you can react quickly, adjusting or exiting trades before a small dip becomes a heavy loss.

Stress Testing and Scenario Analysis

Prepare for the worst by doing stress tests on your strategy. Basically, imagine extreme scenarios and how you’d handle them. For instance, what if the crypto market drops 20% overnight? Would your stop-losses trigger and how much could you lose? What if liquidity dries up suddenly? Could you still exit your positions without huge slippage? By regularly asking such “what if” questions (and even testing your plan against historical crashes), you can spot weaknesses in your risk approach. The goal is to be prepared. If a real crisis hits, you won’t be caught off guard because you’ll already have a game plan in mind.

Psychological Risk Management

Emotional discipline is often the deciding factor in effective risk management. Greed can tempt you to take on too much risk or deviate from your strategy, while fear can make you exit trades too early or avoid taking valid opportunities. Especially in prop trading, where you might feel pressure to perform with the firm’s capital, managing these emotions is crucial.

Some tips to keep a level head:

- Stick to your plan: Trust the trading plan and risk limits you set beforehand. Don’t change your strategy on the fly due to a gut feeling or excitement.

- Take breathers: After a big loss or a big win, take a short break. Strong emotions from a significant trade can cloud your judgment on the next one. Stepping away for a few minutes helps you reset.

- Set loss limits: Decide in advance how much you can lose in a day (or in a series of trades) before you will stop trading for a bit. For example, you might set a rule: “If I’m down 5% in a day, I’ll quit trading for the rest of the day.” Hitting that limit is a signal to cool off and prevent revenge trading.

- Learn from experience: Keep a trading journal where you record each trade along with your emotions or mindset at the time. You might spot patterns, like getting overconfident after a hot streak or becoming overly cautious after a loss. Being aware of these tendencies helps you correct them.

Remember, maintaining emotional discipline is itself a risk management strategy. By controlling your mindset, you ensure that fear or greed don’t drive your decisions, your predefined strategy and rules do.

How much of my trading capital should I risk per trade?

Keep it small. Many traders risk about 1-2% of their capital on each trade. At that level, even if you lose several trades in a row, your account will survive.

Should I use a stop-loss on every trade?

Yes, almost always. A stop-loss defines your worst-case loss on a trade. In a wildly volatile crypto market, having that automatic exit prevents one bad trade from wiping you out.

How can I manage risk when trading with high leverage?

High leverage magnifies everything, gains and losses. To stay safe, use smaller position sizes than you normally would, set tight stop-losses (because even a tiny price move can be big with leverage), and always know your liquidation point (the price where the exchange will close your position). In short, use leverage very carefully and sparingly.

The Role of Prop Trading Firms in Risk Management

Prop trading firms set risk rules to protect their capital (and teach you discipline). For example, a firm might impose a 5% daily loss limit. If you hit that limit, they may freeze your trading for the day or automatically close positions to prevent further losses. While it can feel restrictive, these rules stop a bad day from turning into a total blow-up. By trading under such constraints, you learn to cut losses and respect risk limits like a pro.

Firms like HyroTrader also reward disciplined trading. HyroTrader, for instance, will increase your account size once you prove you can trade profitably while following rules over a period of time. This gives you an incentive to manage risk well, consistent, safe trading can literally boost the capital you have access to.

Additionally, prop firms provide high-quality tools: you trade on real exchanges with live market data, and often get access to a dashboard that tracks your performance (profit, loss, drawdown) in real time. In short, a good crypto prop firm isn’t just funding you; it provides a framework that keeps your risk in check, so you can focus on executing your strategy.

Conclusion

Crypto prop trading offers huge profit potential, but long-term success hinges on rigorous risk management. The crypto market’s wild swings, occasional liquidity issues, operational hiccups, and regulatory curveballs mean traders must stay vigilant. By applying strategies like controlled position sizing, stop-loss orders, diversification, and hedging, and by continuously monitoring your risk, you create a safety net around your trades.

Remember, protecting your capital is as important as growing it. Risk management isn’t a one-time task; it’s a daily habit. Traders who respect their risk limits and stick to well-defined plans are the ones who last and ultimately succeed in the fast-paced world of crypto prop trading.